On August 22, the Vietnamese stock market welcomed the return of PTM Automobile Manufacturing, Trading and Service Joint Stock Company (stock code: PTM). PTM is a subsidiary of Hang Xanh Automobile Service Joint Stock Company (Haxaco, stock code: HAX), the company currently leading the market share in distributing Mercedes-Benz cars in Vietnam.

PTM Automobile Manufacturing, Trading and Service Company is currently a subsidiary of Haxaco, taking on the important role of distributing the MG brand in the Vietnamese market. Previously, Haxaco held up to 98.3% of the charter capital of this company, but now this ratio has been reduced to 51.62% to ensure the requirement of separating ownership for each car brand (Mercedes-Benz and MG) from international partners.

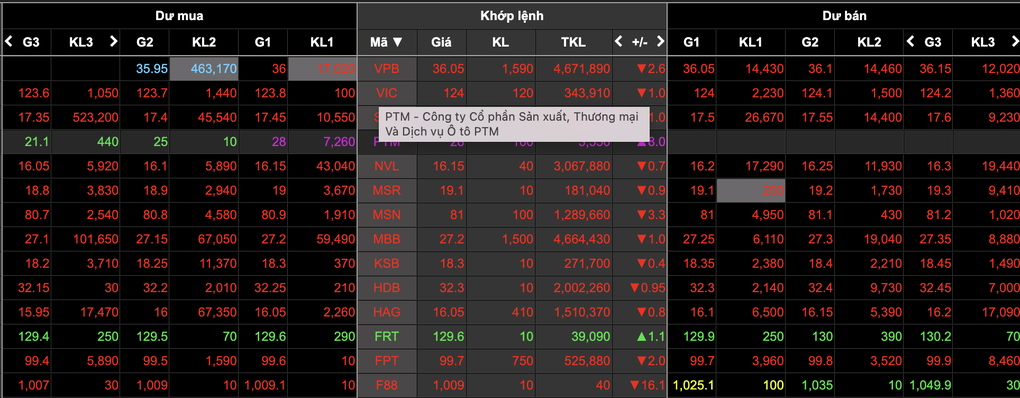

More than 32 million PTM shares officially resumed trading on the UPCoM exchange, with a reference price of VND20,000/share, corresponding to a starting capitalization of about VND640 billion. After just a few hours of trading, PTM shares quickly hit the ceiling, reaching VND28,000/share - a dramatic increase of 40% in the first session, bringing the company's capitalization close to the VND900 billion mark.

It is worth mentioning that PTM code increased to its full amplitude while the whole market sold off, decreasing dozens of points.

PTM increased to the ceiling price on the return to UPCoM, while the whole market decreased sharply (Photo: Screenshot).

PTM Automobile Manufacturing, Trading and Service Company is not a strange name to investors. This company was listed on the HNX since 2009 and then transferred to UPCoM in 2015. However, at the end of 2018, PTM shares were deregistered for trading because they no longer met the conditions of a public company.

After 6 years of absence, the company officially returned to the stock exchange. To prepare for this event, in 2024, the company increased its charter capital to 320 billion VND through offering shares to existing shareholders at a ratio of 1:1.

Mr. Do Tien Dung - Chairman of Haxaco (Photo: HAX).

Regarding business results, before returning to UPCoM, the company's revenue and profit witnessed a sudden growth in 2024. Revenue increased 7 times to VND 1,414 billion, and after-tax profit also increased more than ten times to VND 128 billion.

In the second quarter of 2025, the company achieved net revenue of VND391 billion, up 50% over the same period. However, after-tax profit decreased by 25%, to nearly VND19 billion due to a sharp increase in sales and management costs during the showroom system expansion period.

Source: https://dantri.com.vn/kinh-doanh/trum-buon-o-to-mg-tro-lai-san-chung-khoan-20250822134223487.htm

![[Photo] President Luong Cuong receives delegation of the Youth Committee of the Liberal Democratic Party of Japan](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/22/2632d7f5cf4f4a8e90ce5f5e1989194a)

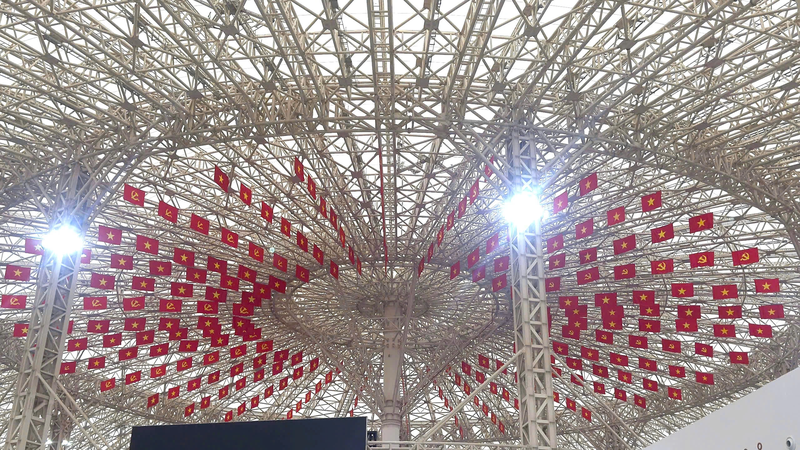

![[Photo] President Luong Cuong attends special political-artistic television show "Golden Opportunity"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/22/44ca13c28fa7476796f9aa3618ff74c4)

![[Photo] Prime Minister Pham Minh Chinh chairs the conference to review the 2024-2025 school year and deploy tasks for the 2025-2026 school year.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/22/2ca5ed79ce6a46a1ac7706a42cefafae)

Comment (0)