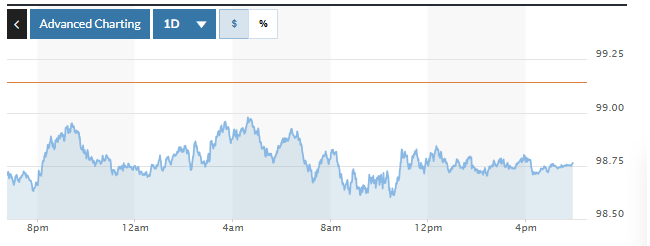

In the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.38% to 98.76.

USD exchange rate today in the world

The US dollar recovered slightly in Monday's trading session, mainly in a corrective manner, after three "big shocks" last Friday sent the greenback tumbling: a disappointing US July jobs report, a Federal Reserve Governor resigning, and US President Donald Trump firing a senior statistics official.

These developments have caused market panic and fueled investors' expectations that the US Federal Reserve (Fed) will soon cut interest rates.

However, according to analysts, the recovery of the USD may only be temporary, in the context of the US economic outlook gradually showing clear signs of weakening and the policy-making environment remains unstable.

Data released on Friday (August 1) showed that US job growth in July was lower than forecast, while non- farm payrolls for the previous two months were revised down sharply by 258,000 jobs, a sign that the labor market is weakening rapidly.

“The U.S. economy appears to be slowing across the board as companies begin to question the benefits of reducing their reliance on overseas manufacturing and purchasing,” said Juan Perez, director of trading at Monex USA in Washington. “The world is not really optimistic right now, even though domestic economic indicators suggest the Fed will likely step in with a rate cut.”

In afternoon trading, the US dollar gained against the euro, Swiss franc and commodity-linked currencies such as the Australian and New Zealand dollars.

Specifically, the EUR fell 0.1% against the greenback, down to 1.1576 USD. The USD rose 0.5% against the Swiss franc, up to 0.8078 USD. The decline of the franc is not surprising as Switzerland has just been hit by the highest tariffs in the White House's global trade policy adjustment.

The Australian and New Zealand dollars also lost value, down 0.2% to $0.6463 and 0.3% to $0.5904, respectively. Against the Japanese yen, the USD increased 0.3% to trade at 146.945.

“The dollar’s July rally was halted last week, but so far there is no clear evidence of increased risk appetite for U.S. assets,” said Karl Schamotta, chief market strategist at Corpay in Toronto.

“Strong corporate earnings so far have been enough to overshadow concerns about a slowing labor market, the impact of higher taxes, the risk of interference with the independence of U.S. statistical agencies, and the likelihood that the next Fed chair will pursue a more dovish monetary policy aimed at boosting inflation,” he added.

Domestic USD exchange rate today

In the domestic market, at the beginning of the trading session on August 5, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 25,240 VND.

* The reference USD exchange rate at the State Bank's transaction office for buying and selling is currently at: 24,028 VND - 26,452 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,980 VND | 26,370 VND |

Vietinbank | 25,870 VND | 26,380 VND |

BIDV | 26,001 VND | 26,361 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center increased, currently at: 27,719 VND - 30,636 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 29,500 VND | 31,056 VND |

Vietinbank | 29,446 VND | 31,156 VND |

BIDV | 29,869 VND | 31,099 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office increased slightly, currently at: 162 VND - 179 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 170.94 VND | 181.80 VND |

Vietinbank | 173.67 VND | 183.37 VND |

BIDV | 173.94 VND | 181.64 VND |

Source: https://baolangson.vn/ty-gia-usd-hom-nay-5-8-dong-usd-phuc-hoi-nhe-5055139.html

Comment (0)