|

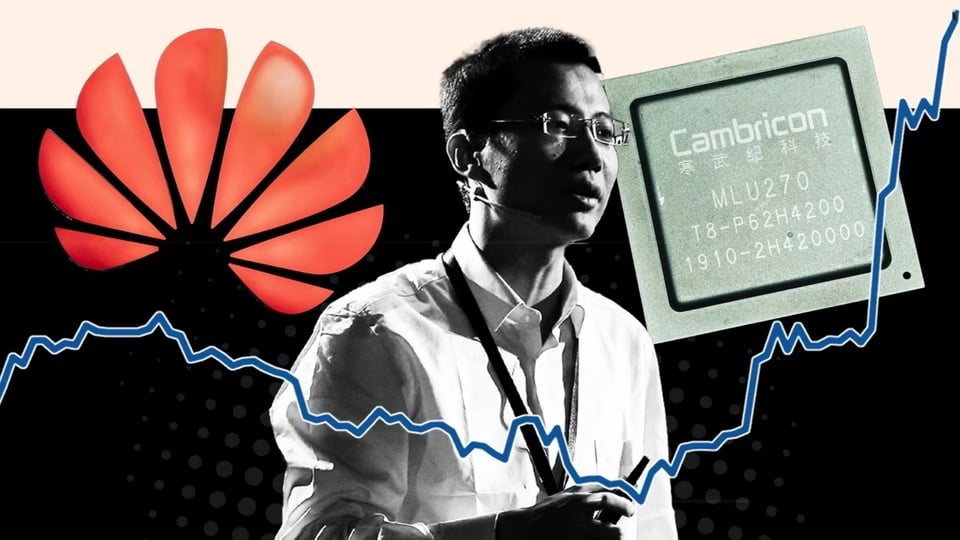

Cambricon is gradually emerging as China's leading AI chip maker. Photo: Bloomberg . |

Cambricon, a Chinese chip design company, is emerging as a direct rival to Huawei in the artificial intelligence (AI) chip race. With its software advantage and government backing, Cambricon is being bet by investors to become one of the pillars of Beijing's technology self-reliance strategy.

In 2019, Cambricon lost almost all of its revenue when Huawei stopped using its chips in its smartphones. Six years later, the picture has changed completely. The semiconductor maker’s stock price doubled in just one month, to 1,495 yuan ( $209 ), giving it a market capitalization of 580 billion yuan ( $81 billion ). The rally was fueled by expectations that the company would supply chips to DeepSeek, a Chinese AI company that has just made a technological breakthrough that has shaken up Silicon Valley.

In the face of market euphoria, Cambricon warned that the stock price may have “decoupled from fundamentals.” But policymakers remain bullish on the company, seeking to balance Huawei as Beijing pushes for domestic chip production.

Founded in 2016 by the Chinese Academy of Sciences (CAS), Cambricon quickly launched its first AI chip. CAS still holds a 15.7% stake, making it the second-largest shareholder after founder Chen Tianshi. Huawei was a customer that accounted for 98% of Cambricon's revenue in 2018.

However, the company struggled until 2022, when the US blacklisted Cambricon and forced it to cut ties with TSMC. Still, from 2020 to 2024, the company poured 5.6 billion yuan ( $81 million ) into R&D, focusing on developing software that makes chips compatible with models trained on Nvidia GPUs.

Software compatibility makes the Cambricon chip easier to deploy than Huawei’s Ascend, according to a ByteDance engineer. The company’s customers include China Telecom, Alibaba, Tencent, and Baidu, which compete directly with Huawei in cloud computing, networking equipment, and autonomous vehicles.

However, manufacturing capacity remains a major bottleneck for the fledgling chipmaker. Cambricon relies on SMIC to produce 7nm chips. Last year, the Chinese government directed SMIC to allocate significant capacity to Cambricon instead of Huawei. The Financial Times reported that SMIC plans to double its 7nm chip production capacity by 2026, opening up more room for growth for the company.

“There has never been a capacity problem that China cannot solve. Building is something we will do if it makes money,” said one semiconductor investor.

Currently, Cambricon's priority is to secure stable supply from SMIC to meet rapidly growing market demand.

Source: https://znews.vn/startup-chip-ai-khien-huawei-de-chung-post1582066.html

![[Photo] Politburo works with the Standing Committees of Vinh Long and Thai Nguyen Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/8/4f046c454726499e830b662497ea1893)

![[Photo] Politburo works with the Standing Committees of Dong Thap and Quang Tri Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/8/3e1c690a190746faa2d4651ac6ddd01a)

![[Photo] Amazing total lunar eclipse in many places around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/8/7f695f794f1849639ff82b64909a6e3d)

Comment (0)