Domestic gold price today August 16, 2025

As of 4:00 a.m. today, August 16, 2025, the domestic gold bar price decreased slightly compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 123.5-124.5 million VND/tael (buy - sell), the price remained unchanged in the buying direction - decreased 200 thousand VND/tael in the selling direction compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 123.5-124.5 million VND/tael (buy - sell), a decrease of 200 thousand VND/tael in both buying and selling directions compared to the closing price on August 15 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 123.8-124.5 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 200 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 123.5-124.5 million VND/tael (buy - sell), a decrease of 200 thousand VND/tael in both buying and selling directions compared to the same period yesterday.

SJC gold price at Phu Quy is traded by businesses at 122.7-124.5 million VND/tael (buy - sell), gold price is unchanged in the buying direction - decreased 200 thousand VND/tael in the selling direction compared to yesterday.

As of 4:00 a.m. on August 16, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.5-119.5 million VND/tael (buy - sell); the price decreased by 300 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.8-119.8 million VND/tael (buy - sell); down 700 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, August 16, 2025 is as follows:

| Gold price today | August 16, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 123.5 | 124.5 | -200 | -200 |

| DOJI Group | 123.5 | 124.5 | - | -200 |

| Red Eyelashes | 123.8 | 124.5 | -200 | -200 |

| PNJ | 123.5 | 124.5 | -200 | -200 |

| Bao Tin Minh Chau | 123.5 | 124.5 | -200 | -200 |

| Phu Quy | 122.7 | 124.5 | - | -200 |

| 1. DOJI - Updated: August 16, 2025 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 123,500 | 124,500 ▼200K |

| AVPL/SJC HCM | 123,500 | 124,500 ▼200K |

| AVPL/SJC DN | 123,500 | 124,500 ▼200K |

| Raw material 9999 - HN | 109,300 ▼300K | 110,300 ▼300K |

| Raw material 999 - HN | 109,200 ▼300K | 110,200 ▼300K |

| 2. PNJ - Updated: August 16, 2025 04:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 123,500 ▼200K | 124,500 ▼200K |

| PNJ 999.9 Plain Ring | 116,600 ▼200K | 119,500 ▼300K |

| Kim Bao Gold 999.9 | 116,600 ▼200K | 119,500 ▼300K |

| Gold Phuc Loc Tai 999.9 | 116,600 ▼200K | 119,500 ▼300K |

| PNJ Gold - Phoenix | 116,600 ▼200K | 119,500 ▼300K |

| 999.9 gold jewelry | 116,100 | 118,600 |

| 999 gold jewelry | 115,980 | 118,480 |

| 9920 jewelry gold | 115,250 | 117,750 |

| 99 gold jewelry | 115,010 | 117,510 |

| 916 Gold (22K) | 106,240 | 108,740 |

| 750 Gold (18K) | 81,600 | 89,100 |

| 680 Gold (16.3K) | 73,300 | 80,800 |

| 650 Gold (15.6K) | 69,740 | 77,240 |

| 610 Gold (14.6K) | 65,000 | 72,500 |

| 585 Gold (14K) | 62,030 | 69,530 |

| 416 Gold (10K) | 41,990 | 49,490 |

| 375 Gold (9K) | 37,130 | 44,630 |

| 333 Gold (8K) | 31,790 | 39,290 |

| 3. SJC - Updated: 8/16/2025 04:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 123,500 ▼200K | 124,500 ▼200K |

| SJC gold 5 chi | 123,500 ▼200K | 124,520 ▼200K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 123,500 ▼200K | 124,530 ▼200K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,600 ▼200K | 119,200 ▼200K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,600 ▼200K | 119,100 ▼200K |

