eTax Mobile is an application developed by the General Department of Taxation, allowing users to check whether they have any unpaid or late taxes, such as personal income tax, real estate tax, business tax, etc.

In addition, eTax Mobile will also notify users if they overpay taxes, helping them receive this excess amount back from tax authorities.

eTax Mobile will help users avoid late or forgotten tax payments, thereby avoiding late payment penalties, administrative penalties or having information disclosed, affecting credit scores and causing difficulties when needing to borrow money...

Since July 1, people have officially used personal identification numbers, a series of 12 numbers printed on Citizen Identification Cards (CCCD) instead of tax codes in all tax-related activities of individuals, households, and business households.

This is to synchronize data between the tax system and the national population database, and at the same time help people easily remember their personal tax codes, as this code is linked to the CCCD number, instead of having to remember many different series of numbers as before.

By default, the process of converting personal tax codes to CCCD numbers will be done automatically. However, in some cases, this process will be slow.

The article below will guide you on how to check whether your tax code has been converted to a CCCD number or not, as well as how to change your personal tax code to a CCCD number on the eTax Mobile application.

Fix “User Authentication Error” on eTax Mobile App

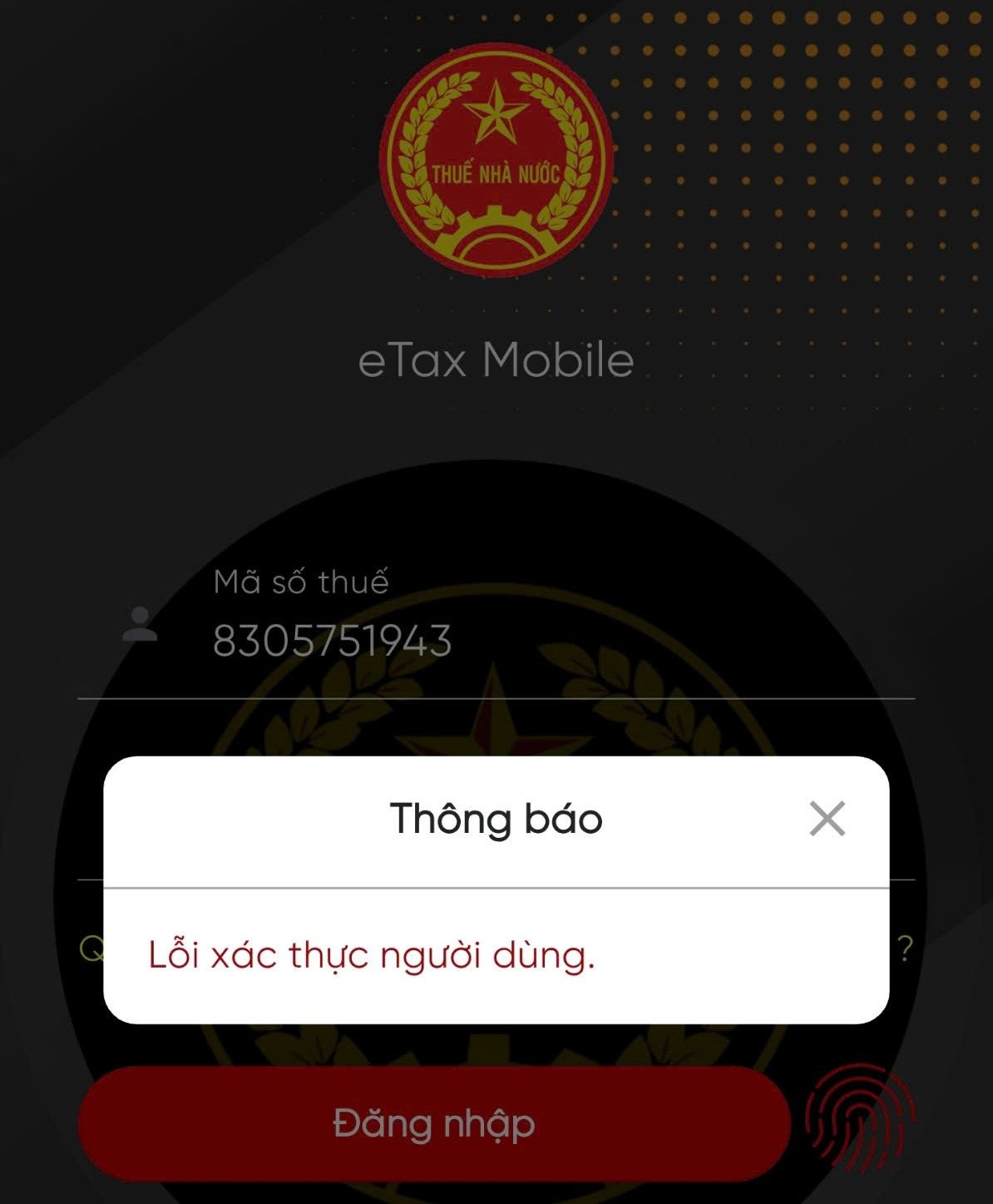

In recent days, many users have encountered a situation where when logging into the eTax Mobile application, even though they have entered the correct tax code and password, they receive a dialog box stating "User authentication error".

This error occurs even when the user requests a new password. This means that the error does not originate from you entering an incorrect tax code or login password.

“User Authentication Error” message dialog box when user logs in to eTax Mobile application (Screenshot).

This error may be due to the user's personal tax code being automatically updated and replaced with the citizen identification number. Therefore, to fix this error, users can try to change the tax code to the citizen identification number to log in.

How to use citizen identification number to replace tax code on eTax Mobile application

In case you can log in to the eTax Mobile application with your citizen identification number, it means that the user can use the CCCD number as a tax code and you do not need to do anything more.

Conversely, if the eTax Mobile application still allows users to log in with the old tax code, it means that you have not been updated to use the citizen identification number as the tax code.

Users can perform this update process manually through the eTax Mobile application. To do this, follow these steps:

