Total assets exceed half a million billion VND, maintaining a strong balance sheet

As of June 30, VIB 's total assets reached over VND530,000 billion, up 8% compared to the beginning of the year. Outstanding credit exceeded VND356,000 billion, up 10%, coming from even growth in the retail, SME, corporate and financial institutions sectors.

VIB launched a VND45,000 billion home loan package with the incentive of "borrow VND1 billion, pay principal only VND1 million/month in the first 5 years", helping young people easily access housing. The loan package has a fixed interest rate from 5.9%/year, super-fast approval thanks to AI and allows flexible repayment, free of prepayment fees. In the SME and corporate segment, VIB continues to selectively expand credit, focusing on supporting working capital flows and production and business needs.

Customer deposits grew steadily by 10%, reaching over VND304,000 billion. CASA and Super Yield accounts increased by 51% compared to the beginning of the year, showing the effectiveness of the strategy of optimizing idle cash flow.

By the end of June, VIB's total assets exceeded half a million billion VND.

Launched in early 2025, the Super Yield account attracted more than 500,000 activated customers, expanding the potential customer base for banking products and services.

Asset quality continued to improve in the first 6 months of the year. The bad debt ratio decreased to 2.54%, 0.14 percentage points lower than the end of the first quarter. VIB's loan portfolio maintained a high level of safety, with more than 75% of outstanding loans belonging to the retail and SME segments - of which over 90% of retail loans are secured by fully legal real estate, concentrated in large urban areas.

Group 2 debt continues to decline. The official legalization of Resolution 42 has created an important legal corridor, supporting VIB to accelerate bad debt settlement, thereby strengthening its stable and sustainable financial foundation in the context of many market challenges.

In the second quarter, the bank completed paying 7% cash dividends. Safety management indicators remained at optimal levels, in which the Basel II capital adequacy ratio (CAR) reached 12% (regulation: over 8%), the loan-to-deposit ratio (LDR) was at 77% (regulation: under 85%), the ratio of short-term capital sources for medium and long-term loans was 23% (regulation: under 30%) and the Basel III net stable capital source ratio (NSFR) was 111% (Basel III standard: over 100%).

6-month profit increased by 9%, promoting revenue diversification

At the end of the first 6 months, VIB recorded a total operating income of over VND9,700 billion, pre-tax profit of over VND5,000 billion, up 9% over the same period. Net interest income reached over VND7,700 billion, continuing to be the main contributor in the context of the bank promoting retail credit with competitive interest rates, focusing on high-quality customers with good collateral. Net interest margin (NIM) remained stable at 3.4%, ensuring sustainable profitability.

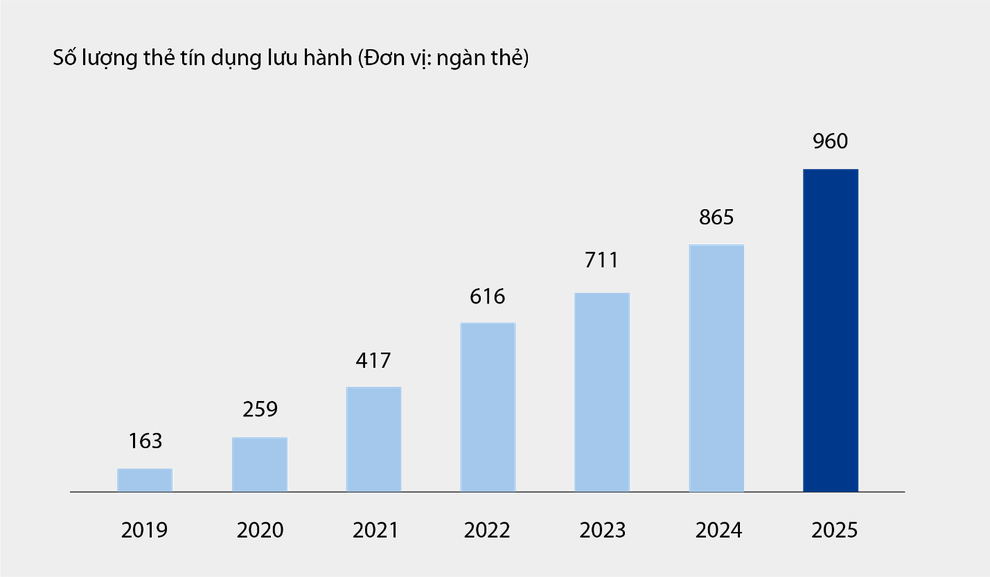

Non-interest income accounted for 21% of total operating income, mainly from fees and service activities. As of June 30, VIB's credit cards reached nearly one million cards in circulation, with total spending after 6 months reaching more than VND67,900 billion, up 15% over the same period. New products and services deployed on the digital banking platform such as bill payment, international money transfer, tuition payment, insurance, etc., along with solution packages and services for corporate customers, contributed to the bank's fee and service income.

Number of credit cards in circulation at VIB from 2019 to 6 months of 2025.

Operating costs decreased by 1% year-on-year thanks to the synchronous implementation of process optimization solutions and effective cost management. Credit risk provisioning costs in the first 6 months of the year decreased by 49% year-on-year.

Perfecting a comprehensive digital financial ecosystem, enhancing customer experience

VIB has just launched Super Pay - a smart payment solution and Super Cash - a flexible loan solution, completing a super personalized financial ecosystem, empowering users to manage their finances.

Super personalized financial ecosystem for VIB cardholders.

Super Pay solution supports customers to proactively manage their spending with three features: choosing payment sources (PayFlex), proactively registering for installment payments (PayEase), and proactively authenticating transactions (PaySafe) right on the MyVIB application.

Super Cash offers a flexible capital access solution, allowing customers to transfer credit limits of up to VND 1 billion between cards and cash loans. The entire process takes place online on the Max by VIB app, with streamlined procedures, transparent interest rates and no early settlement fees.

With a product suite including Super Pay, Super Cash, Super Account and Super Card, VIB is gradually realizing the goal of building a comprehensive digital financial ecosystem, giving users maximum financial control in the digital age.

Positive results in the first 6 months of the year affirm VIB's correct orientation in improving operational efficiency, controlling risks and promoting digitalization.

Source: https://dantri.com.vn/kinh-doanh/vib-lai-6-thang-hon-5000-ty-dong-tong-tai-san-vuot-nua-trieu-ty-dong-20250728092539007.htm

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)