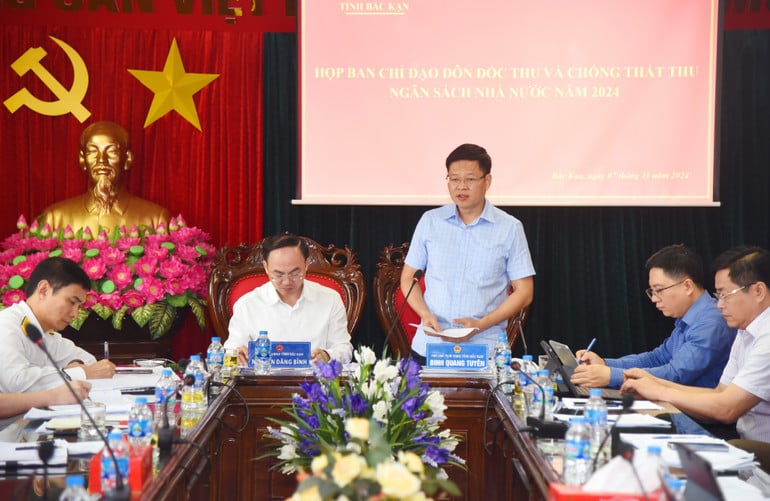

Chairman of the Provincial People's Committee Nguyen Dang Binh and Permanent Vice Chairman Dinh Quang Tuyen chaired the meeting.

According to the report at the meeting, the total state budget revenue in the area by October 31, 2024, reached 744 billion VND (including revenue from import and export activities and revenue from mobilized contributions), equal to 80% of the ordinance estimate, equal to 73.7% of the provincial estimate and equal to 114.2% over the same period.

Of which, total domestic revenue was 700.7 billion VND, reaching 77% of the central budget estimate; 71.6% of the provincial budget estimate, equal to 112.7% over the same period; total revenue from import-export activities was 32.4 billion VND, reaching 162.2% of the central budget estimate; 101.3% of the provincial budget estimate, equal to 124% over the same period.

Domestic revenue results by area and by revenue item, tax, by the end of October, 04 districts have completed the revenue estimate assigned by the province, including: Ngan Son district reached 35.6/30 billion VND, equal to 118.8%; Na Ri reached 28.6/27 billion VND, equal to 105.8%; Pac Nam reached 15.3/15 billion VND, equal to 102.2%; Bach Thong reached 19.5/19.5 billion VND, equal to 100%. The remaining units have low collection progress mainly due to the failure to complete the auction of land use fees.

In addition to some sectors, localities have relatively coordinated with the Tax sector such as: Finance, Natural Resources and Environment, Industry and Trade and some Project Management Boards. Coordination and information exchange for management and prevention of tax losses still have many limitations. Some key tasks assigned by the Provincial People's Committee in the Notices and Conclusions still exist and have not been completed. In addition, there are difficulties and problems regarding land use fees; revenue from the Central State-owned enterprise sector; difficulties in exploiting revenue sources and increasing revenue.

At the meeting, members of the Steering Committee discussed, contributed solutions and proposed recommendations for implementing the collection work in the last two months of the year, such as: Strengthening the management and use of invoices for retail sales of gasoline, alcohol stamps, and electronic invoices generated from cash registers; Project Management Boards directed contractors to speed up construction and disbursement progress; speed up the progress of auctions and land use fee collection, especially in key areas; urging mineral enterprises to declare and pay taxes in accordance with regulations based on the plan assigned from the beginning of the year...

Speaking at the meeting, Mr. Dinh Quang Tuyen, Permanent Vice Chairman of the Provincial People's Committee, requested that units and localities that are currently experiencing revenue shortfalls need to find and exploit maximum potential; for districts that have completed their revenue plans, they need to continue to exploit revenue sources to contribute more to the province; reasonably determine land prices and planning work to serve auctions to ensure land use fee collection; the Tax sector should filter out key enterprises, enterprises with tax debts, enterprises operating in the area without paying taxes to the locality, so that the province can have solutions to urge...

Concluding the meeting, Chairman of the Provincial People's Committee Nguyen Dang Binh directed: The Tax Department has a specific plan, reviews accurate data to strive to collect and exceed targets; continues to organize land auctions to achieve maximum revenue; maintains good revenue from land use and land rent; units and localities thoroughly collect revenues from minerals, taxes, fees, basic construction... strive to complete the budget collection plan of Bac Kan province in 2024 to reach four digits for the first time (VND 1,010 billion)./.

Source: https://baobackan.vn/nganh-thue-can-co-ke-hoach-cu-the-ra-soat-so-lieu-chinh-xac-phan-dau-thu-ngan-sach-dat-va-vuot-chi-tieu-post67255.html

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

Comment (0)