Update on today's gold price increased sharply, setting a record of more than 126 million VND/tael

SJC and DOJI gold prices hit new records

The SJC gold bar market in Hanoi recorded a significant increase today. The buying and selling prices both increased by 300,000 VND/tael. Specifically, the listed price of SJC gold is 125.9 million VND/tael (buy) and 126.9 million VND/tael (sell).

Sharing the same upward trend, the price of gold bars at DOJI Group increased by 300 thousand VND/tael in both buying and selling directions. Currently, DOJI gold price is trading at 125.9 million VND/tael (buy) and 126.9 million VND/tael (sell).

Gold prices at other brands surge to new records

PNJ also had a strong adjustment. Both brands increased by 300 thousand VND/tael in both buying and selling directions. Currently, PNJ gold price is trading at 125.9 million VND/tael (buy) and 126.9 million VND/tael (sell).

At Mi Hong, the price of gold bars had a different development when it increased by 400 thousand VND/tael for buying and 300 thousand VND/tael for selling compared to the previous session. The listed prices were 126.4 million VND/tael (buying) and 126.9 million VND/tael (selling), respectively.

Bao Tin Minh Chau and Phu Quy also recorded an increase of 300 thousand VND/tael for both directions. Specifically, Bao Tin Minh Chau listed at 125.9 million VND/tael (buy) and 126.9 million VND/tael (sell). Meanwhile, Phu Quy had a slightly lower buy price at 124.9 million VND/tael, but the sell price was still 126.9 million VND/tael.

At Vietinbank Gold, the listed selling price has increased by 300 thousand VND/tael, to 126.9 million VND/tael.

The price of 9999 plain gold rings today, August 25, 2025, increased sharply

At 9:30 a.m. on August 25, 2025, the price of DOJI's 9999 Hung Thinh Vuong round gold ring was listed at VND 118.8 million/tael (buy) and VND 121.8 million/tael (sell), unchanged in both buying and selling directions compared to the previous day, with a buying - selling difference of VND 3 million/tael.

Plain gold ring price today 8/25/2025 increased sharply

Bao Tin Minh Chau kept the price of gold rings at 119.0 million VND/tael (buy) and 122.0 million VND/tael (sell), unchanged in both directions compared to early this morning, with a difference of 3 million VND/tael.

Phu Quy Group also listed the price of gold rings at 118.5 million VND/tael (buy) and 121.5 million VND/tael (sell), a slight increase of 200,000 VND/tael in both directions compared to yesterday, with a buy-sell difference of 3 million VND/tael.

Gold price list today 8/25/2025 in Vietnam in detail

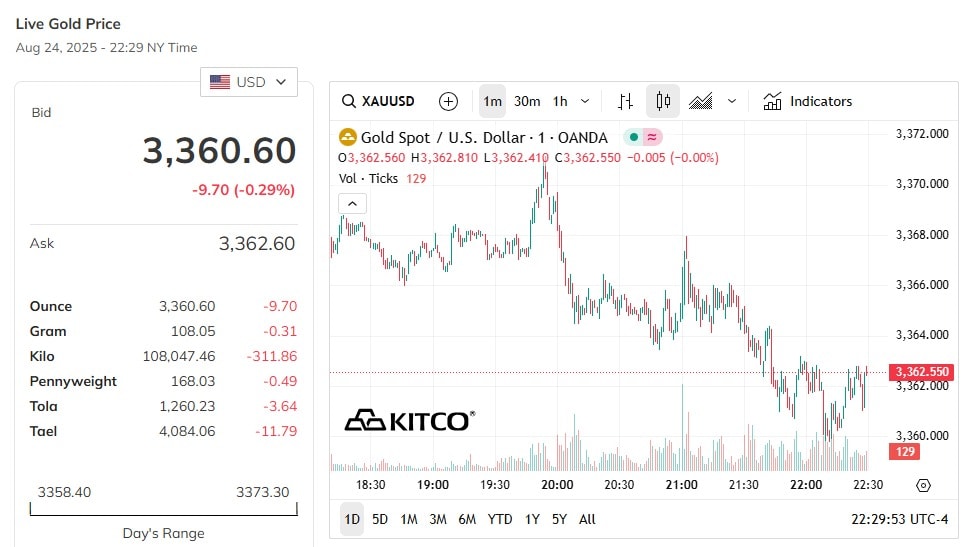

Update on world gold price today, slightly decreased but still maintained at high level