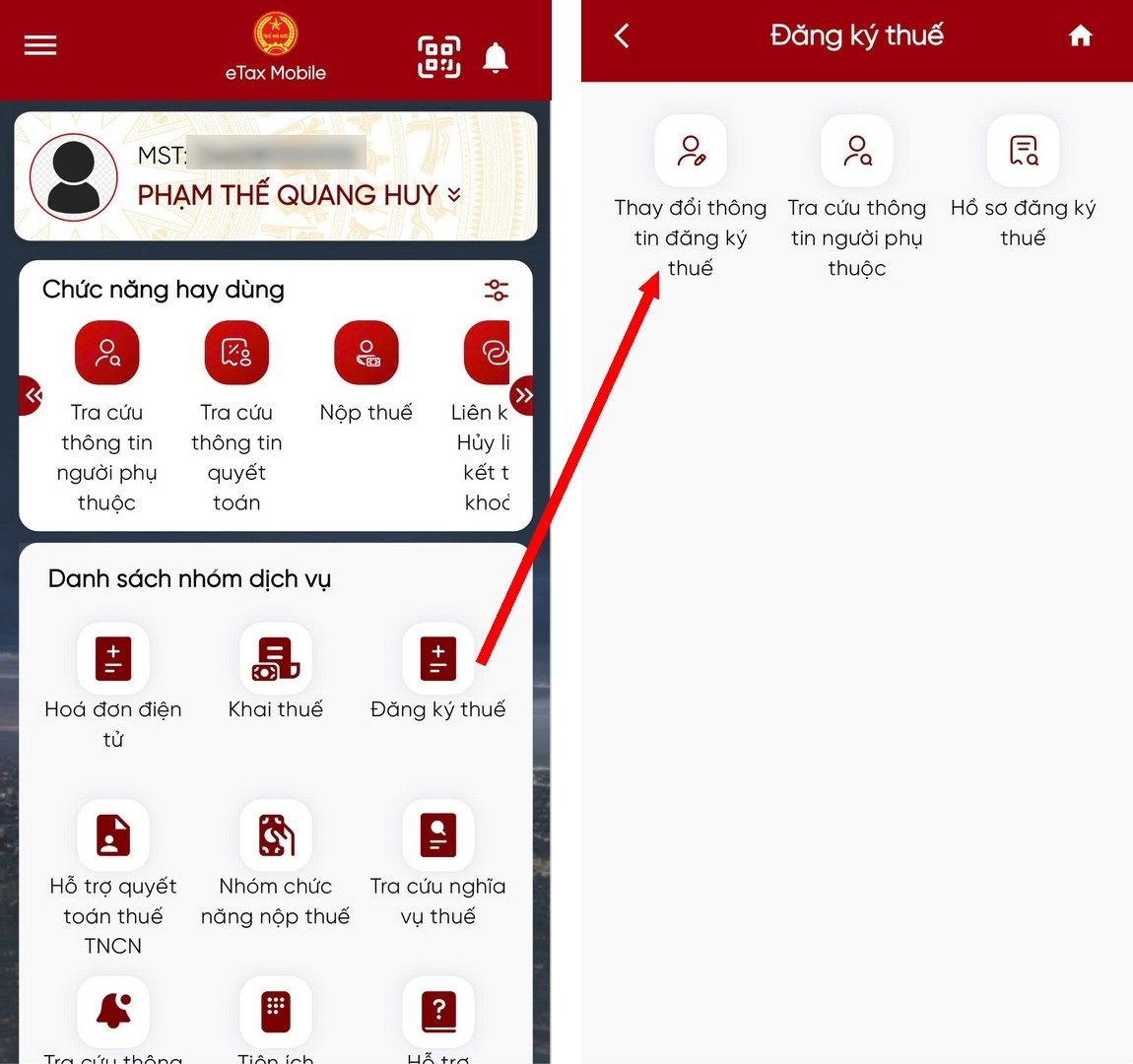

- Activate the eTax Mobile application on your smartphone and log in to your account.

- At the interface that appears, select "Tax registration", then select "Change tax registration information".

