Since the beginning of the year, four green bond lots have been issued, showing the revival of green, social and sustainable bonds.

Since the beginning of the year, four green bond lots have been issued, showing the revival of green, social and sustainable bonds.

More diversified bond issuance structure

FiinRatings' report on the primary bond market in October 2024 said that the issuance value in October 2024 decreased significantly compared to the previous month due to the slowing down of bond issuance scale by credit institutions, reaching 33 trillion VND with 38 issuances, down 41.4% compared to the previous month but up 1.6% compared to the same period last year.

This is the month with the lowest issuance value since July this year, mainly due to the slowdown in the market-leading industry group, the credit institution group, after significant issuance last month to meet the State Bank's safety ratios for the end of the third quarter of 2024. In the first 10 months of the year, the total issuance value of the entire market reached nearly VND348 trillion, up nearly 60% over the same period last year.

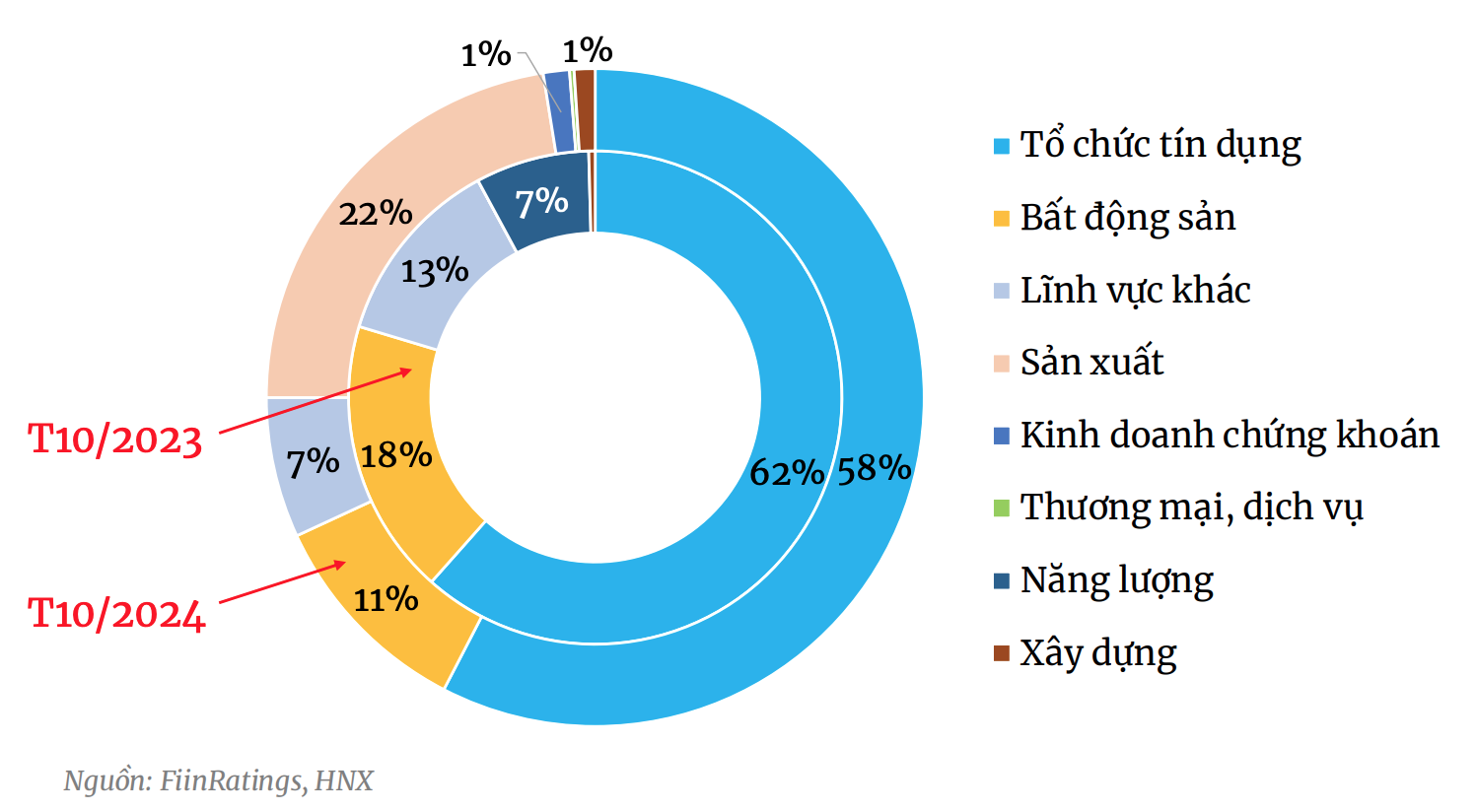

In the past month, the notable information is that the structure of issuance by industry has become more diverse. The proportion of bonds of credit institutions has decreased to 58% compared to over 80% in previous months.

|

| Issuance structure on primary market October 2024 |

In terms of industry structure, the group of credit institutions still accounts for the highest proportion in terms of issuance value. However, this proportion has decreased significantly compared to previous months because many other industry groups issued large-value bonds in October, leading to a relatively diverse industry structure. Some non-banking enterprises that issued large amounts of bonds in October include Vinfast (VND 6,000 billion), Vinhomes (VND 2,000 billion) and Vietjet (VND 2,000 billion).

Corporate bond repurchases in October 2024 reached nearly VND17.5 trillion, down 14.5% compared to the previous month. Maturity pressure in the final period of 2024 reached VND54.4 trillion and focused on non-financial enterprises, especially in the Real Estate and Manufacturing sectors.

In October, the non-financial business group doubled the value of acquisitions, but banks still accounted for 72% of the value in October.

4 green bond lots issued since the beginning of the year

