KPMG representative presents project completion confirmation letter toACB

ACB: Pioneer bank in implementing Basel III

As one of 10 banks selected by the State Bank of Vietnam (SBV) to pilot Basel III in Vietnam, ACB is also a member of the Steering Committee and the Working Group for the implementation of Basel Capital Standards. This is a recognition not only of ACB's ability to implement complex projects, but also of its strategic vision and readiness to approach international governance standards.

The IRB project will be implemented by ACB from 2024 to meet the roadmap required by the State Bank of Vietnam. Accordingly, the bank has completed the model and operating process for calculating credit risk capital and data platforms. The internal models have closely reflected the risk characteristics and contributed to standardizing credit control work and were developed based on actual data from ACB's loan portfolio.

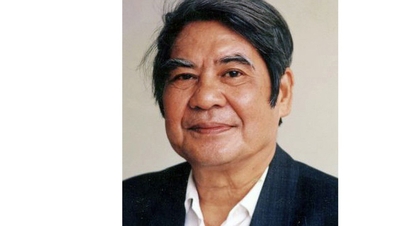

Mr. Nguyen Van Hoa, Deputy General Director of ACB and Project Owner of IRB, said that the completion of the project demonstrates ACB's pioneering role in implementing advanced Basel standards in the Vietnamese market, thereby aiming at the goal of increasingly professional risk management, enhancing transparency and sustainable development according to advanced international standards.

Mr. Nguyen Van Hoa, Deputy General Director of ACB and Project Owner, spoke at the project completion announcement ceremony.

IRB helps ACB improve risk management capacity

The successful implementation of IRB is an important contribution to the completion of the SBV's Basel roadmap, and is also an important step in completing ACB's strategy of continuous improvement and enhancement of risk management standards. IRB helps ACB improve its risk management capacity, increase the accuracy and suitability of risk estimation tools with the bank's own risk characteristics.

IRB also acts as a positive signal to the market and investors. In the context of international credit rating agencies and capital flows increasingly emphasizing risk control capacity, transparency and adaptability to ESG standards, the IRB platform is a clear demonstration of ACB's in-depth operational capacity.

To calculate capital and estimate credit risk according to IRB, banks must meet strict requirements on measurement methods, data quality used and model governance. Therefore, ACB has invested resources to collect data, build and manage datamarts with large data volumes. In particular, it has built a full range of models with high applicability in business operations and risk management.

ACB is currently among the top banks with the highest credit ratings. FinnRatings has announced the results of the initial long-term issuer credit rating for ACB at AA+ with a rating outlook of "Stable", FiinRatings assessed ACB's business position at "Good". ACB has continuously maintained its leading position in the group of private commercial banks in Vietnam.

Le Nguyen

Source: https://baochinhphu.vn/acb-uu-tien-cho-chien-luoc-quan-tri-rui-ro-de-phat-trien-ben-vung-102250819170347933.htm

![[Photo] General Secretary To Lam attends the inauguration and groundbreaking ceremony of 250 projects to celebrate National Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/3aa7478438a8470e9c63f4951a16248b)

![[Photo] President Luong Cuong's wife and Queen of Bhutan visit Tran Quoc Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/62696af3852a44c8823ec52b03c3beb0)

![[Photo] Politburo works with the Standing Committee of Da Nang City Party Committee and Quang Ninh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/b1678391898c4d32a05132bec02dd6e1)

![[Photo] General Secretary and Prime Minister visit the National Exhibition and Fair Center](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/19/f4503ad032d24a90beb39eb71c2a583f)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Government's Founding](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/20/3375b78559fa4d558776197d684b8356)

![[Maritime News] Maersk announces positive results in the first half of 2025](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/20/d9f3704e9e8647a0ade1f6e2309d75d1)

Comment (0)