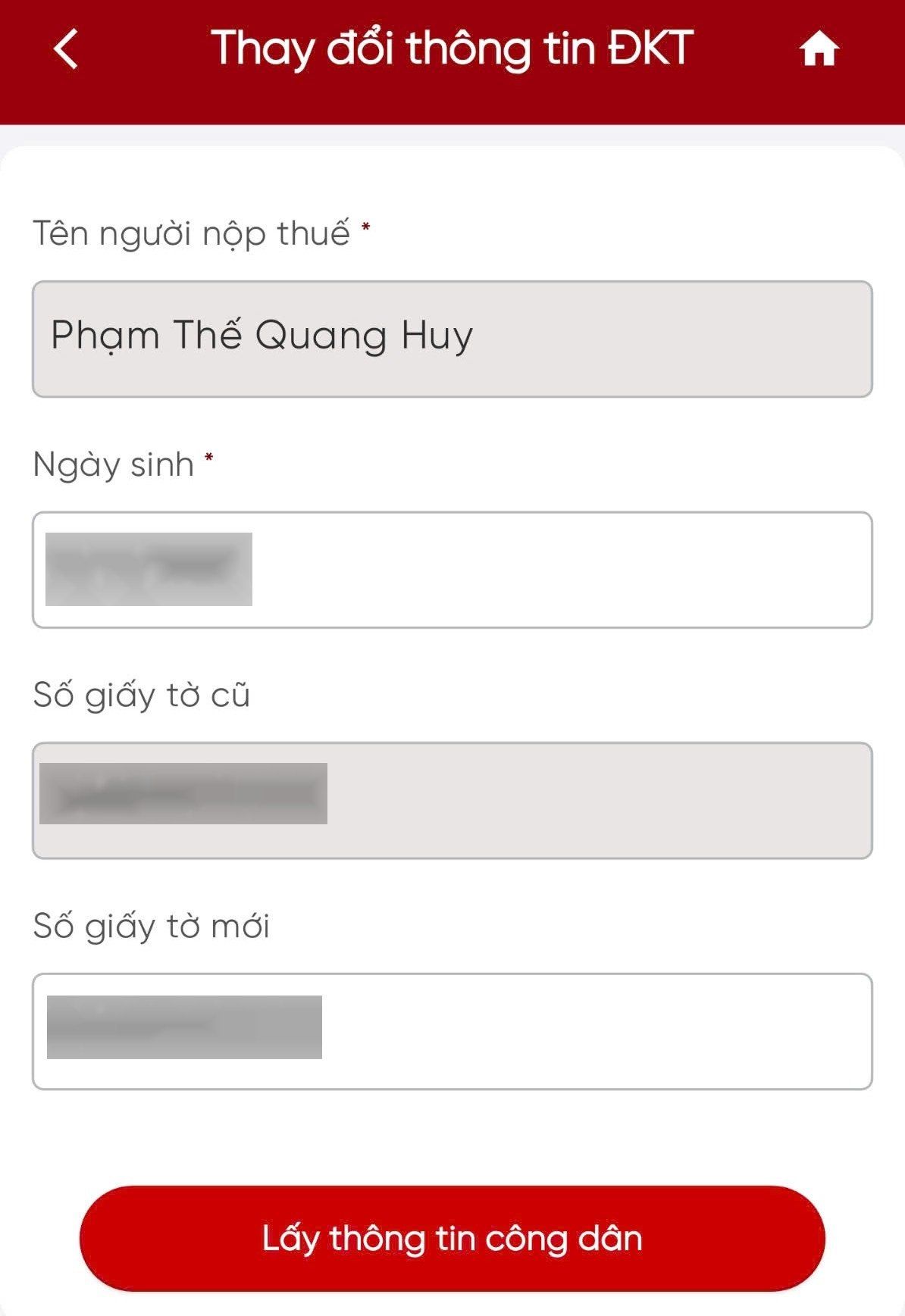

- Here, you enter the CCCD number in the "New document number" box and click the "Get citizen information" button.

- The eTax Mobile application will rely on the CCCD number declared by the user to retrieve personal information from the national population database.

Note: In case the eTax Mobile application displays the message "Invalid information", users need to contact the police agency where they live to update personal information into the national population database.

