From June 1, according to Decree 70, business households with revenue of over 1 billion VND per year in certain industries (food and beverage, hotels, retail...) must use electronic invoices generated from cash registers and connect data with tax authorities.

After more than half a month of implementation, many households still have concerns about input invoices, especially for agricultural products purchased from farmers or "hand-carried" goods from acquaintances.

A representative of the Tax Department said that in the case of importing goods from a seller without an invoice, business households can keep purchase and payment documents to ensure proof of the origin of the goods. More specifically, they need to use a purchase list with documents such as payment vouchers, warehouse receipts or handover minutes.

Ms. Tran Le Trang, General Director of Ha An Consulting Company Limited, noted that the list with accompanying documents only applies to the import of goods by business individuals who are not required to have invoices, such as farmers. If the selling unit is a company, individual or business household that declares, they are required to issue sales invoices according to regulations.

Another popular source of imported goods is "hand-carried" goods , even from acquaintances, which are not considered valid inputs without import documents. "These goods can even be considered contraband. If you want transparency, you need to switch to official import as a company," said Ms. Nguyen Quynh Duong, General Director of Nhanh.vn multi-channel sales management software.

Similar to importing clothes from China for sale, business households need to study import policies, comply with legal regulations on import tax, customs law, border trade... Mr. Mai Son, Deputy Director of the Tax Department ( Ministry of Finance ), recommends that business households need to have documents to prove the origin of goods including sales contracts, commercial invoices, bills of lading, import tax payment documents...

In case of inability or not being allowed to import goods according to regulations, business households and companies can make an import entrustment contract through a logistics unit. They will carry out import procedures and issue input invoices on behalf of the entrusting enterprise.

Tax authorities recommend that business households and individuals should store invoices and documents of purchased goods and services to provide to management agencies when requested. This is to prove and ensure the origin and quality of goods.

When switching from a contract business household to a declaration form , the tax consultancy unit said that documents and accounting books are required forms according to Circular 88/2021.

According to Ms. Trang, households need to use 7 accounting books according to categories, such as detailed books on sales revenue of goods and services; books on production and business costs; tracking tax obligations, salary payments and other payments. In addition, this number also includes cash books and bank deposits.

In addition, business households also need to have necessary accounting documents such as receipts and payments, warehouse receipts/deliveries, salary payment sheets and employee income.

A representative of the Tax Department said that this agency, together with associations and e-invoice solution providers, researched and calculated the provision of free shared accounting tools and software, as well as support for equipment and e-invoice service costs for business households in the initial phase of conversion.

In addition, the tax authority continues to review to minimize administrative procedures on taxes and invoices for business households, according to the Deputy Director of the Tax Department. He added that the tax sector will continue to provide tax utilities and electronic invoices to help business households easily declare and pay taxes when using electronic invoices generated from cash registers.

HA (according to VnE)Source: https://baohaiduong.vn/ho-kinh-doanh-ke-khai-thue-the-nao-khi-mua-nong-san-hang-xach-tay-414319.html

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

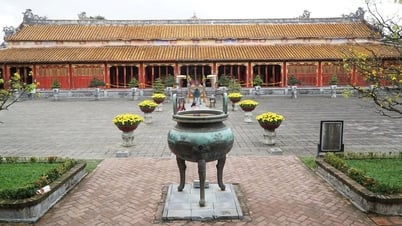

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] General Secretary To Lam attends Meeting with generations of National Assembly deputies](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/27/a79fc06e4aa744c9a4b7fa7dfef8a266)

Comment (0)