| Jewelry 99.99% | 116,400 ▼200K | 118,200 ▼200K |

| Jewelry 99% | 112,529 ▼198K | 117,029 ▼198K |

| Jewelry 68% | 73,334 ▼136K | 80,534 ▼136K |

| Jewelry 41.7% | 42,244 ▼83K | 49,444 ▼83K |

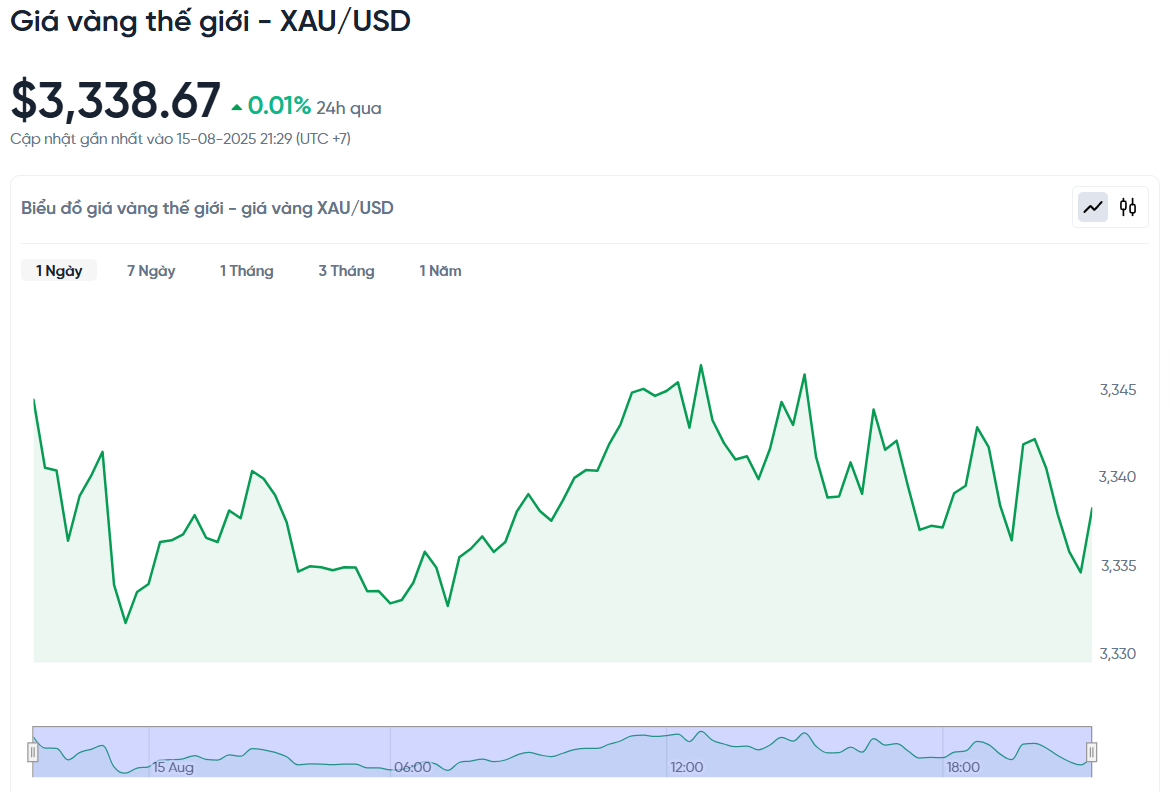

World gold price today August 16, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 a.m. on August 16, Vietnam time, was 3,338.67 USD/ounce. Today's gold price increased by 0.38 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,450 VND/USD), the world gold price is about 106.36 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.14 million VND/tael higher than the international gold price.

Gold prices edged up slightly but remained down for the week after higher-than-expected inflation data dampened expectations of interest rate cuts. Markets are now focused on an upcoming meeting between US President Donald Trump and his Russian counterpart Vladimir Putin.

Specifically, spot gold prices increased 0.01% but decreased 1.6% for the week. Meanwhile, US gold futures for December delivery increased slightly 0.2% to $3,390.80.