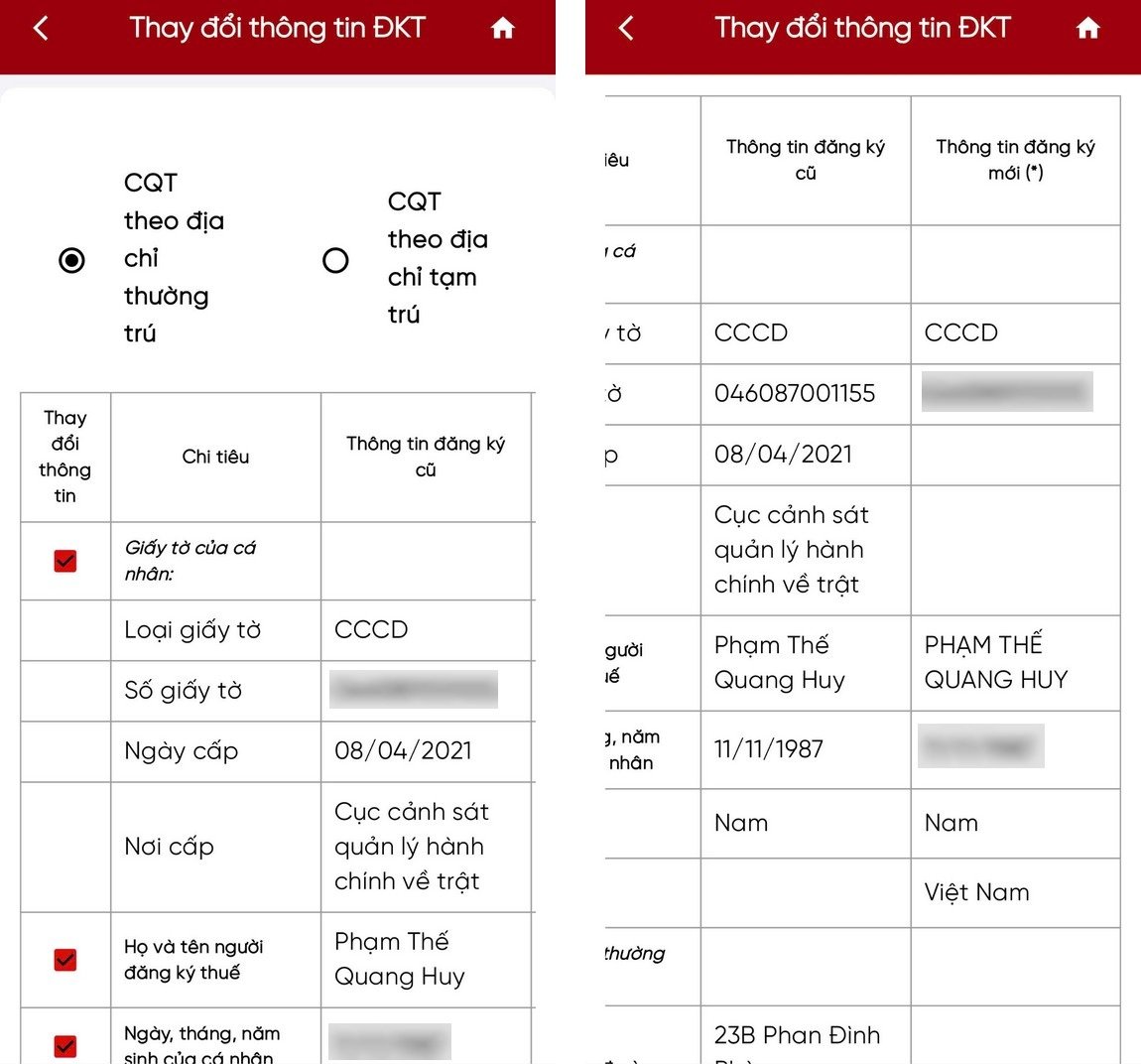

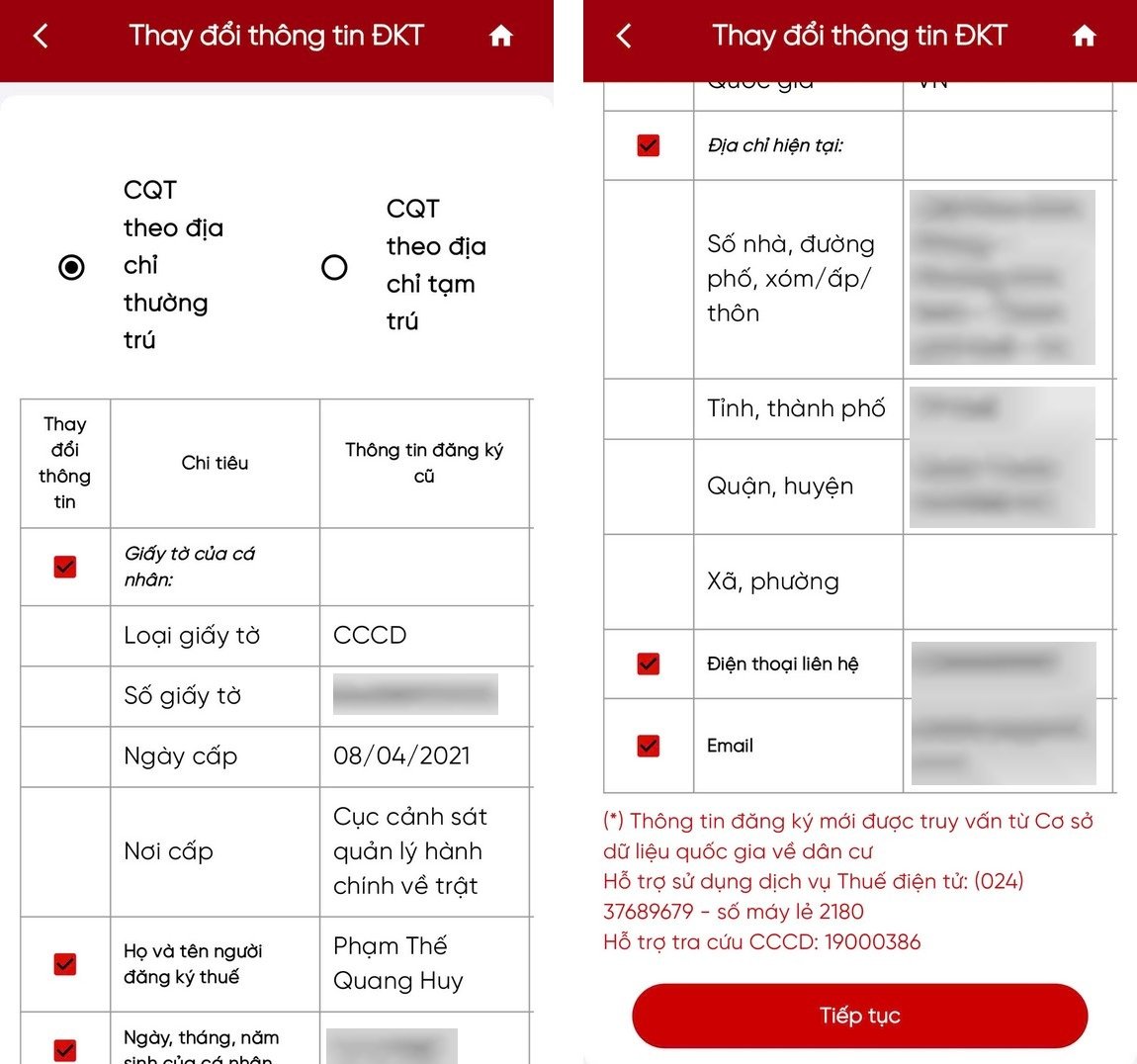

- At the interface that appears, the eTax Mobile application will display in parallel the old and new registration information taken from the national population database for users to compare and make changes to the information if necessary. You swipe right to see the entire comparison table of old and new information.

At this interface, you choose "CQT (Tax Authority) by permanent address" or "CQT by temporary address" to choose the tax authority to submit the declaration requesting information change.

On this information change interface, eTax Mobile only allows users to change some personal information such as "Personal documents" (Update citizen identification number, date of issue, place of issue); "Full name of tax registrant"; "Nationality", "Permanent address"; "Current address", "Contact phone number", "Email".

You check the items that need to change information on the eTax Mobile application, then scroll down and press the "Continue" button.

Note: In case you do not change the information of “Permanent residence address”, the declaration will be sent to the tax authority according to the old registration information. If you change the “Permanent residence address”, the declaration will be sent to the tax authority corresponding to the new address.

- Next step, the application will allow users to enter new information as selected, then press the "Complete declaration" button.

