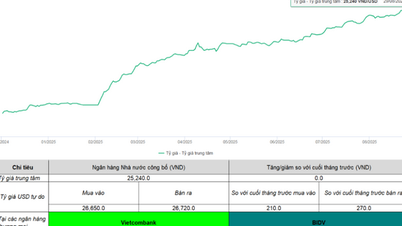

In the trading session on September 5, the State Bank kept the central exchange rate unchanged compared to September 4, announcing it at 25,248 VND. The reference exchange rate at the State Bank's Exchange is 24,036 VND/USD (buy) - 26,460 VND/USD (sell).

For commercial banks, at the Joint Stock Commercial Bank for Foreign Trade of Vietnam ( Vietcombank ), the USD exchange rate listed on the electronic board is 26,160 VND/USD (buy) - 26,510 VND/USD (sell), only slightly increased by 2 VND compared to the previous day's session.

Joint Stock Commercial Bank for Investment and Development of Vietnam ( BIDV ) listed at 26,190 VND/USD (buy) - 26,510 VND/USD (sell). In the "black market", the USD exchange rate remained unchanged in both buying and selling directions, compared to yesterday's trading session, trading around 26,814 VND/USD (buy) - 26,914 VND/USD (sell).

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.15%, currently at 98.29 points.

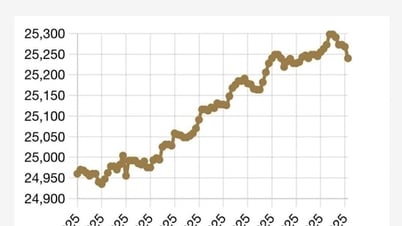

Obviously, the exchange rate is still high compared to the beginning of 2025, as well as the same period last year. According to experts, if the US Federal Reserve (FED) decides to lower the USD interest rate in September, the USD in the international market will weaken, bringing two direct benefits to Vietnam. That is, it will contribute to reducing pressure on VND, narrowing the interest rate gap with VND, reducing the attractiveness of holding USD and limiting the situation of foreign investors withdrawing capital from Vietnam. However, on the contrary, if the FED does not lower interest rates, the USD/VND exchange rate will not be under pressure.

Although the exchange rate has not fluctuated much in recent sessions, the pressure of the exchange rate in recent times has made it difficult for the interest rate to decrease further. Not to mention the high demand for loans from businesses, forcing many banks to raise input prices, i.e. increase deposit interest rates to attract deposits.

Experts also said that the State Bank may not adjust the VND policy interest rates in the short term, but will continue to monitor domestic macroeconomic developments, monitor USD interest rate trends and impacts from new tariff policies, from which it will make decisions on VND interest rates.

Source: https://hanoimoi.vn/ap-luc-cua-ty-gia-khien-lai-suat-kho-giam-715195.html

![[Photo] Impressive display booths of provinces and cities at the Exhibition 80 years of the Journey of Independence - Freedom - Happiness](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/7/cd63e24d8ef7414dbf2194ab1af337ed)

![[Photo] Prime Minister Pham Minh Chinh attends the 80th anniversary of the founding of Voice of Vietnam Radio Station](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/7/abdcaa3d5d7f471abbe3ab22e5a35ec9)

![[Photo] General Secretary To Lam attends the 55th anniversary of the first television program broadcast](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/7/8b8bd4844b84459db41f6192ceb6dfdd)

![[Highlight] VIMC's mark at the National Achievement Exhibition](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/7/932133a54d8b4becad48ef4f082f3eea)

![[COMING UP] Workshop: Resolving concerns for Business Households about eliminating lump-sum tax](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/7/5627bb2d0c3349f2bf26accd8ca6dbc2)

Comment (0)