Up to now, the whole province has 39,544 hectares of durian, of which the harvested area is about 26,600 hectares (an increase of 4,000 hectares compared to 2024), with an expected output of about 392,000 tons (an increase of 30,000 tons compared to 2024).

|

| Tax officers from 6 Dak Lak provinces conduct a field inspection at a durian business unit. |

Before entering the 2025 durian season, Dak Lak Provincial Tax Department has directed specialized departments and local tax agencies to strengthen propaganda and dissemination of the Law on Value Added Tax, which will take effect on July 1, 2025, which stipulates that crop products (including durian) that have not been processed into other products or have only undergone normal preliminary processing and sold at the commercial stage, previously not required to declare and pay value added tax, will now be subject to a value added tax rate of 5%.

Conducting review, inspection, and full grasp of information related to business activities of households, individuals, and enterprises (DN) such as: scale, area of warehouses, yards, human resources, assets, means, and tools serving business activities; investigating and determining revenue and tax payable of each household and enterprise to ensure that it is close to the actual business activities. Organizing direct work to guide and promptly handle difficulties and problems, creating favorable conditions for taxpayers to register, declare, and pay taxes according to regulations, ensuring that 100% of organizations and individuals with revenue and income from business activities must be subject to tax management.

In addition, units should strengthen propaganda and guidance for organizations and enterprises when selling or transporting goods out of the area, they must make invoices in accordance with regulations, accurately reflecting the quantity and selling price. When purchasing agricultural and aquatic products directly raised, grown, and exploited by farmers, they must make a list according to the form; when purchasing from enterprises or other business households, they must have invoices in accordance with regulations. At the same time, strictly inspect and handle according to regulations cases of intentionally making lists of direct purchases from farmers to legalize goods purchased from other enterprises and business households, causing losses to the state budget.

The tax department said that during durian season, many traders inside and outside the province gathered in key durian growing communes and wards to purchase the product. Many organizations and individuals engaged in production and business activities did not declare and pay taxes or declared incorrectly, businesses purchased goods without making a list, and sold goods without issuing invoices, causing difficulties for tax management and tax collection in this field. |

Along with that, communes and wards with durian production have established interdisciplinary inspection teams, including police, market management, tax, etc. to coordinate and strengthen the inspection of invoices and documents of organizations and individuals transporting agricultural products and durian in circulation. If there are any violations, they will be handled in accordance with the provisions of law.

Mr. Nguyen Xuan Hai, Head of Tax Department 6, said that the tax management unit covers 17 communes, including key localities for durian cultivation such as: Krong Pac, Ea Knuec, Tan Tien, Ea Phe.

The unit has established a team to manage durian business activities, coordinate with communes to review households trading in this item to include in the set; advise the Commune People's Committee to direct departments, offices, villages and hamlets to coordinate in disseminating information in many forms so that people and taxpayers who buy and sell durian know the tax regulations, thereby complying with tax declaration and payment.

Similarly, Base Tax 4 also manages taxes in areas with many communes and wards with durian production activities such as: Buon Ho, Cu Bao, Krong Nang...

The unit has reviewed organizations and individuals involved in durian trading; organized direct work to guide and promptly handle difficulties and problems, creating favorable conditions for taxpayers to register, declare and pay taxes according to regulations, ensuring that all organizations and individuals with revenue and income from business activities must be taxed; strictly managed the buying and selling of business households in the area, periodically recorded the quantity of goods purchased, inventory, selling price, etc.

When a business household sells goods to other businesses or households, it must issue invoices for each occurrence to declare and pay taxes in accordance with regulations.

Source: https://baodaklak.vn/kinh-te/202509/chong-that-thu-thue-trong-kinh-doanh-mua-ban-sau-rieng-989154d/

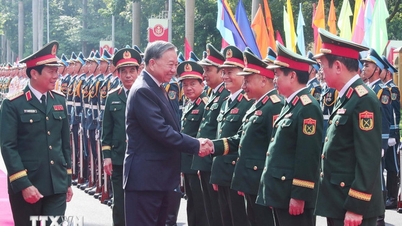

![[Photo] General Secretary To Lam attends the 80th Anniversary of the General Staff of the Vietnam People's Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/126697ab3e904fd68a2a510323659767)

![[Photo] Many people directly experience beloved Uncle Ho and the General Secretaries](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/2f4d9a1c1ef14be3933dbef3cd5403f6)

![[Photo] 80th Anniversary of the General Staff of the Vietnam People's Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/6/49153e2a2ffc43b7b5b5396399b0c471)

![[Photo] Hanoi students excitedly and joyfully open the new school year 2025-2026](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/5/ecc91eddd50a467aa7670463f7b142f5)

Comment (0)