FiinRatinsg's report said that the requirement to have collateral or payment guarantees by the Draft Amendment to the Securities Law will have a significant impact on the supply of bonds to the market if the Draft Amendment to the Law is passed and comes into effect.

However, the Draft Amendment to the Law currently only mentions “guarantee by credit institutions” and does not mention any reference to guarantees by international organizations. Meanwhile, the market has witnessed a number of green bond lots issued by international organizations with high credit ratings, including CGIF (ADB’s trust fund) and GuarantCo (a credit guarantee unit of PIDG Group) and successfully issued.

From the beginning of the year to November 20, 2024, there have been 04 green bond lots issued under the Green Principles of the International Capital Market Association (ICMA) with a total value of VND 6.87 billion, accounting for about 2% of the total issuance value during the period. These bond lots have all been assessed and confirmed by independent organizations, including FiinRatings on the Green Bond Framework.

Last October, a VND1,000 billion bond lot was issued by IDI Multinational Investment and Development Corporation (in the aquaculture sector) guaranteed by GuarantCo. This is also the first green bond lot issued by a non-financial enterprise.

During the 2016-2023 period, Vietnam has issued approximately USD 1.1 billion (nearly VND 27 trillion) of Green, Social and Sustainable Bonds. Bonds issued by non-bank organizations in this group currently have a modest balance with issuances from EVNFinance (VND 1,725 billion), BIDV (VND 2,500 billion), Vinpearl (USD 425 million), and BIM Land (USD 101 million), accounting for 1.8% of the total market value, significantly lower than the 5-7% of regional countries such as Thailand, Malaysia and the Philippines.

In 2024, with 4 green bond lots issued, the market is witnessing a resurgence of green, social and sustainable bonds.

Vietnam is in the process of drafting a framework to classify green bonds and green credit, but green bond transactions issued recently have been somewhat more prosperous thanks to the initial basic legal framework and especially the voluntary participation of market members. In fact, recent green bond transactions have shown that they have gradually contributed to improving the quality of goods for the corporate bond market, FiinRatings assessed.

Source: https://baodautu.vn/tin-hieu-soi-dong-tro-lai-cua-trai-phieu-xanh-d230581.html

Comment (0)