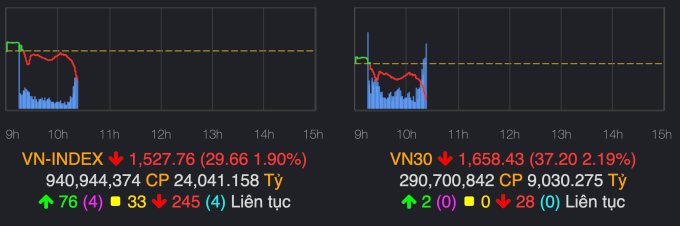

Opening the morning session, the index representing the Ho Chi Minh City Stock Exchange maintained its excitement and increased by 7 points, reaching nearly 1,565 points. However, this development did not last long because of the looming selling pressure.

At around 9:30 a.m., the index reversed and continuously widened its decline. The selling pressure caused the market to lose more than 30 points at one point, down to 1,526 points. The VN30, an index representing the large-cap basket, lost 37 points at one point.

The index representing the Ho Chi Minh City Stock Exchange narrowed its decline range several times thanks to the cash flow disbursed into strongly adjusted stocks. By the end of the session, the index lost nearly 24 points, down to 1,533 points.

Market liquidity increased rapidly. Just 90 minutes after opening, more than one billion shares were matched, equivalent to nearly VND27,000 billion. At the end of the morning session, the number of successful transfers increased to 1.42 billion shares, equivalent to VND36,400 billion. The VN30 basket contributed about VND14,500 billion of this, the rest came from small and medium-cap stocks.

The Ho Chi Minh City Stock Exchange was covered in red with 258 stocks decreasing, 3 times the number of stocks increasing. The large-cap basket was similar when 26 stocks traded below the reference, the remaining 4 stocks went against the market trend: VIB , GAS, STB and VNM.

The stock group was under the most intense selling pressure. VDS and VIX this morning changed from increasing to falling to the floor, then narrowed the adjustment range to 5.1% and 1.8%. Some other pillar stocks such as SSI, VCI, HCM, VND decreased by 1-4.5%.

Bank stocks also saw strong profit-taking. EIB lost 5.3%, while HDB, MSB, OCB , TPB and MBB all fell more than 3%. VCB, the market's largest stock by capitalization, lost 1.4% at the end of the morning session.

In the real estate group, most stocks reversed from increasing to decreasing. Two codes related to Dat Xanh, DXG and DXS, led the decrease with a loss of 6.2%. Leading codes such as VHM, VRE, KDH, NLG also lost more than 2% compared to the reference.

Before today's trading session, many securities companies warned about the risk of the market facing a strong correction after surpassing its historical peak. The short-term support level predicted by many companies is 1,490 points, a decrease of about 60 points compared to today's opening level.

"With the hot growth in many consecutive weeks, the probability of short-term fluctuations is inevitable, especially when speculative cash flows tend to take short-term profits in stocks that have increased hotly in a short period of time," said an expert from Vietcombank Securities Company (VCBS).

Analysts also recommend that investors take partial profits and take advantage of strong corrections to gradually disburse funds for medium-term goals. Buying at high prices, according to many analysts, should be avoided during this period.

VnExpressSource: https://baohaiphongplus.vn/chung-khoan-mat-gan-30-diem-417509.html

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)