After 25 years of development, the stock market is increasingly improving.

At the 25th anniversary celebration of the official opening of the Vietnamese stock market on the morning of July 28, organized by the Ho Chi Minh City Stock Exchange (HoSE), Minister of Finance Nguyen Van Thang commented: “If in the early days of its establishment, the market only had 2 enterprises, with a capitalization scale of only about 0.2% of GDP, now we have more than 1,600 enterprises participating in the market, with a capitalization scale of the stock and bond market reaching nearly 100% of GDP, becoming an important medium and long-term capital mobilization channel for the economy and economic organizations.”

“A quarter of a century, although not too long, is a journey of building and developing the Vietnamese stock market with courage and perseverance, from the beginning to the standards of a high-level market of the country's economy . The Vietnamese stock market has shown its role and effective contribution in each stage of the country's economic development; thereby affirming itself as an important medium- and long-term capital channel for the economy and enterprises,” Minister Nguyen Van Thang emphasized.

Speaking at the ceremony, Ms. Vu Thi Chan Phuong, Chairwoman of the State Securities Commission, said that in the context of the country entering a new era, the issue of mobilizing all resources, including capital resources, for rapid and sustainable economic development will create momentum for the development of the Vietnamese stock market.

Up to now, after 25 years of development, the Vietnamese stock market is increasingly improving in terms of legal framework, market structure, technology infrastructure, products, intermediary organizations and is an attractive investment channel with more than 10 million accounts of domestic and foreign investors.

25th anniversary of Vietnam stock market on July 28, 2025 in Ho Chi Minh City.

After the first foundation of Decree 48/1998/ND-CP, Decree 144/2003/ND-CP created the basis for organizing and operating the market officially.

As of June 30, 2025, there were 640 listed and traded stocks on HoSE. Of which, 44 enterprises had a capitalization of over 1 billion USD, of which 3 enterprises reached over 10 billion USD. Market liquidity with an average daily trading volume in 2000 had an average daily trading value of only 1.4 billion VND, up to now, the trading volume and average trading value have reached over 19,000 billion VND respectively.

Ms. Vu Thi Chan Phuong, Chairwoman of the State Securities Commission, spoke at the ceremony.

From a young market, Vietnam has gradually improved its legal system with generations of Securities Laws and synchronous guiding documents. Most recently, in Law No. 56/QH15, the amended and supplemented Securities Law passed by the National Assembly continues to create a legal corridor in line with international practices and practices, contributing to the sustainable development of the market.

Chairwoman of the State Securities Commission Vu Thi Chan Phuong said that in order to achieve the goals set out in Resolution 68 of the Politburo, Resolution 86 of the Government and the Strategy for Stock Market Development to 2030, in addition to the determination and utmost efforts of officials, civil servants and public employees, the Securities industry hopes to continue to receive the attention and leadership of the leaders of the Party, State, Government and the Ministry of Finance.

“Although there are many challenges ahead, with solidarity, consensus, creativity and innovation, the Vietnamese stock market will continue to develop strongly, contributing more effectively to economic growth,” said Chairwoman Vu Thi Chan Phuong.

Although it was born after the stock markets of countries in Southeast Asia such as Thailand, Malaysia, Singapore, Philippines, and Indonesia, the growth in capitalization and liquidity at HoSE is gradually narrowing the gap and becoming one of the most vibrant markets in the region.

Looking back at the journey of formation and development with the Vietnamese stock market over 25 years, centralized transactions at HOSE have become the stock market with the largest capitalization value in the country (as of May 30, 2025, it is 218 billion USD), meeting the expectations of the Government and investors.

The VN-Index is a measure of stock price growth in the market, from 100 points on July 28, 2000, it has increased to more than 1,512.31 points on July 23, 2025.

“With Vietnam likely to be upgraded to emerging market status this year, it promises to expand capital mobilization channels and strongly attract foreign investment flows, increasing market capitalization and liquidity,” Ms. Nguyen Thi Viet Ha, Acting Chairwoman of the Ho Chi Minh City Stock Exchange, emphasized.

Resolutely and synchronously deploy solutions to upgrade the market

With many synchronous solutions from the management agency, especially Circular 68 of 2024 and Circular 18 of 2025 of the Ministry of Finance, the Vietnamese stock market is facing a great opportunity to be upgraded from a frontier market to an emerging market in 2025.

According to the World Bank, if upgraded, Vietnam could attract up to 25 billion USD in indirect investment in the next 5 years. Currently, the market has met most of the criteria for upgrading according to FTSE Russell standards. Rating agencies, international financial institutions and market participants all highly appreciate Vietnam's reform efforts.

