From July 22-24, Batdongsan.com.vn organized the event "Real estate market overview in the first 6 months of 2025" in Ho Chi Minh City and Hanoi , with a total of nearly 1,500 attendees. At the event, Batdongsan.com.vn provided a lot of information, the latest updated data on the market and in-depth analysis to support buyers, investors, brokers and real estate businesses.

Macroeconomics maintains positive rhythm, creating a foundation to support the market

The first half of 2025 marks a period with many remarkable changes in the Vietnamese real estate market. In the context of many macroeconomic fluctuations, the State has issued positive policies that have established the premise to promote the economy in general and the real estate market in particular. Factors such as: reciprocal tax policy, speed of public investment disbursement, interest rate adjustment signals, new urban planning orientation after the merger... are playing a key role in maintaining market confidence and shaping transaction trends in the second half of 2025.

One of the fundamental factors is that interest rates remain low, while credit growth shows signs of improvement, especially in the home loan and business loan groups. This is an important support to stimulate consumer and investment demand and open up capital flows into real economic activities.

Notably, the Government’s issuance of Decree 151 and Official Dispatch 78 has directly removed legal “bottlenecks” for real estate projects. This series of policies is expected to have an impact in the following quarters, promoting project implementation progress and contributing to re-establishing market supply and demand.

A highlight of this period comes from the formation of new growth poles after the merger, especially the linking area of Ho Chi Minh City - Binh Duong - Ba Ria - Vung Tau. Each locality is taking on its own role in the interconnected value chain: Ho Chi Minh City - Financial, coordination and high-end service center; Binh Duong - Industrial - high-tech core; Ba Ria - Vung Tau - Logistics hub - international seaport. This multi-polar development model not only creates growth momentum for each locality, but also opens up the prospect of forming the largest metropolitan area in Vietnam.

|

| The macro economy is acting as a “stable foundation”, helping the real estate market gradually escape the defensive phase and move towards a more sustainable recovery cycle in the second half of the year. (Source: Pexels) |

Besides the key metropolis of Ho Chi Minh City, the merger of provinces and cities also forms new industrial and tourist centers with synergy and positive impacts on the real estate market.

For example, typical industrial centers include: Bac Ninh - high-tech industrial center; Hai Phong - commercial - logistics - industrial center; Dong Nai - industrial - logistics - high-tech agricultural center.

In the Central region, Da Nang’s merger with Quang Nam will form an integrated logistics – industrial – tourism center, with the tourism – service sector accounting for 71% of GRDP, supporting the economy. Similarly, an international marine – energy and tourism economic center will also be formed in the new Khanh Hoa after the merger.

With the leverage of inter-regional connectivity infrastructure, synchronous planning policies and continued priority of public investment capital, the macro economy is acting as a “stable foundation”, helping the real estate market gradually escape the defensive phase and move towards a more sustainable recovery cycle in the second half of the year.

Prices continue to rise, interest levels recover

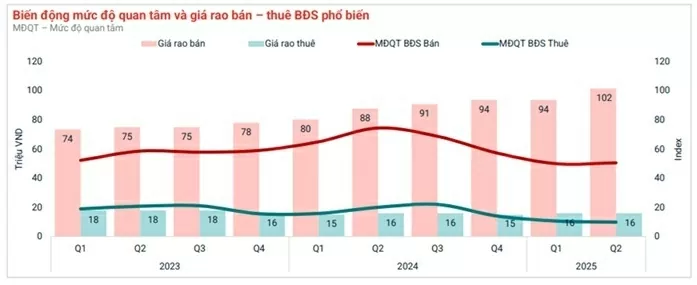

The real estate market in the second quarter of 2025 continued to record an upward trend in prices, especially in the sales segment. According to data from Batdongsan.com.vn , the average asking price continued to increase, in the context of gradually unblocking investment cash flow and gradually positive macroeconomic factors.

Meanwhile, the level of interest (MĐQT) in real estate for sale tended to decrease slightly compared to the previous quarter, reflecting short-term observational psychology. However, the end of the second quarter recorded clear signs of recovery after the long holiday and information about the temporary suspension of reciprocal tariffs from the US.

|

Selling prices continue to increase, MĐQT recorded a slight decrease but there was a recovery after the long holiday and macro fluctuations. (Source: Batdongsan.com.vn) |

For rental real estate, the market remained stable in the second quarter. Rental prices did not fluctuate significantly, and MĐQT in major cities remained stable.

By region, the Ho Chi Minh City market showed resilience amid macroeconomic fluctuations. Specifically, the new Ho Chi Minh City (including the merged areas of Binh Duong and Ba Ria - Vung Tau) increased by 6% in Q1 compared to the previous quarter, showing the positive effect from expectations of new urban planning. The old Ho Chi Minh City also increased by 6% in Q1, while Hanoi recorded a decrease of 16%, reflecting the difference in interest between the two major economic centers.

For the rental market, major cities still maintain a stable pace: Ho Chi Minh City slightly decreased by 4% of the rental market, while Hanoi decreased by 1%.

By type, apartments are the segment that recorded the strongest increase in MĐQT in the second quarter of 2025 with +8%. This is considered a positive signal from the market after a series of adjustments to reduce home loan interest rates, along with the appearance of new projects in Hanoi and Ho Chi Minh City.

|

| The Ho Chi Minh City apartment market has shown resilience in the context of macroeconomic fluctuations. (Source: VnEconomy) |

In contrast, the land segment decreased by 19% of the MĐQT, showing a clear “cooling down” after the hot growth period at the beginning of the year. Types such as townhouses, villas, and private houses also recorded a slight decrease, ranging from 2-15%, reflecting a tendency for the market to defend against macro fluctuations, returning to real estate types that are easy to exploit.

Overall, the second quarter of 2025 shows that the market is in a "watch and wait" state, with clear differentiation between regions and types.

Source: https://baoquocte.vn/thi-truong-bat-dong-san-6-thang-dau-nam-2025-don-bay-tu-ha-tang-ket-noi-lien-vung-tp-ho-chi-minh-tang-suc-hut-322445.html

Comment (0)