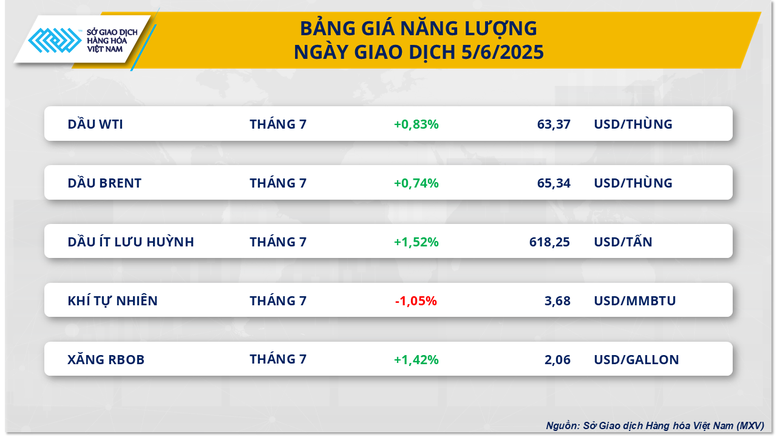

World crude oil prices reverse sharply

At the close of the last trading week (June 2-6), buying power completely overwhelmed the energy market. In particular, the prices of two crude oil products simultaneously recovered despite concerns surrounding OPEC+'s decision to increase production.

Specifically, Brent oil price stopped at 66.47 USD/barrel, up 5.88% compared to the previous week's close. WTI oil price also recorded a weekly increase of up to 6.23%, reaching 64.58 USD/barrel.

As many had predicted, OPEC+ officially announced its decision to increase production in July after an online meeting between eight key member countries on May 31. This is the third consecutive month that the alliance has increased production by 411,000 barrels per day, a move that is expected to put pressure on oil prices due to concerns about oversupply in the market.

However, market developments did not fully reflect these concerns. In the first trading session of the week, the impact of OPEC+'s decision was not strong enough to cause a sharp drop in oil prices. On the contrary, the trading session on June 2 recorded an increase of nearly 3% for both key oil products. According to experts' analysis, many investors actually expected a higher increase in production, so OPEC+'s decision did not come as a big surprise. In addition, information about the risk of supply disruptions from Canada and Venezuela further increased buying power in the market, contributing to pushing oil prices up.

Many major organizations such as Barclays and Goldman Sachs predict that OPEC+ may continue to increase production in August, when oil demand usually increases sharply according to the summer cycle in the US. This assessment was further reinforced after the American Petroleum Institute (API) and the US Energy Information Administration (EIA) simultaneously released data showing that commercial crude oil inventories in the US fell sharply for the second consecutive week. Specifically, the API estimated that inventories decreased by about 3.3 million barrels in the week ending May 30, while the EIA recorded a decrease of up to 4.3 million barrels - both far exceeding the market's previous forecast, which was only around 1 million barrels.

In addition, last week, S&P Global also released a series of important PMI indices of the US economy , showing positive signals across the board. All three PMI indices, including the manufacturing PMI, the services PMI, and the composite PMI, recorded increases in May. Notably, the services PMI and the composite PMI both far exceeded market expectations, reflecting strong improvements in the service sector and the entire economy. In addition, the US trade deficit in April fell by more than half compared to the previous month, showing clear signs of improvement in the trade balance.

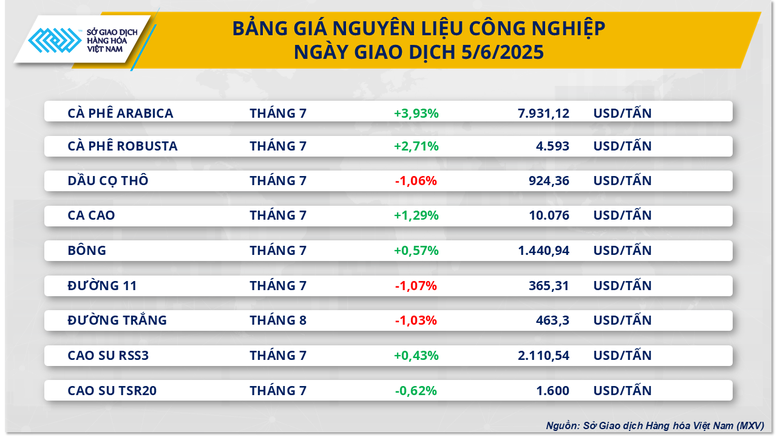

Sugar prices fall for fourth consecutive week

According to MXV, at the end of the last trading week, contrary to the general trend of the industrial raw material group, the prices of two sugar products continued to extend their decline for the fourth consecutive week due to pressure from oversupply and reduced consumption globally.

Specifically, the price of sugar 11 decreased by 3.28% compared to the closing price of the previous week, down to 363 USD/ton - the lowest level in nearly 4 years, while the price of white sugar decreased by 2.28%, to 465 USD/ton.

According to the USDA’s recently released Global Sugar Supply and Demand Report for the 2025-2026 season, the global sugar surplus is expected to more than double to 11.4 million tons compared to the previous season. The increase in supply is mainly due to stable output in the 2025-2026 season in major producing countries such as Brazil, Thailand, China and some other countries. Notably, India’s sugar output recorded an outstanding growth of 25% thanks to favorable weather conditions and expanded planting area. These are key factors that continue to weigh on the sugar market, causing downward pressure on prices.

Source: https://baochinhphu.vn/dong-tien-dau-tu-quay-lai-thi-truong-hang-hoa-nguyen-lieu-the-gioi-102250609084744474.htm

Comment (0)