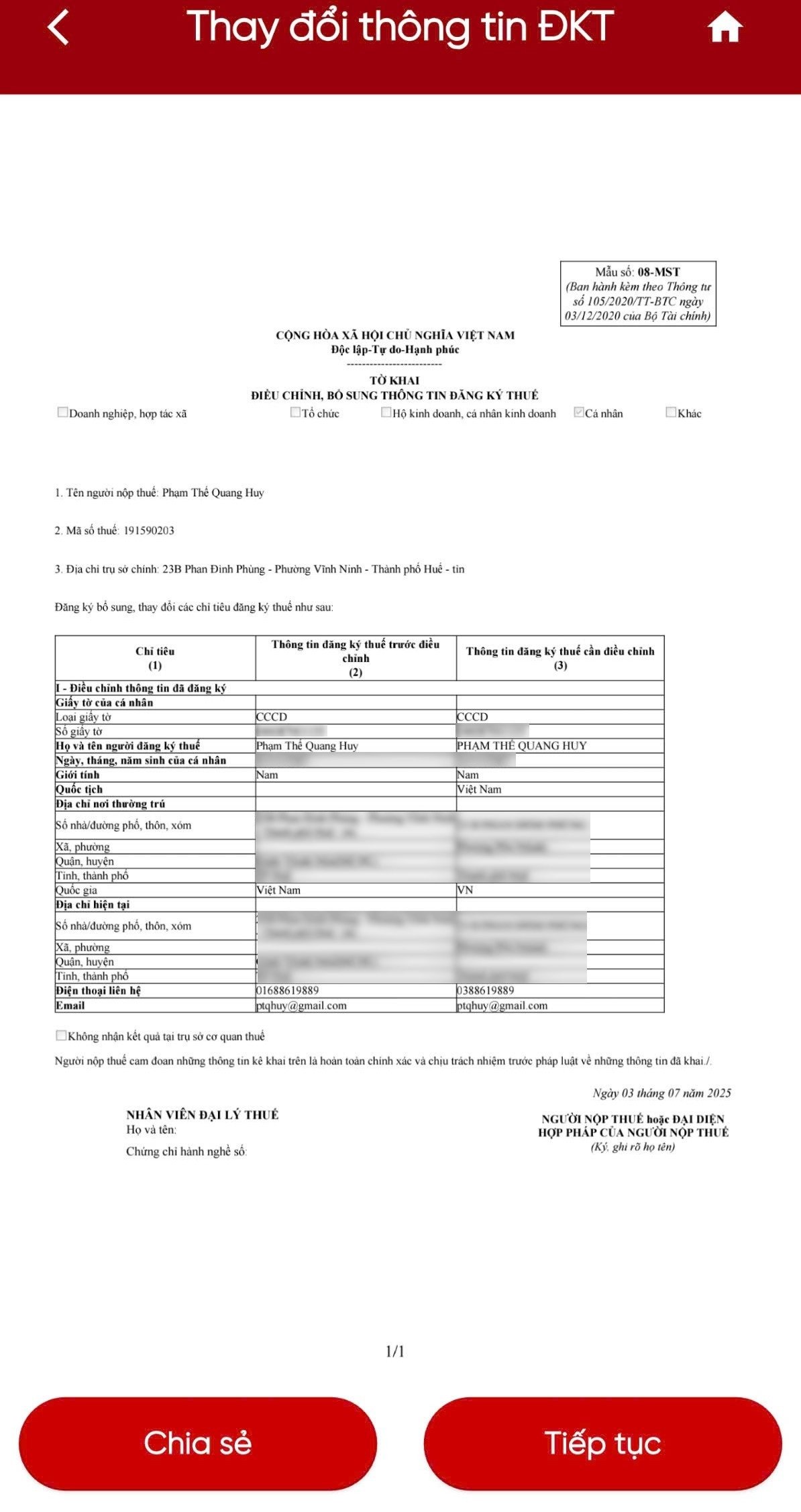

- The interface of the eTax Mobile application will display the declaration form requesting to change taxpayer information (form 08-MST). You review the information on the declaration to see if it is correct, then click the "Share" button to save the declaration to your smartphone as a pdf file or send this declaration via text message or email.

If the information on the form is correct, click the “Continue” button to move to the next step.

