The index representing the Ho Chi Minh City Stock Exchange continuously reversed from increasing to decreasing and vice versa with an amplitude of no more than 5 points compared to the reference. Towards the end of the session, the fluctuation amplitude was widened due to strong selling pressure.

The index closed at 1,671 points, down nearly 10 points from the reference. This was the second consecutive correction session in the context of the market lacking supportive information, plus investor caution as the US Federal Reserve (Fed) interest rate adjustment meeting and official information about the FTSE market upgrade assessment are approaching.

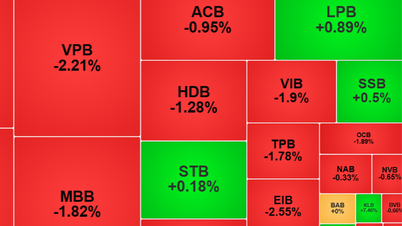

The Ho Chi Minh City Stock Exchange was covered in red today with more than 200 stocks falling, nearly double the number of stocks rising. The large-cap basket performed similarly with 19 stocks closing below reference, while 10 stocks rose.

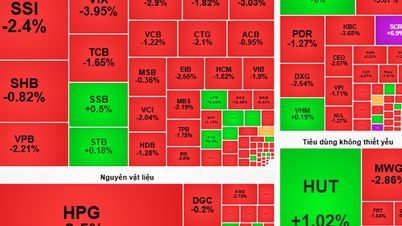

The banking group was under strong selling pressure with a series of leading stocks falling sharply. BID lost 2.5%, while VPB, CTG,VIB , MBB and TCB adjusted 1.7-2.2%. LPB and STB were the rare representatives of this group to go against the market trend, although the increase was relatively modest.

In the securities group, red covered all component stocks. VIX led the way with a decrease of nearly 4%, followed by VND losing 2.9%. SSI traded in the green at times today, then reversed and decreased by more than 2.4%.

Fertilizer stocks were also sold off heavily. DPM and DCM, the two pillars of the group, lost 2.2% and 0.9%, respectively.

Meanwhile, the real estate group was strongly differentiated. Some midcap codes such as NVL, NLG, KDH decreased by 1.3-2.5% while small-cap stocks such as HQC, QCG, LDG, SCR soared. Vingroup stocks were also in a state of excitement, contributing greatly to the VN-Index avoiding a deep correction session.

Compared to yesterday's session, the market no longer has many positive signals. Liquidity dropped sharply by about 9,000 billion VND, down to 32,500 billion VND. HPG ranked first in terms of matched value with more than 3,685 billion VND, more than the two following codes FPT (2,125 billion VND) and SSI (1,553 billion VND) combined.

After a buying session, foreign investors returned to selling strongly. This group disbursed nearly 3,100 billion VND while withdrawing more than 3,220 billion VND. VPB was the focus of foreign withdrawals with about 3 million shares, followed by SSI, DXG and VND.

According to some securities companies, the VN-Index has decreased but the short-term trend of the market is not too negative. The accumulation state may take place before the Fed's interest rate announcement, plus the restructuring session of the two ETFs this weekend. This state will only end to establish a new trend in case the index surpasses the resistance level of 1,690 points or breaks through the 1,650 point mark.

PV (synthesis)Source: https://baohaiphong.vn/chung-khoan-giam-manh-521038.html

![[Photo] General Secretary To Lam chairs a working session with the Standing Committee of the Government Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/17/cf3d855fdc974fa9a45e80d380b0eb7c)

![[Photo] Science and Technology Trade Union honors exemplary workers and excellent union officials](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/17/842ff35bce69449290ec23b75727934e)

Comment (0)