VPBank and businesses seize new opportunities

Decree 70/2025/ND-CP on strengthening tax management requires business households with revenue of VND1 billion/year in certain industries to issue electronic invoices and declare taxes in accordance with legal procedures. This policy is an important step forward in the effort to modernize tax management and promote transparency in business activities.

At first, many businesses, who were used to lump-sum tax and had no accounting experience, had difficulty with the new regulations. However, this was also an opportunity for proactive businesses to grow and operate according to new standards, more professionally and sustainably.

In the process of transformation and development, the issue of capital is always the top concern for business households. Access to capital, especially low-cost capital, simple procedures and quick disbursement, is of particular concern to business households.

Accompanying the business community to adapt to the changes in Decree 70, Vietnam Prosperity Joint Stock Commercial Bank (VPBank) officially launched a comprehensive solution, named V20000 - fully meeting the needs from capital to operations and in-depth consulting. With a total scale of 20,000 billion VND, this is one of the largest credit packages ever of VPBank for business households, and is also a program of a scale rarely seen in the financial market for this group of customers.

The highlight of the loan package in the V20000 solution is not only the scale of 20,000 billion VND, but also the mortgage interest rate exclusively for production and business customers from only 3.99%. This is an extremely attractive and unprecedented interest rate. With this special preferential mortgage loan package, VPBank hopes to accompany and help business individuals overcome difficult times, boldly using financial leverage to continue developing their business.

Loan limit up to 20 billion VND, with super fast approval process "in just 3 minutes", thus preferential capital, easy access, quick approval are the "magic" trio to help businesses in the most practical way.

In parallel, with its leading position in the unsecured lending segment for business households, the bank also launched an unsecured loan package, with interest rates reduced by up to 2% over the entire loan term compared to existing products. At the same time, the loan limit of this product is up to 1 billion VND, along with quick approval time and simple application.

Professional operating solutions, in-depth consulting

Not only providing loans with the most preferential interest rates on the market, VPBank also deploys a comprehensive "5 in 1" solution set including "account - capital - tax - insurance - payment management", which is "tailored" exclusively, professionally, specifically, and adaptable to the new business environment. The bank has cooperated with partners providing digital solutions to sponsor electronic invoice software and digital signatures - essential tools to help businesses meet new requirements on invoices and tax management.

Accordingly, 70,000 compliance software packages worth VND1.2 million/package will be provided by VPBank to business households to support customers in complying with the regulations of Decree 70. At the same time, the bank also gives away Soundbox speakers to conveniently notify balance fluctuations, or refunds up to VND400,000 to customers who proactively purchase this device. In addition, VPBank will refund e-vouchers to business households that reach transaction milestones from 10 to 400 transactions, with a total refund value of up to VND1 million.

Along with the professional operational solution package, through a series of livestream events and workshops, VPBank's team of experts in the fields of finance - banking - operations will accompany business households to remove obstacles in the conversion process. The team of experts will provide the necessary knowledge and skills to manage transparent cash flow, declare invoices correctly and operate business more effectively in the new context.

With the guiding principle of “Accompanying small traders, Steady steps to prosperity”, the solutions that VPBank deploys are not only purely financial support, but also a deep understanding of the needs and practical concerns of business households in this period. From flexible loans, modern operating tools to in-depth consulting, all solutions are intelligently designed, close to each specific situation that customers are facing.

Through the V20000 solution package, VPBank affirms its commitment to accompany business households in proactively adapting to new legal regulations, optimizing operational efficiency and developing sustainably and transparently.

Source: https://baodaknong.vn/vpbank-tung-goi-giai-phap-toan-dien-cung-ho-kinh-doanh-bat-nhip-nghi-dinh-70-256715.html

![[Photo] Cuban artists bring "party" of classic excerpts from world ballet to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/797945d5d20b4693bc3f245e69b6142c)

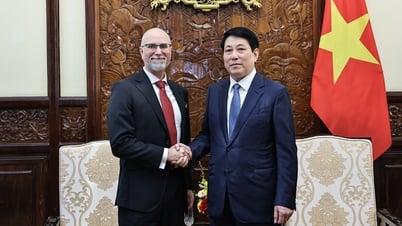

![[Photo] General Secretary To Lam receives Australian Ambassador to Vietnam Gillian Bird](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/26/ce86495a92b4465181604bfb79f257de)

Comment (0)