Since the beginning of August, only 3 banks have adjusted their deposit interest rates. Of which, ABBank has reduced 0.1%/year interest rates for terms from 1-36 months for online savings, while keeping the interest rates for savings at the counter unchanged.

The highest interest rate at ABBank is only 5.6%/year when saving online for a 12-month term.

Previously, Eximbank announced the expansion of the “Combo Casa” product with online deposits, the highest savings interest rate is 6%/year with a term of 18-36 months applied to Infinite customers.

Notably, Viet A Bank announced new interest rates for the following products: Dac Loc Savings, with the highest mobilization interest rate up to 6.3%/year; Dac Loi Savings with the highest interest rate up to 6.4%/year and Dac Tai Savings with the highest interest rate of 6.8%/year.

The new interest rates of the above deposit products of Viet A Bank are even much higher than the normal mobilization interest rates (including mobilization interest rates at the counter and mobilization interest rates online), which are being listed in parallel by Viet A Bank.

Currently, the highest deposit interest rate at Viet A Bank in particular and the savings interest rate market in general is 6.8%/year when customers deposit savings under the Dac Tai Savings program, implemented by this bank in 2025.

Viet A Bank commits to keep the deposit interest rate of this product unchanged until December 31, 2025.

The conditions to participate in this program are simply to open a payment account and register for a digital banking application at Viet A Bank, have a minimum deposit balance of 100 million VND, and save for one of the following terms: 1 month, 3 months, 6 months, 7 months, 12 months, 13 months, 15 months and 18 months.

There are two interest rates for this program, including Offer 1 (popular) and Offer 2 (applicable to customers according to separate policies).

According to the deposit interest rate table posted by Viet A Bank for Preferential level 1, the deposit interest rate with interest paid at the end of the term is specified as follows: Interest rate for 1-month term is 3.8%/year, 3-month term is 4.2%/year, 6-month term is 5.8%/year, 7-month term is 5.9%/year, 12-month term is 6.3%/year, 13-month term is 6.4%/year, 15-month term is 6.5%/year and 18-month term is 6.6%/year.

For interest rates for Preferential level 2, the bank interest rate for 1-month term has reached 4%/year, and for 3-month term is 4.4%/year.

This is the only interest rate package on the market today with an interest rate of up to 6%/year for 6-month term deposits.

Viet A Bank surprised even more when it announced deposit interest rates of 6.1%/year for a 7-month term; 6.5%/year for a 12-month term; 6.6%/year for a 13-month term; 6.7%/year for a 15-month term and the highest deposit interest rate of up to 6.8%/year for a 18-month term.

| INTEREST RATES FOR ONLINE DEPOSITS AT BANKS ON AUGUST 12, 2025 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.4 | 3 | 3.7 | 3.7 | 4.8 | 4.8 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.1 | 3.8 | 5.3 | 5.4 | 5.6 | 5.4 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.8 | 4.1 | 5.25 | 5.35 | 5.5 | 5.8 |

| BAOVIETBANK | 3.5 | 4.35 | 5.45 | 5.5 | 5.8 | 5.9 |

| BVBANK | 3.95 | 4.15 | 5.15 | 5.3 | 5.6 | 5.9 |

| EXIMBANK | 4.3 | 4.5 | 4.9 | 4.9 | 5.2 | 5.7 |

| GPBANK | 3.95 | 4.05 | 5.65 | 5.75 | 5.95 | 5.95 |

| HDBANK | 3.85 | 3.95 | 5.3 | 5.3 | 5.6 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.1 | 5.2 | 5.5 | 5.45 |

| LPBANK | 3.6 | 3.9 | 5.1 | 5.1 | 5.4 | 5.4 |

| MB | 3.5 | 3.8 | 4.4 | 4.4 | 4.9 | 4.9 |

| MBV | 4.1 | 4.4 | 5.5 | 5.6 | 5.8 | 5.9 |

| MSB | 3.9 | 3.9 | 5 | 5 | 5.6 | 5.6 |

| NAM A BANK | 3.8 | 4 | 4.9 | 5.2 | 5.5 | 5.6 |

| NCB | 4 | 4.2 | 5.35 | 5.45 | 5.6 | 5.6 |

| OCB | 3.9 | 4.1 | 5 | 5 | 5.1 | 5.2 |

| PGBANK | 3.4 | 3.8 | 5 | 4.9 | 5.4 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.6 | 3.9 | 4.8 | 4.8 | 5.3 | 5.5 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.6 | 5.8 |

