Oil prices under pressure on inventory data and oversupply concerns

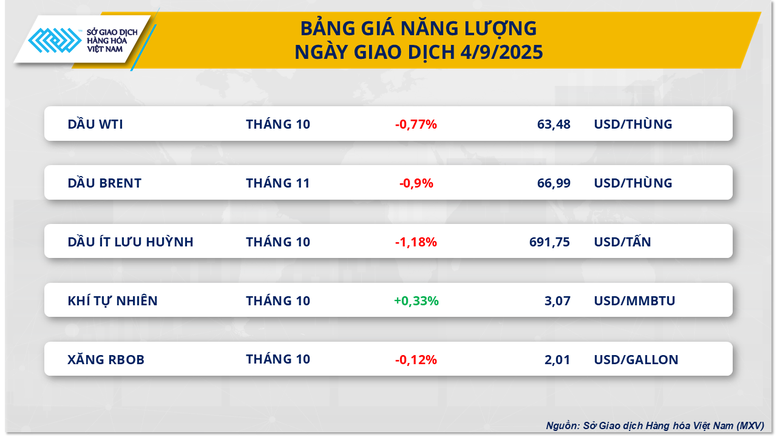

According to MXV, the energy market was under strong selling pressure yesterday when 4/5 commodities decreased in price, in which Brent and WTI oil prices both lost nearly 1%, closing at 66.99 USD/barrel and 63.48 USD/barrel, respectively.

The biggest pressure came from unexpectedly rising US crude inventories, contrary to expectations of a decline. The API and EIA reports showed that commercial inventories rose by 622,000 and more than 2.4 million barrels in the week ended August 29, as many refineries entered routine maintenance, reducing demand for crude. This signal overshadowed the supportive impact of a drop in gasoline inventories, suggesting that consumption is cooling.

Market sentiment is also being weighed down by the possibility that OPEC+ will raise production earlier than expected, by around 1.65 million barrels per day, which could loosen the global supply-demand balance. Although the bloc’s leaders, including Russia, have said they have not yet made a decision, the risk has investors selling defensively.

The US economic picture is also not supportive for oil prices in the short term, with both the services and composite PMI indexes falling in August, ADP data showing just 54,000 new jobs, nearly half the previous month, and initial jobless claims rising. This raises concerns about weakening energy demand.

However, these less positive economic signals reinforce expectations that the US Federal Reserve (Fed) will soon lower interest rates in September to help support oil consumption in the medium term.

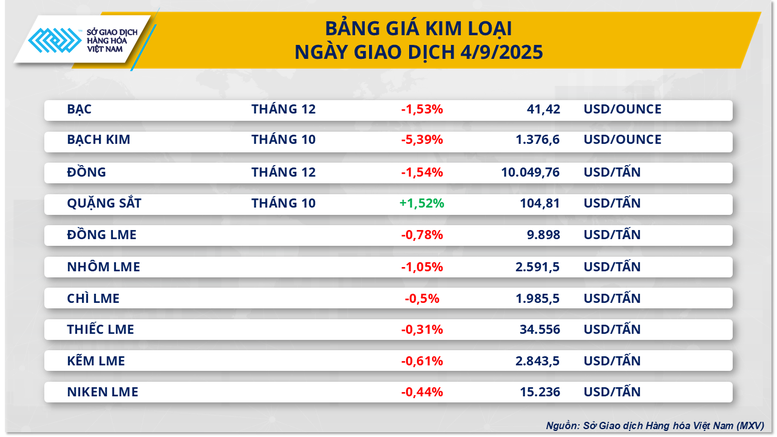

Iron ore prices mark third consecutive increase

Iron ore prices closed yesterday up 1.52% at $104.8 a tonne, bucking the downward trend of most metals. According to MXV, the main support came from expectations that Beijing would tighten its excess steel production to address overcapacity and compete on low prices. This positive sentiment helped prices remain stable above $100 a tonne, despite the current lack of strong demand.

Recently, five Chinese government agencies announced a plan to stabilize the steel industry's growth in 2025-2026, emphasizing tightening production capacity and output. Crude steel output in 2025 is forecast to fall below 980 million tons, down from more than 1 billion tons in 2024. Morgan Stanley (USA) noted that the cuts are currently focused on electric arc furnaces, but if expanded to blast furnaces using iron ore, the price support impact would be more pronounced.

However, the risk of a correction remains as physical demand in China shrinks. Data from the Pilbara Port Authority (Australia) shows that iron ore exports to China in July fell more than 20% compared to June.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-ap-luc-cung-cau-dan-dat-bien-dong-gia-hang-hoa-the-gioi-102250905105946775.htm

![[Photo] Amazing total lunar eclipse in many places around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/8/7f695f794f1849639ff82b64909a6e3d)

Comment (0)