The new US tax rate on Vietnamese goods is 20% - 1 percentage point higher than other ASEAN countries but still lower than many global competitors.

The question is: is this a warning, a punishment or an opportunity to push Vietnam into a higher playing field in the global value chain?

In this article, we examine the Vietnam-US trade relationship through two lenses: new tax policies and Vietnam's market prospects when applying 0% tax to US goods.

Compare with Asean

The United States has decided to impose a 20% reciprocal tax on Vietnamese goods exported to the US – higher than the 19% applied to Thailand, Indonesia, the Philippines and Cambodia.

The 1 percentage point difference may seem small in terms of arithmetic, but it carries significant geopolitical messaging and trade positioning because globally, Vietnam is now the third largest goods trading partner of the US, after China and Mexico.

In 2024, Vietnam will export 136 billion USD to the US and import 13 billion USD, meaning a trade surplus of 10.5 times. Meanwhile, Thailand will have a trade surplus of only 3.5 times, Indonesia 2.8 times, the Philippines 1.6 times, and Cambodia - although having a trade surplus of 43 times - is only 1/10th of Vietnam's.

Clearly, the 20% tariff is a form of “soft adjustment” that the United States has imposed on Vietnam. This tariff is probably not punitive, but it is not preferential either.

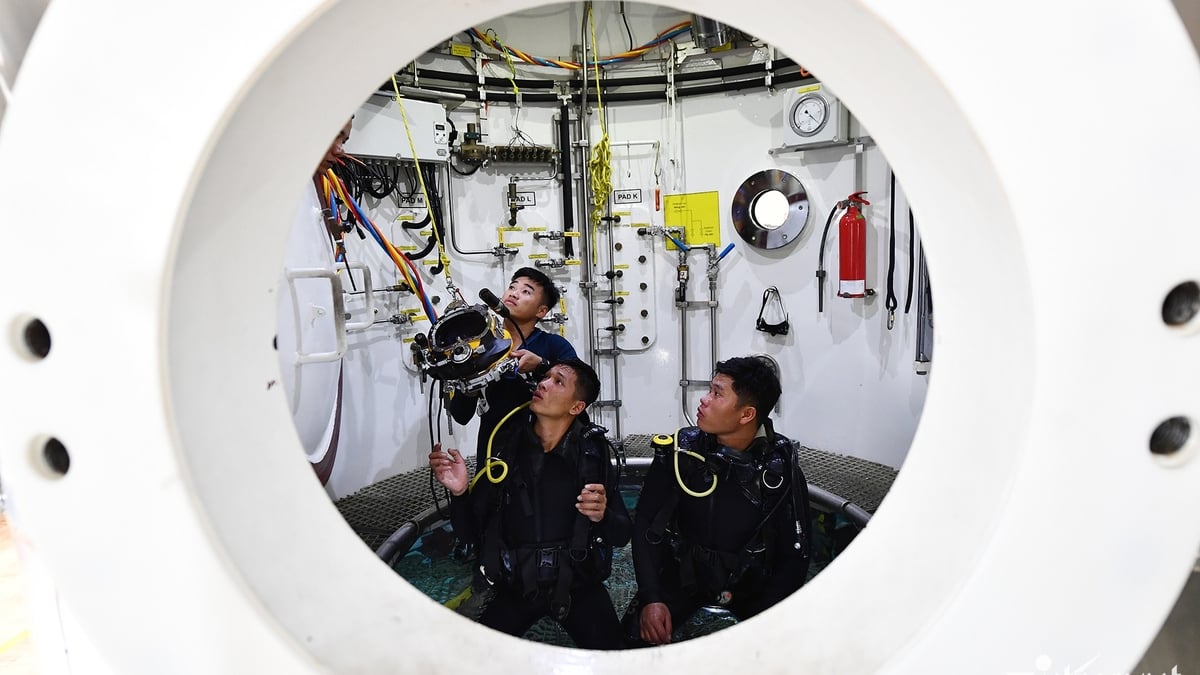

The 20% US tax is a test. We are forced to improve production capacity, increase localization rate, invest in R&D, and develop Vietnamese brands. Photo: Hoang Ha

Through this, it can be seen that the US is sending a message: Vietnam is an important and rising partner, but needs to rebalance the trade balance. How? It is to pressure Vietnam to increase domestic value, develop supporting industries, and escape the previous position of a "processing factory".

In the bigger picture, a 20% tariff puts Vietnam in a middle ground: higher than ASEAN, lower than many global competitors. China is taxed 50% by the US, India 25%, Canada 35%. Mexico, thanks to the USMCA, is exempt.

Will Vietnam become a consumer market?

On the other hand, Vietnam imposes a 0% import tax on American goods. The question is: What will happen, will American goods flood Vietnam?

An experienced expert gives the assessment: “The answer is no.”

She explained: The US manufacturing structure is very different. They hardly produce consumer goods suitable for the Vietnamese market. SUVs and large engines – items that President Trump has especially emphasized – only have the potential to increase gradually, but are not the type that can “sweep” the market.

In the agricultural sector, Vietnam has committed to importing $2 billion per year of US goods such as corn, soybeans, and animal feed. However, most corporations such as Cargill already have factories in Vietnam, so they do not need to import directly. US medical and pharmaceutical products are mostly manufactured in factories in Costa Rica, Uruguay, and Taiwan – not in the US.

In other words, even if Vietnam opens its doors completely, it will be difficult for American goods to flood in. What Vietnam needs is technology, and the US needs the market. This is a complementary relationship, not a direct competition.

Challenges ahead

According to diplomats , the recent Vietnam-US trade negotiations are a vivid example of flexible foreign policy.

Since the end of April 2025, a series of working sessions have taken place between the two countries, resulting in the tax rate being adjusted from 46% to 20%, not just reducing taxes, but reducing pressure.

Meanwhile, Vietnam is also emerging as a new star in the global supply chain. Stable GDP growth of 6-7%, approaching double digits, accelerating digital and industrial infrastructure, young population, abundant purchasing power, etc.

The remaining problem is internal strength. The 20% US tax is a test. We are forced to improve production capacity, increase the localization rate, invest in R&D, and develop Vietnamese brands. At the same time, we must continue to reform institutions, make the market transparent, attract high-quality FDI, and develop sustainably.

Of course, the difficulties are not small. The Asian Development Bank (ADB) assessed that the trade agreement with the United States, announced in early July 2025, which imposes significantly higher import tariffs on exports from Vietnam to the United States, is expected to reduce export demand for the rest of 2025 and into 2026. In addition, the Purchasing Managers' Index (PMI) shows that industrial production has slowed since late 2024.

Faced with that reality, ADB said that Vietnam's GDP growth is expected to be adjusted down to 6.3% in 2025 and 6.0% in 2026.

Vietnamnet.vn

Source: https://vietnamnet.vn/muc-thue-20-cua-my-thu-thach-hay-la-dong-luc-cho-viet-nam-2428285.html

![[Infographic] Traditional friendship and good cooperation between Vietnam and Egypt](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/4/9a2112b4046e4c128fdcb5403489866a)

Comment (0)