|

Jensen Huang, CEO of Nvidia. Photo: Bloomberg . |

In its first quarter 2025 financial report, Nvidia sent a strong message to the Trump administration about regulations restricting the export of AI chips to China.

“China’s AI industry will continue to grow regardless of whether it uses chips from the US or not,” Nvidia CEO Jensen Huang said.

Given that more than half of the world’s AI programmers come from China, Huang said that preventing American companies from competing in the country of a billion people could cost the US its lead in the AI race. Nvidia itself cannot abandon the Chinese market.

Big impact on revenue

“Ultimately, the platform that AI developers trust will win the AI race. Export controls should be used to strengthen America’s foundation, not to ‘give away’ half of the world’s AI talent to competitors,” Huang stressed.

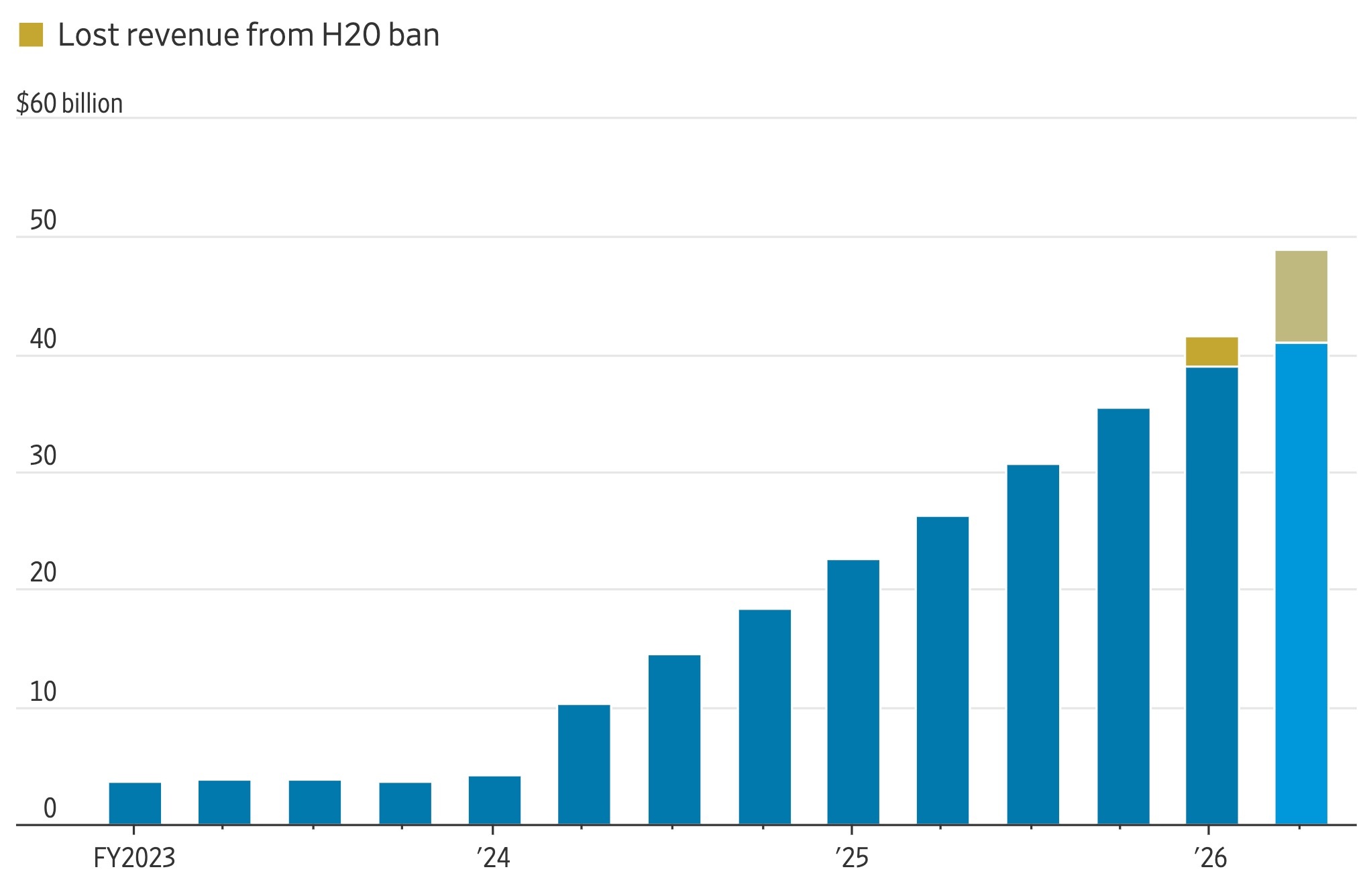

According to WSJ , finance is also the reason for Nvidia's tough argument. The US government 's decision in April to block the sale of H20 chips to China caused Nvidia's revenue to drop by about $2.5 billion in the most recent fiscal quarter (ending April), and is expected to lose another $8 billion in the next fiscal quarter (ending July).

