According to the resolution, households, individuals and organizations directly using land for agricultural production will be exempted from this land tax until 2030, an additional 5 years. This is to ensure food security and increase Vietnam's competitiveness.

In case the State allocates land but the organization or individual does not directly use this area for agricultural production and leases it to another unit, they must pay 100% of this tax during the period the State has not yet reclaimed the land.

The Resolution takes effect from January 1, 2026.

According to the Government report, in the period 2001-2010, the total amount of agricultural land tax exempted and reduced was an average of 3,268 billion VND per year. This figure increased to 7,500 billion VND per year in the last 3 years.

Therefore, the exemption of agricultural land tax will encourage land concentration for large-scale production, shifting the agricultural and rural economic structure towards modernization.

In the report explaining and accepting before the National Assembly voted, Chairman of the Economic and Financial Committee Phan Van Mai said that some opinions suggested not exempting tax on land left fallow or used for improper purposes.

Other opinions suggest that it is necessary to regulate criteria and conditions for tax exemption, as well as have sanctions to handle cases of taking advantage of policies to use land for the wrong purposes.

The Standing Committee of the National Assembly believes that, as the National Assembly deputies have said, the situation of using land for the wrong purpose, leaving land fallow, and wasting resources is quite common.

According to the National Assembly Standing Committee, in addition to supporting farmers and rural areas, the policy of exempting agricultural land use tax also needs to encourage organizations and individuals to use land effectively, as well as having criteria to classify and identify appropriate tax-exempt subjects to ensure support for the right subjects.

However, specifying specific criteria to determine the correct subjects that are exempt from tax and those that are not exempt from tax for abandoned land or land used for improper purposes requires research time.

The 2024 Land Law also has a number of provisions to help overcome the situation of abandoned agricultural land.

Therefore, the Standing Committee of the National Assembly requests not to add tax-exempt subjects to the resolution, but requests the Government to comprehensively assess the current status of agricultural land use as well as the effectiveness of tax exemption for this land in the past time.

"The National Assembly Standing Committee recommends that the Government pay attention to fully guiding the provisions of the Land Law and have solutions to avoid the situation of land waste and waste of land resources," Mr. Mai said.

The National Assembly Standing Committee also requested the Government to review and evaluate the exemption of agricultural land use tax, as well as tax and fee policies for land to propose appropriate mechanisms, or amend the Law on Agricultural Land Use Tax to suit management requirements in the new period.

Mr. Phan Van Mai also said that there are opinions suggesting to consider and expand the tax-exempt subjects.

Regarding this content, the Standing Committee of the National Assembly believes that, according to current regulations, the scope of application of the agricultural land use tax exemption policy is households, individuals and organizations directly using land for agricultural production.

The tax exemption policy does not apply to the area of agricultural land that the State assigns to organizations for management but does not directly use the land for agricultural production but assigns it to other organizations or individuals to receive contracts for agricultural production.

Therefore, the Standing Committee of the National Assembly requests the National Assembly not to expand the beneficiaries of the agricultural land use tax exemption policy.

Source: https://baolangson.vn/quoc-hoi-thong-nhat-mien-thue-dat-nong-nghiep-them-5-nam-5051329.html

![[Photo] Cuban artists bring "party" of classic excerpts from world ballet to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/797945d5d20b4693bc3f245e69b6142c)

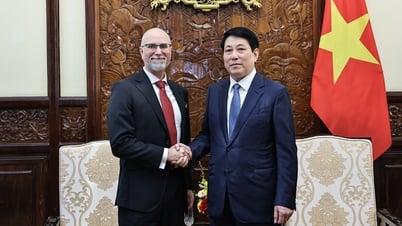

![[Photo] General Secretary To Lam receives Australian Ambassador to Vietnam Gillian Bird](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/ce86495a92b4465181604bfb79f257de)

Comment (0)