Data released Thursday evening showed U.S. producer prices rose the most in three years in July. Markets now see a 92.6% chance of the Fed cutting interest rates by 25 basis points in September, lower than previously expected. Gold prices fell after the data was released due to the lack of interest rates, with spot gold closing down 0.6%.

Gold prices were steady on Friday but could fall further depending on the outcome of the meeting between Trump and Putin in Alaska, according to Lukman Otunuga, an analyst at FXTM. The two leaders are expected to discuss a ceasefire in Ukraine. Geopolitical uncertainty and low interest rates typically boost demand for gold.

Analysts at ANZ said that macroeconomic and geopolitical risks will increase in the second half of the year, reinforcing gold's appeal as a safe-haven asset. ANZ said the bullish outlook for gold remains supported by rising tariffs, a slowing global economy, looser US monetary policy and continued weakness in the US dollar.

Meanwhile, US retail sales rose sharply in July, but a slowing labor market and high commodity prices could limit consumer spending growth in the third quarter.

Besides gold, spot silver fell 0.4% to $37.85 an ounce and was down more than 1% for the week. Platinum fell 1% to $1,344.14, while palladium fell 2.3% to $1,119.37.

Gold Price Forecast

A series of US economic indicators were released early this morning, having mixed impacts on world gold prices, but overall, gold prices will close the week with a decrease as not many economic data support gold's upward momentum.

Specifically, according to preliminary data from the University of Michigan, the consumer sentiment index in August only reached 58.6 points, lower than the 61.7 in July and below the experts' forecast of 62 points, while inflation expectations increased. This caused gold prices to increase slightly before the market closed at the end of the week.

However, the rally did not last long as the New York Fed's Empire State Manufacturing Index rose to 11.9 points in August, far exceeding experts' forecasts. Along with the US Commerce Department announcing a 0.5% increase in July retail sales, gold prices fell back to $3,338.67/ounce.

Gold prices could see a big move once the market becomes more aware of the U.S. debt problem, according to Ryan McIntyre of Sprott Inc. He pointed out that central banks have been buying gold aggressively since the Russia-Ukraine conflict broke out, creating a solid floor for prices and sending a positive signal to the market.

However, Mohammed Taha of MH Markets noted that inflationary pressures remain, leading many investors to expect interest rates to remain high. This could be a headwind for gold in the short term. However, if inflation persists and leads to a recession, gold will return to its safe-haven status.

Technically, the gold price trend remains positive. If gold breaks the key resistance level of $3,400 an ounce, the next rally could be driven by geopolitical factors rather than economic data, according to Fawad Razaqzada of City Index.

However, he also predicted that gold prices could experience a slight correction in the coming months, especially as the stock market is on a strong uptrend. However, in the long term, factors such as inflation, public debt and geopolitical instability will continue to support gold prices.

Source: https://baonghean.vn/gia-vang-hom-nay-16-8-gia-vang-trong-nuoc-rot-khoi-dinh-the-gioi-chot-tuan-giam-nhe-10304529.html

![[Photo] Binh Khanh Bridge Ho Chi Minh City is ready to reach the finish line](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/14/b0dcfb8ba9374bd9bc29f26e6814cee2)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Cambodian Prime Minister Hun Manet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/15/72d3838db8154bafabdadc0a5165677f)

![[Photo] The special solidarity relationship between Vietnam and Cuba](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/15/5f06c789ab1647c384ccb78b222ad18e)

![[Photo] Prime Minister Pham Minh Chinh attends a special art program called "Hanoi - From the historic autumn of 1945"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/15/c1c42655275c40d1be461fee0fd132f3)

![[Photo] Firmly marching under the military flag: Ready for the big festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/15/86df2fb3199343e0b16b178d53f841ec)

![[Photo] President Luong Cuong receives Finnish Ambassador to Vietnam Keijo Norvanto](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/15/9787f940853c45d39e9d26b6d6827710)

Comment (0)