| SCB | 3.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 4.9 | 5 | 5.3 | 5.5 |

| TECHCOMBANK | 3.45 | 3.75 | 4.65 | 4.65 | 4.85 | 4.85 |

| TPBANK | 3.7 | 4 | 4.9 | 5 | 5.3 | 5.6 |

| VCBNEO | 4.35 | 4.55 | 5.6 | 5.45 | 5.5 | 5.55 |

| VIB | 3.7 | 3.8 | 4.7 | 4.7 | 4.9 | 5.2 |

| VIET A BANK | 3.7 | 4 | 5.1 | 5.3 | 5.6 | 5.8 |

| VIETBANK | 4.1 | 4.4 | 5.4 | 5.4 | 5.8 | 5.9 |

| VIKKI BANK | 4.15 | 4.35 | 5.65 | 5.65 | 5.95 | 6 |

| VPBANK | 3.7 | 3.8 | 4.7 | 4.7 | 5.2 | 5.2 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-12-8-2025-lai-suat-huy-dong-6-8-nam-danh-cho-ai-2431044.html

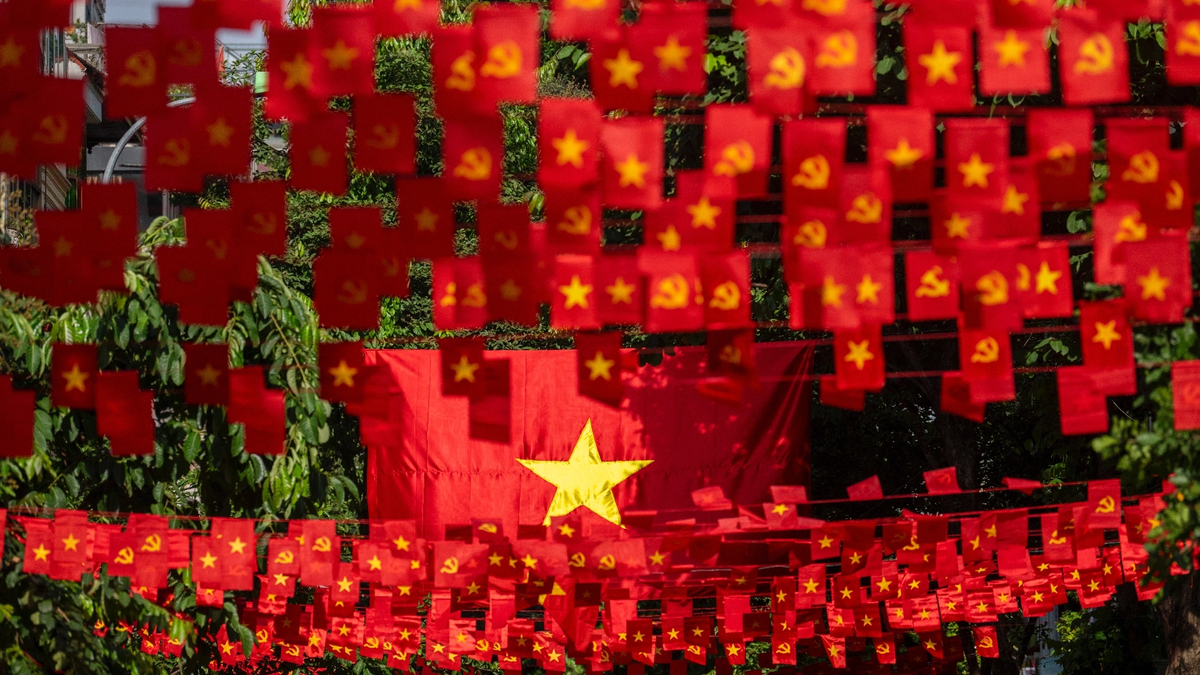

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

Comment (0)