World gold price, at 09:30 on August 25, 2025 (Vietnam time), the world spot gold price was at 3,360.6 USD/ounce. Today's gold price decreased by 9.7 USD compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,480 VND/USD), the world gold price is about 111.92 million VND/tael (excluding taxes and fees). Compared to the domestic SJC gold bar price on the same day (125.6-126.6 million VND/tael), the current SJC gold price is about 14.98 million higher than the international gold price.

In the morning trading session on Monday, August 25, the world gold price turned down slightly. The main reason came from the recovery of the US dollar, making gold more expensive for investors holding other foreign currencies.

However, the precious metal's decline was tempered by positive signals that the US Federal Reserve (Fed) will soon cut interest rates. Fed Chairman Jerome Powell's remarks last week raised hopes for a more dovish monetary policy, as he highlighted risks to the labor market. The market is now pricing in an 87% chance of a rate cut at the Fed's September meeting, according to the CME FedWatch tool.

Interest rate cuts are typically positive for gold prices, as they reduce the opportunity cost of holding the non-yielding metal.

Markets are now looking ahead to Friday's US personal consumption expenditures (PCE) price report, which is expected to show core inflation rising to 2.9%, the highest level since late 2023.

On the physical front, demand for gold in major Asian trading hubs remained subdued due to volatile prices. In contrast, jewelers in India have resumed purchases in preparation for the upcoming festive season.

Besides gold, prices of other precious metals also recorded a slight decrease:

Spot silver fell 0.2% to $38.09 an ounce.

Platinum fell 0.3% to $1,356.95 an ounce.

Palladium fell 0.6% to $1,119.67 an ounce.

News, gold price trends today August 25, 2025

One of the most important factors affecting the world gold price is the move of the US Federal Reserve (Fed), the world's most powerful central bank. Recently, at a major conference in Jackson Hole, Fed Chairman Jerome Powell gave signals that the Fed may soon cut interest rates. This information immediately weakened the US dollar, which is good news for gold prices.

You can think of the relationship like this: when interest rates fall, holding dollars in the bank becomes less attractive. Investors then move their money into other assets, including gold. Increased demand drives up the price of gold. Conversely, when the dollar weakens, gold becomes cheaper for holders of other currencies, encouraging them to buy it and pushing the price higher.

In addition, concerns about political interference in monetary policy are also boosting gold prices. Gold is considered a “safe haven asset,” meaning that when there is uncertainty, whether economic or political, people often turn to gold to protect their assets. Recently, comments from US President Donald Trump about interfering with the Fed's operations have raised concerns, and this has further increased the appeal of gold.

Recent surveys show that experts and investors are quite optimistic about the future of this precious metal. Most analysts believe that gold prices will continue to rise or at least not fall in the near future. Retail investors also share the same view, with the majority expecting gold prices to rise this week.

While gold prices may have rallied after the Fed's signal, the next big question is whether this will be a one-off cut or a series of cuts to come. The combination of factors such as the Fed's easing policy, the weakening dollar and political uncertainty is creating an extremely favorable environment for gold, experts say.

Some experts have made very bold predictions. The Head of Research at WisdomTree believes that gold prices could break previous records and reach $4,000 an ounce early next year, indicating strong growth potential in the future.

Source: https://baodanang.vn/gia-vang-hom-nay-25-8-2025-gia-vang-trong-nuoc-lap-them-ky-luc-moi-sat-127-trieu-vang-the-gioi-giam-nhe-3300252.html

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)