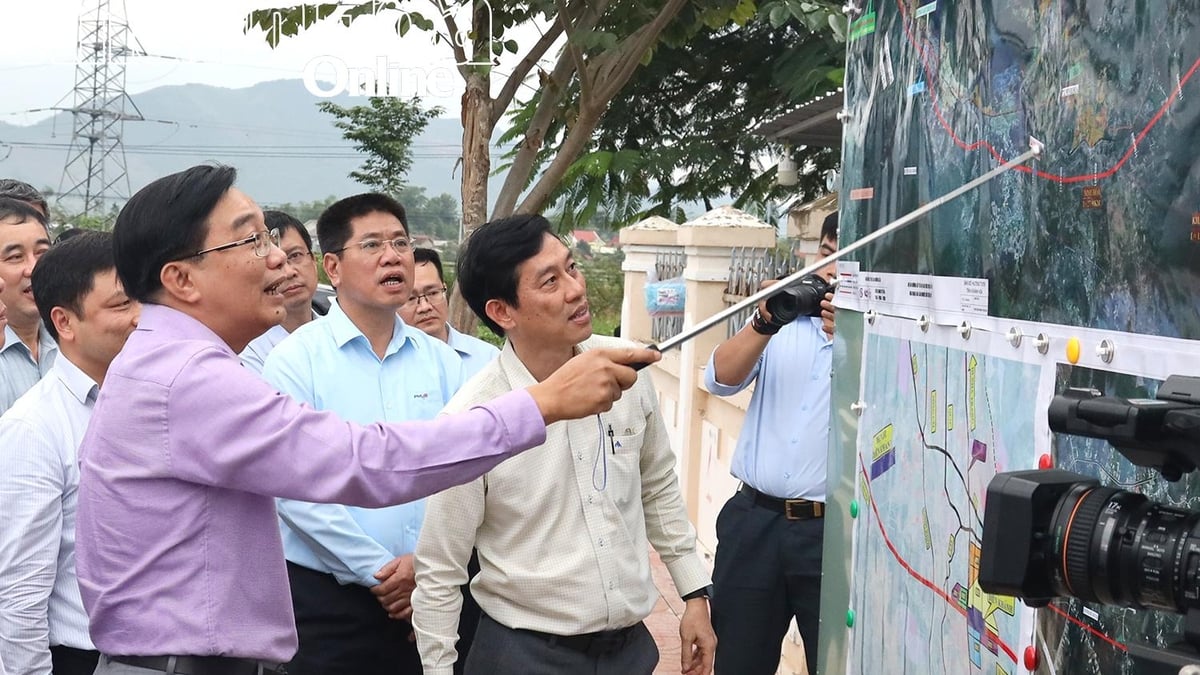

Deputy Prime Minister Ho Duc Phoc, Minister of Finance Nguyen Van Thang, and delegates performed the launching ceremony of the new Information Technology System.

Along with the development process, technology infrastructure is constantly invested in modern and synchronous manner, aiming at the goal of efficient, transparent, safe operation and approaching international standards.

An important milestone is that on May 5, 2025, the new information technology system was officially put into operation synchronously at HOSE, HNX, VSDC and market members, modernizing the infrastructure for the Vietnamese stock market. The stable operation of the new information technology system is an important step forward, creating a foundation for deploying new products and services and contributing to supporting the stock market to be upgraded soon.

Minister of Finance Nguyen Van Thang assessed that the successful implementation of the KRX System invested by the Ho Chi Minh City Stock Exchange has brought about many strong changes to the Vietnamese stock market, including increasing transaction speed and settlement time. At the same time, it has paved the way for the application of new market products; increased transparency of market activities and system safety. This has helped to enhance the confidence of investors, especially foreign investors, and created a foundation for Vietnam to be included in the list of emerging markets of international organizations.

In order to promote the achieved results and with the highest determination to complete the goals and tasks assigned by the Government, Minister of Finance Nguyen Van Thang requested the entire Securities sector to thoroughly grasp the spirit and resolutely implement 5 key tasks.

Firstly, continue to build and perfect a synchronous legal framework in line with international practices, ensuring market stability, transparency and efficiency.

Second, organize the market to operate safely, stably and effectively; reform administrative procedures, create favorable conditions for organizations and individuals to participate in the market; improve management capacity, quality of supervision, inspection, examination, and strictly handle violations, in order to enhance transparency and market discipline.

Third, continue to effectively restructure the pillars of the market, increase institutional investors, improve the quality of goods, diversify products and services in the stock market, and meet the diverse needs of the market and investors.

Fourth, promote digital transformation and modernize information technology infrastructure, both effectively serving state management and meeting market development requirements in the new period.

Fifth, strengthen information and propaganda work and provide knowledge training for investors; promote comprehensive and in-depth international cooperation, and enhance the position of the Vietnamese stock market.

“In particular, drastic and synchronous implementation of solutions to soon upgrade the Vietnamese stock market from frontier to emerging market, thereby strongly attracting domestic and foreign investment capital flows,” the Minister emphasized.

Source: https://nhandan.vn/thi-truong-chung-khoan-25-nam-nen-tang-vung-chac-san-sang-but-pha-post897039.html

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)