China – known for its economic might and strategic moves on the global stage – has once again captured the world’s attention with the latest move by its central bank.

Official data released by the People's Bank of China (PBoC) on October 7 showed that the Asian giant's gold reserves increased for the 11th consecutive month in September after adding 840,000 troy ounces of gold, equivalent to 26 tonnes of bullion.

Part of a larger global trend

The PBoC’s holdings of the precious metal account for more than 4% of China’s total reserve assets. The East Asian nation’s total gold reserves currently stand at 2,191 tonnes, with about 217 tonnes to be added in purchases starting in November 2022.

“It is very likely that the PBoC will increase its gold reserves,” Huang Jun, an analyst at financial trading platform FXTM, was quoted by Chinese media as saying in September. “As China reduces its holdings of US Treasuries, it needs to increase its holdings of other assets, and gold is a high-quality credit asset, which is rare in the current environment.”

The trend of China and many other developing economies increasing their gold reserves could continue to support the price of the precious metal in the medium to long term, according to analysts. However, in the short term, gold prices could be pressured by the US dollar, Mr. Huang added.

Consumers look at gold jewelry at a jewelry store in Huai'an, eastern China's Jiangsu Province, July 8, 2023. Photo: Global Times

Meanwhile, Sun Xiaoji, a scholar and author specializing in Chinese finance, said that the country's central bank is actively increasing its gold holdings because it does not rule out the scenario that Beijing could be expelled from the global payment system using the US dollar, just as happened to Moscow since Russia launched a "special military operation" in Ukraine.

The PBoC’s increase in gold reserves is also part of a larger global trend. Central banks around the world have been ramping up purchases of the precious metal, with net purchases hitting a record 387 tonnes in the first half of this year.

The move towards gold is seen as a strategic decision to diversify reserves away from the US dollar and stabilize the exchange rate. This is especially relevant in the context of increasing volatility and economic recession in Europe and the US – factors that boost demand for gold as a safe-haven asset.

Trade more in local currency

China’s growing gold reserves are not just a byproduct of global trends. They are also closely tied to Beijing’s efforts to reduce its dependence on the US dollar. The US dollar’s dominance in international trade and finance has long been a point of contention for China.

The world's No. 2 economy is pushing to do more trade in its own currency (the yuan), and to strengthen ties with other countries such as the BRICS nations (Brazil, Russia, India, China and South Africa).

Chinese analysts believe that increasing gold reserves not only helps stabilize the exchange rate but also enhances a country’s soft power. It helps internationalize its currency – a goal that China is aiming for. They expect this trend to continue in the coming months, and other countries are likely to follow suit and increase their gold reserves.

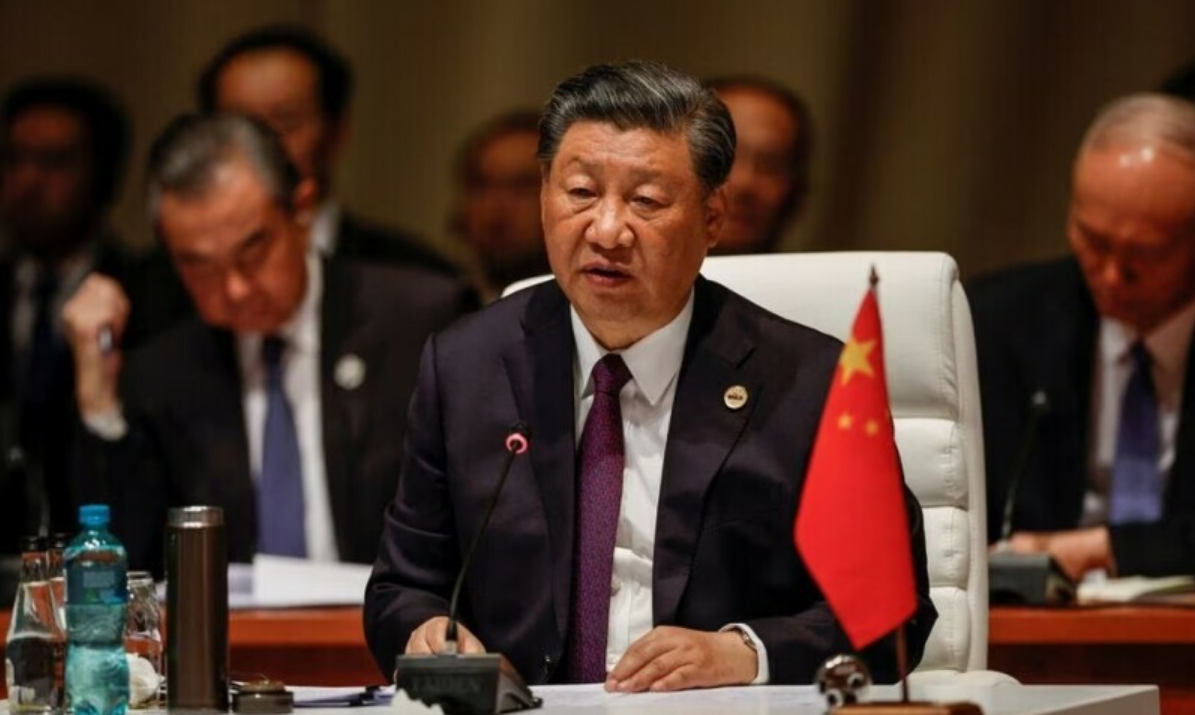

Chinese President Xi Jinping attends the plenary session of the 15th BRICS Summit in Johannesburg, South Africa, August 23, 2023. Photo: Dawn

As Chinese President Xi Jinping strengthens ties with the BRICS and later BRICS+ countries, and promotes more trade in their local currencies, demand for gold is expected to increase further.

The continued increase in China's gold reserves could have a significant impact on global financial markets. It has the potential to change the dynamics of the global gold market, affecting prices and demand patterns.

Moreover, it could also impact the dominance of the US dollar in international trade and finance, especially if other countries follow China’s lead. As the world waits to see how this plays out, one thing is certain: China’s gold reserve buildup is more than just a series of actions; it is a carefully calculated strategy with far-reaching implications .

Minh Duc (According to BNN Breaking, Sputnik)

Source

![[Photo] More than 124,000 candidates in Hanoi complete procedures for the 2025 High School Graduation Exam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/fa62985b10464d6a943b58699098ae3f)

![[Photo] First training session in preparation for the parade to celebrate the 80th anniversary of National Day, September 2nd](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/ebf0364280904c019e24ade59fb08b18)

![[Photo] General Secretary To Lam works with the Standing Committee of Quang Binh and Quang Tri Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/6acdc70e139d44beaef4133fefbe2c7f)

Comment (0)