Leading in financial performance and sustainable development

In 2024, with its relentless efforts, Joint Stock Commercial Bank for Foreign Trade of Vietnam ( Vietcombank ) continues to affirm its position as the No. 1 bank in Vietnam in terms of quality and operational efficiency with total assets of over 2 million billion VND, leading profits in the banking industry, and the best asset quality in the system.

With outstanding business results, Vietcombank is one of the enterprises with the largest contribution to the state budget, affirming its solid position in the group of 100 banks with the largest capitalization in the world, and is the Vietnamese enterprise with the highest ranking in the Top 1,000 largest public enterprises in the world.

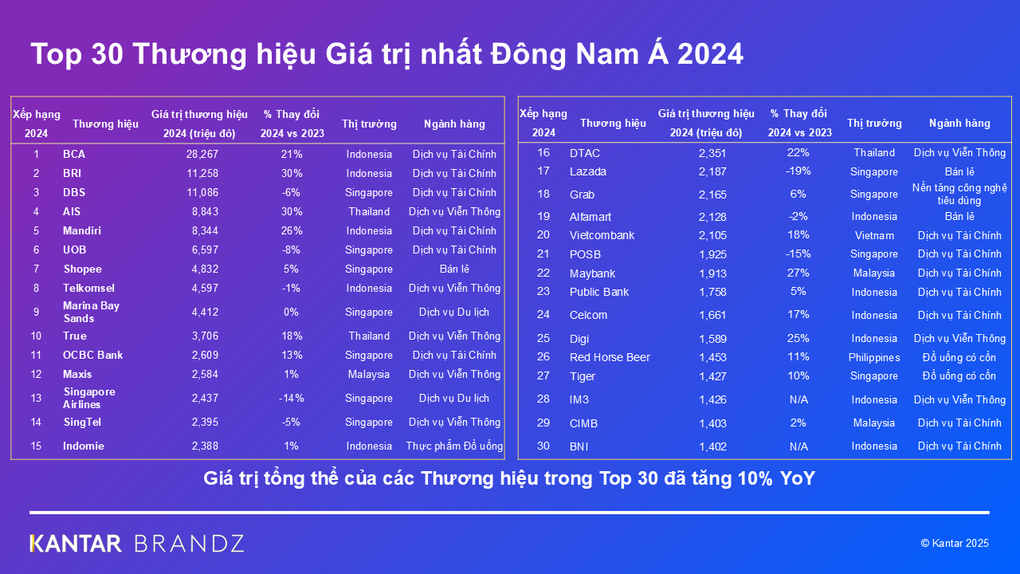

Vietcombank always maintains its position in many important rankings of domestic and international organizations.

In addition, Vietcombank has made a strong mark as a pioneer in promoting social responsibility to the community, maintaining its dominant role in providing capital to the economy with the lowest interest rates on the market, synchronously implementing programs to waive and reduce interest and fees. The bank also accompanies the Government to support customers in economic recovery, overcoming damage caused by epidemics, natural disasters, etc., sponsoring social security activities, participating in supporting weak credit institutions, contributing to the healthy and stable development of the banking industry and the economy .

In the period of 2020-2024, Vietcombank will spend more than VND 2,300 billion on social security programs, of which VND 571 billion in 2024 alone, focusing on the fields of health, education, supporting the construction of charity houses, paying special attention to investing in mountainous areas, ethnic minority areas, poor districts, communes, villages, and hamlets with special difficulties, islands, etc.

Pioneering green finance and comprehensive ESG practices

In November 2024, Vietcombank issued green bonds in accordance with domestic law and voluntarily complied with the Green Bond Principles of the International Capital Market Association (ICMA), affirming its pioneering role in the field of green finance. The bank continues to expand its green credit portfolio, focusing on financing renewable energy projects, sustainable infrastructure and clean production.

By the end of 2024, Vietcombank's green credit balance will reach nearly VND 47,600 billion, an increase of more than 4 times compared to 2020, accounting for 3.3% of total outstanding loans; of which 84.7% is allocated to renewable energy and clean energy projects.

Vietcombank issues green bonds in accordance with domestic laws and voluntarily complies with the green bond principles of (ICMA).

At the same time, Vietcombank promotes comprehensive digital transformation to optimize operations, improve resource efficiency and reduce carbon emissions. The bank also gradually standardizes its Sustainability Report according to international practices such as GRI and TCFD, while focusing on training a team of ESG specialists, contributing to building a sustainable development culture foundation throughout the system.

Continuing to be honored in the Top 20 VNSI in 2025 is an affirmation of Vietcombank's correct strategy, continuous efforts and deep commitment to promoting green finance, sustainable development and creating long-term value for shareholders, customers and the community. With a solid financial foundation, a clear development strategy and valuable companionship from customers, shareholders and partners, Vietcombank said it is confident in continuing its pioneering role in the industry, becoming a sustainable green bank, a convenient and safe digital bank, providing outstanding experiences, being the top choice of customers, contributing to shaping the future of green finance in Vietnam.

Source: https://dantri.com.vn/kinh-doanh/vietcombank-lan-thu-ba-lien-tiep-ghi-danh-trong-top-vnsi-20250723193057651.htm

Comment (0)