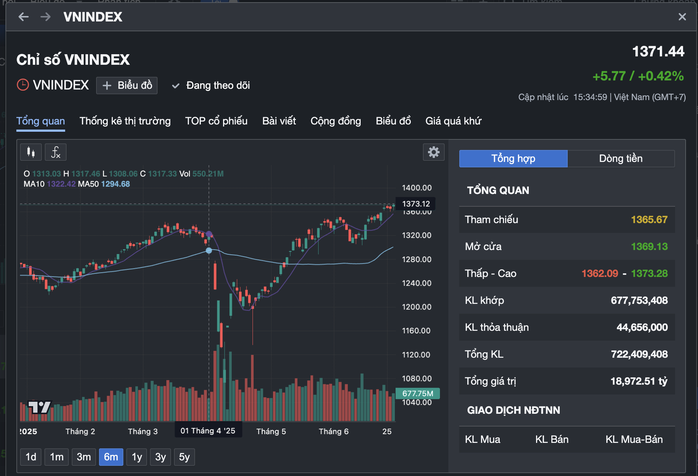

Dù có nhiều dự báo thị trường sẽ điều chỉnh, rung lắc mạnh ở mốc cao nhất trong hơn 3 năm qua, VN-Index vẫn ghi nhận thêm một tuần giao dịch tích cực.

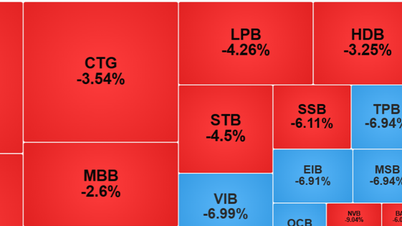

Chốt tuần giao dịch 23 - 27/6, VN-Index tạm dừng ở mức 1.371,44 điểm, lập đỉnh mới của năm. Giá cổ phiếu tăng tích cực ở các nhóm bán lẻ, khu công nghiệp, thủy sản, xây dựng, công nghệ, bất động sản... Áp lực điều chỉnh mạnh ở nhóm dầu khí khi giá dầu giảm mạnh sau thỏa thuận ngừng bắn ở Trung Đông.

Trao đổi với phóng viên Báo Người Lao Động, một số nhà đầu tư cho biết họ bất ngờ với diễn biến của thị trường tuần qua, nhiều thời điểm VN-Index giảm sâu nhưng phục hồi ngay trong phiên. Một số nhà đầu tư đã bán chốt lời cổ phiếu, chờ thị trường giảm để mua lại. Tuy nhiên, kết quả là cổ phiếu vẫn tăng tiếp.

VN-Index lên mốc đỉnh của năm nay

Ông Nguyễn Thái Học, Chuyên gia phân tích của Công ty Chứng khoán Pinetree, cho rằng việc VN-Index tăng hai tuần liên tiếp, vượt qua vùng đỉnh cũ hồi cuối tháng 3 là một tín hiệu tích cực đối với thị trường.

Theo ông Học, động lực chính giúp thị trường khởi sắc trong tuần qua đến từ những đồn đoán xung quanh khả năng Việt Nam đã đạt được thỏa thuận thuế đối ứng với Mỹ, với mức thuế thấp hơn so với lo ngại ban đầu, chỉ khoảng 15%, thậm chí một số mặt hàng có thể chỉ chịu thuế 10%.

Tuy nhiên, ông cũng lưu ý thị trường hiện vẫn chưa cho thấy sự đồng thuận rõ nét của dòng tiền. Các nhóm ngành luân phiên dẫn dắt chỉ số, tuần qua nổi bật là cổ phiếu bán lẻ, công nghệ và viễn thông.

Thị trường chứng khoán tuần tới dự báo có nhiều thông tin sẽ tác động

Ông Nguyễn Thái Học nhận định tuần tới, thị trường có thể chịu tác động mạnh bởi hàng loạt yếu tố xuất hiện cùng lúc, nổi bật là phiên chốt NAV (tài sản ròng) quý II ngay đầu tuần, cùng những thông tin sớm về kết quả kinh doanh 6 tháng đầu năm của các doanh nghiệp lớn. Đặc biệt, thị trường đang tiến sát thời điểm hoãn áp thuế đối ứng giữa Việt Nam và Mỹ vào ngày 8-7, càng khiến tâm lý nhà đầu tư thêm thận trọng.

Trong khi đó, các chuyên gia của Công ty Chứng khoán SHS cho rằng thị trường hiện đặt nhiều kỳ vọng vào mức thuế đối ứng sau đàm phán thương mại cũng như kết quả kinh doanh quý II/2025. Đây có thể mở ra cơ hội ngắn hạn cho nhiều nhóm cổ phiếu hồi phục về các vùng giá trước khi bị bán mạnh do lo ngại áp thuế.

Tuy vậy, SHS khuyến nghị nhà đầu tư mua mới ở thời điểm này cần dựa trên việc cập nhật, phân tích kỹ các yếu tố cơ bản và định giá doanh nghiệp, với trọng tâm là triển vọng tăng trưởng trong nửa cuối năm. Chiến lược được ưu tiên vẫn là nắm giữ và chờ đánh giá lại các yếu tố nền tảng của cổ phiếu.

Công ty Chứng khoán Kiến Thiết Việt Nam (CSI) tiếp tục giữ quan điểm lạc quan về thị trường, dự báo VN-Index có thể hướng tới vùng kháng cự 1.398 - 1.418 điểm trong các phiên giao dịch tuần sau. Theo CSI, nhà đầu tư nên duy trì danh mục hiện tại và kiên nhẫn chờ đợi khi chỉ số tiệm cận vùng kháng cự nói trên rồi mới tính đến việc chốt lời.

Ông Nguyễn Thái Học nhận định nửa cuối tuần sau sẽ là giai đoạn đặc biệt đáng chú ý, khi các thông tin liên quan đến kết quả kinh doanh bán niên và tiến triển đàm phán thương mại có khả năng được công bố. Tuy nhiên, ông cũng cảnh báo rủi ro vẫn hiện hữu nếu kết quả đàm phán không đạt kỳ vọng. "Nhà đầu tư nên duy trì sự thận trọng, nhất là với các quyết định giải ngân mới" - ông Học nhấn mạnh.

Nguồn: https://nld.com.vn/vn-index-ap-sat-1400-diem-nha-dau-tu-nen-mua-hay-ban-196250629094339316.htm

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)