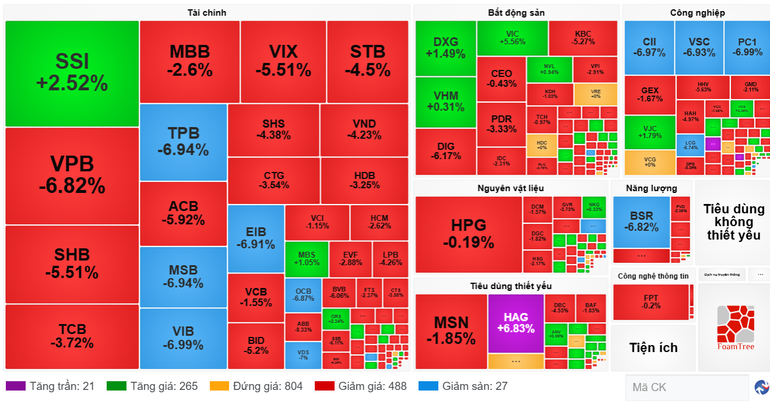

Market liquidity decreased sharply compared to the previous session, with total trading volume on the three exchanges reaching more than 1,722 million shares, equivalent to a total trading value of more than VND46,052 billion.

Foreign investors sold strongly for the 13th consecutive session on all 3 exchanges, more than 1,781 billion VND, focusing on codes HPG (586.03 billion VND), VPB (433.81 billion VND), STB (244.56 billion VND), VHM (230.02 billion VND),FPT (176.88 billion VND)...

On the contrary, the codes that were net bought a lot in this session included MBB (289.64 billion VND), SSI (81.33 billion VND),SHB (80.67 billion VND), DXG (73.43 billion VND), GEX (58.88 billion VND)...

On the HoSE floor, the order matching value this session decreased compared to the previous session, reaching more than 40,076 billion VND.

In this session, the codes that contributed positively to the VN-Index increased by more than 9.03 points include: VIC, SSI, GAS, VJC, VHM, HAG, BVH, VCF, DXG, NVL.

On the contrary, the stocks that negatively impacted the VN-Index by more than 21.36 points included: VPB, BID, TCB, CTG, VCB,ACB , LPB, BSR, VIB, STB.

In terms of industry groups, this session, software stocks had a negative performance, down 0.28%, mainly from FPT, CMG, ELC, PIA, CMT... Some codes increased including ITD, HPT, SBD...

The group of securities stocks this session leaned towards red, with a decrease of 1.86%, mainly from codes VIX, VND, VCI, SHS, HCM, FTS, FUEVFVND, BSI... On the contrary, a few codes increased including SSI, MBS, ORS, AAS, APS...

Banking stocks traded mainly in red and closed down 4.38%, mainly from codes VCB, BID, VPB, TCB, CTG, MBB, ACB, LPB, HDB, STB...

Real estate stocks this session were in the green and increased by 1.2%, mainly from codes VIC, VHM, SSH, NVL, DXG, DXS, QCG, SCR, VC3... On the contrary, the codes that decreased included BCM, KDH, KBC, PDR, KSF, SJS, VPI, NLG, DIG...

Energy stocks this session were mostly red, down 3.65%, mainly from codes BSR, PLX, PVS, OIL, PVD, PVT, MVB, PVP, TMB... Increasing direction included codes VTO, CCI, NBC, HLC, PPT, PJT, THT...

The group of raw material stocks this session leaned towards red, down 1.18%, mainly from codes HPG, GVR, DGC, KSV, MSR, DCM, HSG, DPM... On the contrary, the codes that increased included NTP, PHR, NKG, HT1, VIF, DDV, PRT, AAA, GDA, RTB...

Insurance stocks traded in green and closed up 1.22%, mainly from codes BVH, BIC, PGI, ABI, AIC... Declining stocks included PVI, VNR, MIG, PTI, BMI...

Retail stocks performed negatively, down 1.62%, mainly from codes MWG, PNJ, FRT, HUT, DGW, PET, HAX, PEG, VVS, TSC, BTT... On the contrary, the codes that increased included HHS, HTM, SVC, SHN, PSD, C69...

* The Vietnamese stock market index was in red today, VNXALL-Index closed down 65.29 points (-2.31%), down to 2,765.84 points. Liquidity with a trading volume of more than 1,549.51 million units, equivalent to a trading value of more than VND 42,977.43 billion. In the whole market, there were 118 stocks increasing in price, 71 stocks remaining unchanged and 266 stocks decreasing in price.

* At the Hanoi Stock Exchange, the HNX-Index closed at 266.58 points, down 5.9 points (-2.17%). Liquidity reached a total of more than 121.82 million shares transferred, with a corresponding trading value of more than VND2,754.38 billion. In the whole market, there were 69 stocks increasing in price, 48 stocks remaining unchanged and 100 stocks decreasing in price.

The HNX30 index closed down 9.75 points (-1.65%) to 582.72 points. Trading volume reached over 86.51 million units, equivalent to over VND2,354.85 billion. In the whole market, there were 6 stocks increasing in price, 6 stocks remaining unchanged and 18 stocks decreasing in price.

On the UPCoM market, the UPCoM-Index closed at 108.58 points, down 0.69 points (-0.62%). Market liquidity, total trading volume reached over 76.09 million shares, corresponding trading value reached over VND 1,029.73 billion. In the whole market, there were 105 stocks increasing in price, 92 stocks remaining unchanged and 154 stocks decreasing in price.

* At the Ho Chi Minh City Stock Exchange, the VN-Index closed down 31.44 points (-1.91%) to 1,614.03 points. Liquidity reached over 1,524.72 million units, equivalent to a trading value of VND42,268.47 billion. The entire floor had 100 stocks increasing, 42 stocks remaining unchanged and 233 stocks decreasing.

The VN30 Index decreased by 30.9 points (-1.7%) and stopped at 1,783.12 points. Liquidity reached more than 714.53 million units, equivalent to a trading value of more than VND 23,811.9 billion. The VN30 group of stocks ended the trading day with 5 stocks increasing, 2 stocks remaining unchanged and 23 stocks decreasing.

The 5 stocks with the highest trading volume are SSI (over 69.34 million units), HAG (over 43.31 million units), DXG (over 27.11 million units), NVL (over 14.92 million units), ORS (over 8.36 million units).

The 5 stocks with the highest price increase are VOS (+6.99%), HVH (+6.88%), GIL (+6.84%), HAG (+6.83%), TTE (+6.63%).

The 5 stocks with the biggest price decrease were VDS (-7%), VIB (-6.99%), PC1 (-6.99%), BFC (-6.98%), TVS (-6.97%).

* Today's derivatives market had 388,013 contracts traded, worth more than VND 69,943.55 billion.

Source: https://nhandan.vn/bank-stocks-giam-san-vn-index-mat-hon-31-diem-post903425.html

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)