National Assembly Chairman Tran Thanh Man has just signed and issued Resolution 92 adjusting the National Assembly's 2025 legislative program.

Accordingly, the National Assembly Standing Committee decided to submit to the National Assembly for comments on amending the Personal Income Tax Law at the 10th session, taking place next October.

National Assembly Chairman Tran Thanh Man has just signed a resolution of the National Assembly Standing Committee to add the draft Law on Personal Income Tax (amended) to the 2025 law-making program.

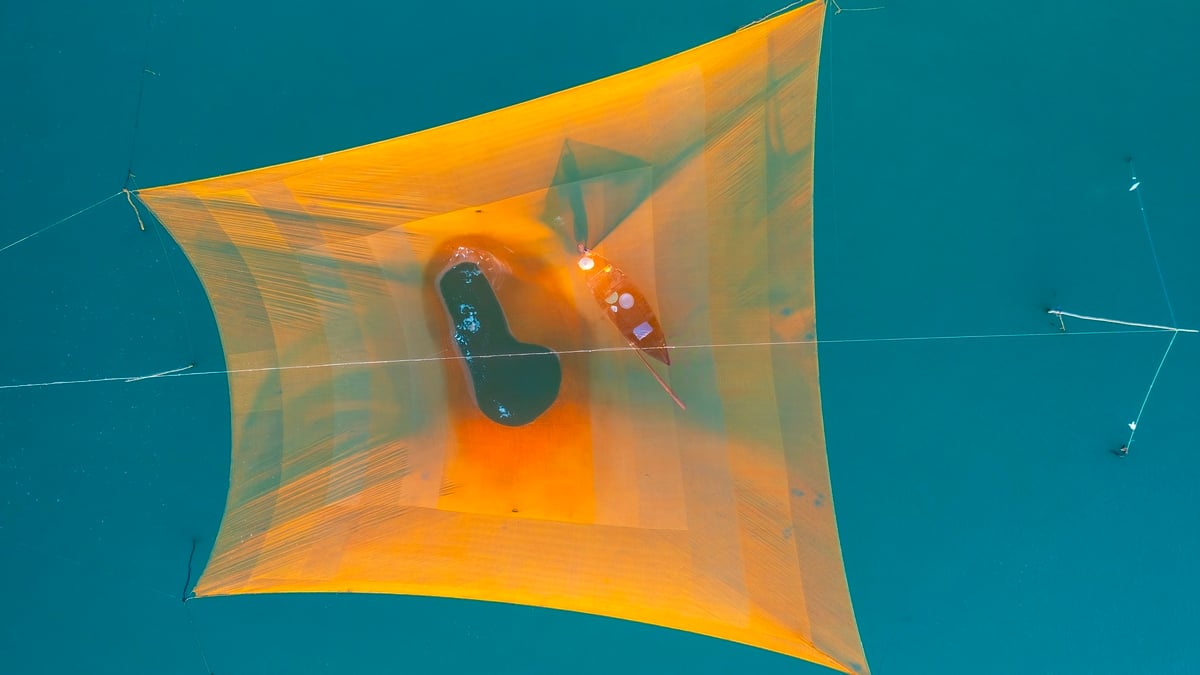

PHOTO: GIA HAN

Along with the draft law on Personal Income Tax (amended), the National Assembly Standing Committee also decided to add three other draft laws to the agenda of the 10th session, including: the Law on Tax Administration (amended); the Law on Protection of State Secrets (amended); and the Law on Public Employees (amended).

In particular, the Law on Protection of State Secrets (amended) and the Law on Civil Servants (amended) will be implemented according to the simplified procedures (approved at 1 session).

Also according to the Resolution of the National Assembly Standing Committee, the above draft laws will be submitted to the National Assembly Standing Committee for comments at the upcoming September session, before being submitted to the National Assembly.

Resolution of the National Assembly Standing Committee on adding 4 draft laws to the law-making program of the 10th session of the 15th National Assembly based on the Government's submissions to the National Assembly last July.

Previously, at the National Assembly's forum on supervision activities on the morning of August 6, National Assembly Chairman Tran Thanh Man said that at the 10th session in October, the Government will submit 90 contents to the National Assembly, including 47 draft laws and the majority of the draft laws will be passed according to the shortened process of 1 session to resolve urgent issues.

How will personal income tax be amended?

The Personal Income Tax Law, especially the family deduction, has been proposed to be amended many times by many National Assembly deputies and experts because they believe it is decades out of date, but so far the Government has not submitted it to the National Assembly.

According to the draft Law on Personal Income Tax (amended) that is soliciting opinions, the drafting agency, the Ministry of Finance, proposes not to have "rigid" regulations on family deduction levels as in the current law, but to assign the Government to regulate them in accordance with the socio-economic situation of each period.

Regarding the personal income tax table, the Government proposed to reduce the number of levels in the personal income tax table to 5 levels instead of the current 7 levels, but keep the current tax rate of 5 - 35%.

Regarding the family deduction level, the Government is also drafting a resolution of the National Assembly Standing Committee to adjust the family deduction level due to fluctuations in the consumer price index (CPI) from 2020 to the end of 2025, which is calculated to exceed 20% (about 21.24%) according to the law.

In the draft resolution, the Government is proposing two options to adjust the family deduction level, applicable from the 2026 tax period. Option 1 is to increase the family deduction level for taxpayers from the current VND 11 million to VND 12.3 million/month; the deduction level for each dependent from VND 4 million to VND 5.3 million/month.

Option 2 is to increase the deduction for taxpayers to 15.5 million VND/month; for each dependent to 6.2 million VND/month.

At the Government press conference yesterday afternoon, August 7, Deputy Minister of Finance Nguyen Duc Chi said that the majority of comments agreed with option 2. This is the option to adjust the family deduction level according to the average income per capita and GDP.

Regarding the calculation of higher family deductions for big cities like Hanoi and Ho Chi Minh City due to high living costs, the leader of the Ministry of Finance said that there have been calculations, but if the family deductions are divided by region, it will be very difficult to implement.

It is still unclear when the Government will submit to the National Assembly Standing Committee for approval the draft resolution adjusting this family deduction level.

Thanhnien.vn

Source: https://thanhnien.vn/trinh-quoc-hoi-sua-luat-thue-thu-nhap-ca-nhan-tai-ky-hop-thang-10-185250808090605363.htm

Comment (0)