USD exchange rate today 7/27/2025

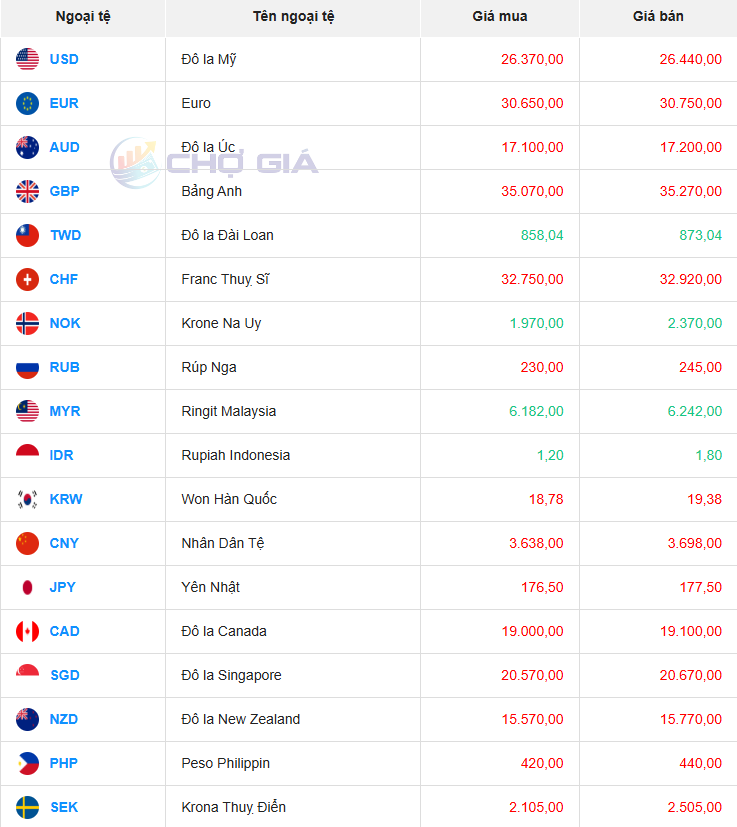

At the time of survey at 4:30 a.m. on July 27, the central exchange rate at the State Bank was currently 25,164 VND/USD, unchanged from yesterday's trading session.

Specifically, at Vietcombank , the USD exchange rate is 25,930 - 26,320 VND/USD, unchanged in both directions, compared to yesterday's trading session.

VietBank is buying USD cash at the lowest price: 1 USD = 25,100 VND

VietBank is buying USD transfers at the lowest price: 1 USD = 25,115 VND

HSBC Bank is buying USD cash at the highest price: 1 USD = 26,021 VND

OCB Bank is buying USD transfers at the highest price: 1 USD = 26,032 VND

HSBC Bank is selling USD cash at the lowest price: 1 USD = 26,257 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 26,257 VND

SCB and UOB banks are selling USD cash at the highest price: 1 USD = 26,380 VND

SCB Bank is selling USD transfers at the highest price: 1 USD = 26,380 VND

In the "black market", the black market USD exchange rate as of 4:30 a.m. on July 27, 2025 decreased by 1 VND in both directions, compared to yesterday's trading session, trading around 26,370 - 26,440 VND/USD.

USD exchange rate today July 27, 2025 on the world market

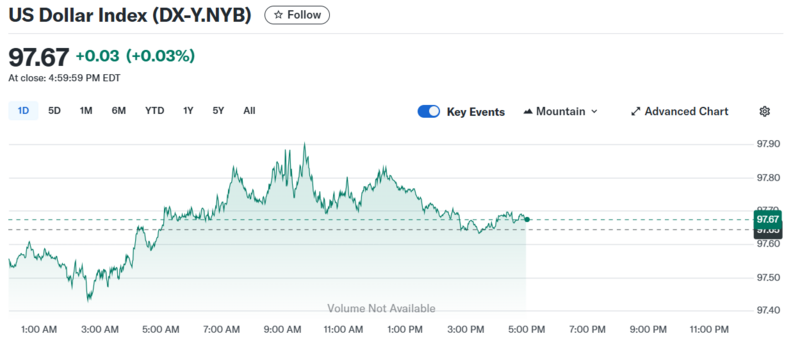

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 97.80 - down 0.13 points compared to July 26, 2025.

Although new orders in the US manufacturing sector have fallen, shipments have edged up slightly, suggesting that investment spending has not weakened too much, experts say. This has helped the US dollar recover in the last two sessions, although it is still down 0.8% for the week.

The euro held steady at $1.1741, while the pound fell 0.6% to $1.3434 after U.K. retail sales missed expectations. The Japanese yen also weakened after Tokyo inflation was lower than expected, pushing the USD/JPY pair up to 147.59 yen.

Political factors continue to weigh on both central banks, especially in the US, where President Donald Trump continues to call for the Fed to lower interest rates amid tensions with Chairman Jerome Powell. Still, the dollar index is on track for its biggest weekly decline in a month as investors await further progress on tariff negotiations and policy meetings of major central banks next week.

Source: https://baohatinh.vn/ty-gia-usd-hom-nay-277-dong-usd-tang-gia-dong-yen-suy-yeu-post292565.html

Comment (0)