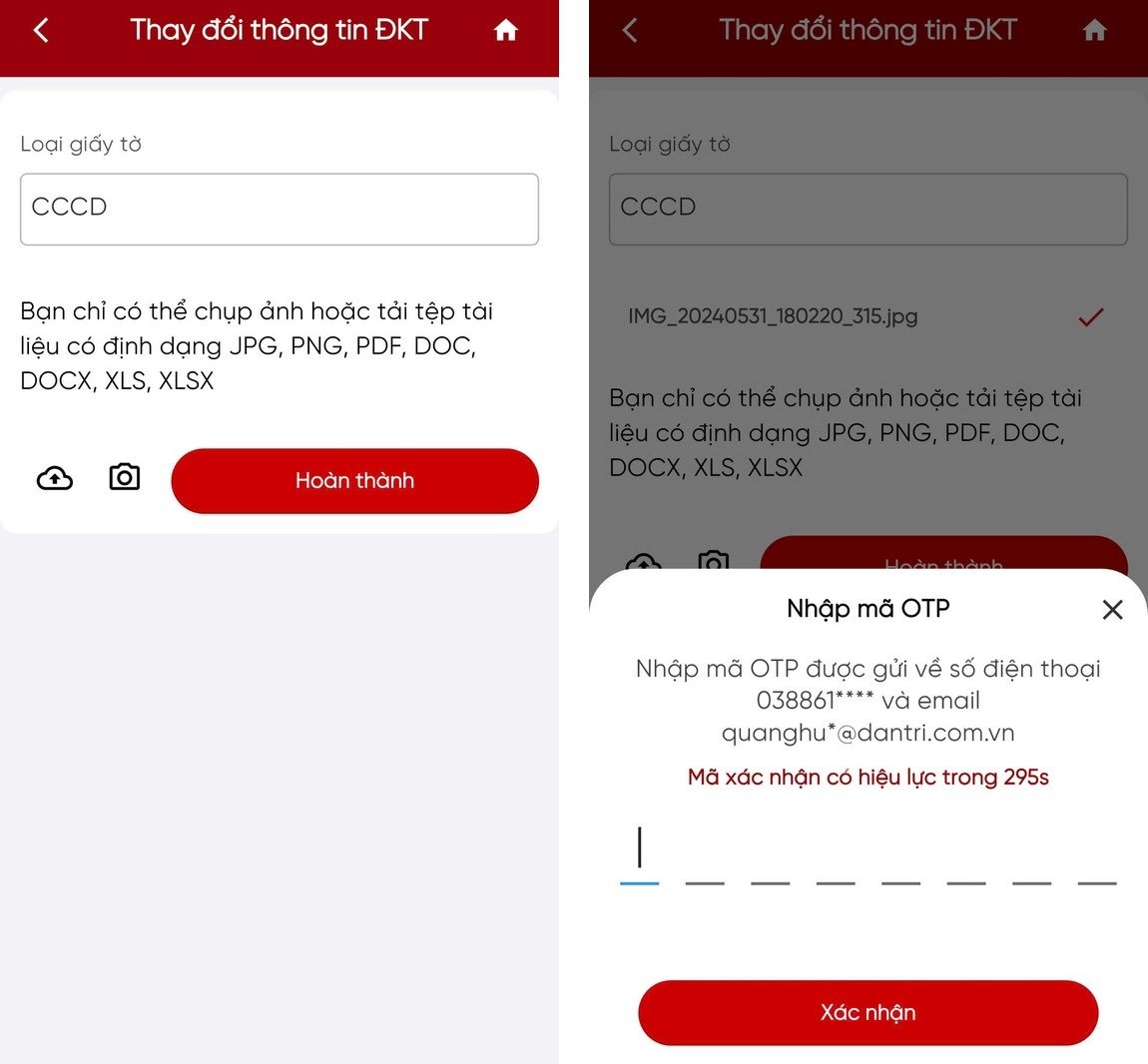

- At this step, the user clicks on the camera icon to take a photo of the citizen ID card or the cloud icon to attach a photo of the citizen ID card available on the smartphone to the eTax Mobile application, then clicks the "Complete" button.

An OTP code will be sent to your phone number. Enter the OTP code into eTax Mobile and press the “Confirm” button.

Note: If you do not see the OTP code sent to your phone number, you can check the OTP code sent to your email address.

After completing the steps, you will receive a notification "The tax registration information change file has been successfully submitted. Please wait for processing!".

Users will now have to wait for their information to be updated on the eTax Mobile tax app and will receive a notification when the process is complete.

Source: https://dantri.com.vn/cong-nghe/cach-cap-nhat-ma-so-thue-va-xu-ly-loi-khi-khong-the-dang-nhap-etax-mobile-20250703032101880.htm

![[VIDEO] Propaganda and promotion of the use of E10 RON95 gasoline products in Quang Ngai | QNgTV](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/4/eeb7f42edd2745a482b4e5fd2f10e9b2)

![[VIDEO] Petrovietnam – 50 Years of Keeping the Heritage Torch, Building National Energy](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/3/3f5df73a4d394f2484f016fda7725e10)

Comment (0)