The H20 chip was designed specifically for the Chinese market to comply with the previous restrictions. If it is not sold in China, Nvidia will not be able to sell this chip line in other markets.

|

Nvidia's total revenue and losses due to the restriction on selling H20 chips to China. Photo: WSJ . |

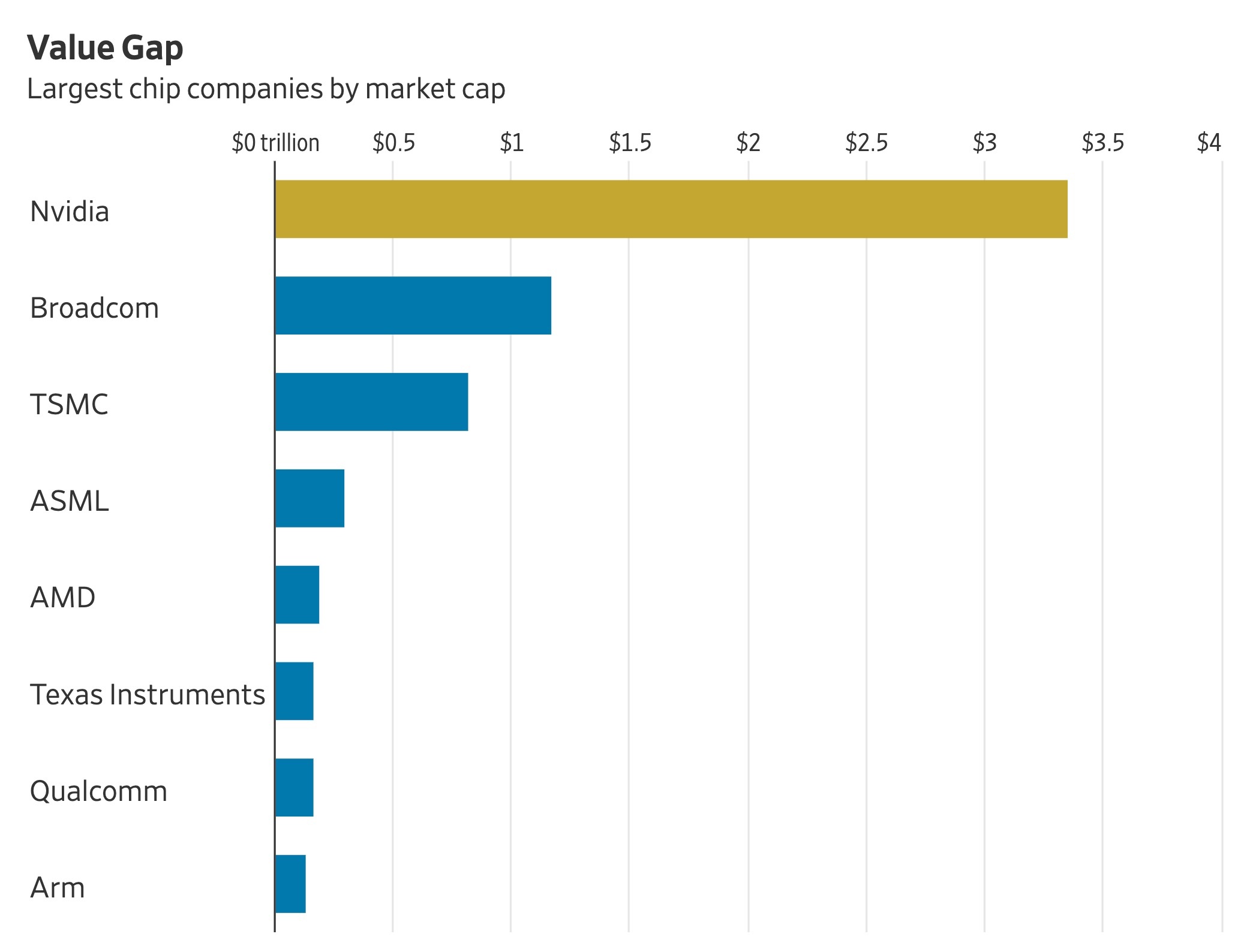

Demand for Nvidia’s AI chips is still booming in many countries, helping to make up for some of the lost sales. Nvidia’s market capitalization is now around $3.3 trillion , three times that of the next-biggest chip company (Broadcom). This shows that investors still believe in Nvidia’s growth potential.

Wall Street analysts forecast Nvidia’s annual revenue will surpass $200 billion this year and reach $300 billion by 2028. However, that is unlikely to happen without including China, the world’s second-largest economy , which has big ambitions in AI.

According to Morgan Stanley, Chinese government-backed venture capital funds invested $184 billion in AI startups between 2000 and 2023. Nvidia estimates that the AI accelerator market in China is worth about $50 billion .

“China is a quarter of the market. That’s a big number,” said UBS analyst Tim Arcuri, adding that Nvidia would gain “dominance” if it could compete in the country.

Competitive potential in China

Wall Street analysts still expect Nvidia to return to the Chinese market soon. “We believe that some of the business opportunities in China will recover,” said Morgan Stanley analyst Joe Moore.

However, any change at this stage would require the Trump administration to repeal or revise existing regulations, which, based on recent moves, the WSJ says is unlikely.

|

Nvidia's market capitalization compared to its chip rivals. Photo: WSJ . |

Analyst Tim Arcuri said that modifications to allow Nvidia to sell more powerful chips in China could still happen, especially since the US has restricted exports of advanced chipmaking equipment to China.

“If the equipment restrictions don’t change, China will still be limited in what they can do,” Arcuri stressed.

Nvidia’s absence opens the door for domestic rivals like Huawei, which Morgan Stanley estimates currently meets about 34% of AI chip demand, a figure that could reach 82% by 2027.

If it returns to China, Nvidia will still have to compete with domestic rivals, especially as the Chinese government pushes for the use of domestic technology for key industries.

Nvidia is a global AI giant with a highly regarded ecosystem of chips, hardware, and software. The company can still compete well in China, but that depends on the White House.

Source: https://znews.vn/ly-do-nvidia-khong-the-tu-bo-trung-quoc-post1557960.html

Comment (0)