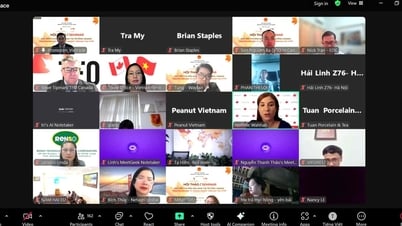

Representatives of enterprises and business households said that production and business need capital, and the connection between banks and enterprises has created a bridge to provide transparent information on mechanisms, monetary policies, credit, exchange rates, and bank interest rates to enterprises and business people. However, the opinions of enterprises also reflected to banks that enterprises with many assets still have difficulty accessing loans.

|

| Mr. Vo Minh Tuan (left cover) said that deposit interest rates are being held by banks to stabilize lending interest rates to support businesses and business households - Photo: Dinh Hai |

In a dialogue with businesses, Mr. Vo Minh Tuan publicly disclosed 5 sets of basic loan conditions of the bank. If any commercial bank requires other conditions outside of that set of documents, businesses can report to the monetary management agency - the bank to have a form of relief for borrowers.

At the same time, businesses and business households also need to demonstrate effective business plans and proper use of capital so that credit institutions can manage loans in accordance with the law.

"Banks lend for the purpose of developing production and business to create jobs and goods and services for society. Banks do not lend to keep assets or sell assets of enterprises" - Mr. Vo Minh Tuan answered questions from enterprises.

The head of the Banking sector in Region 2 said that the State Bank of Vietnam is currently operating a monetary policy to support economic growth. Since the beginning of 2025, credit institutions in Ho Chi Minh City have implemented many solutions to improve operational efficiency and reduce costs to keep deposit interest rates from increasing abnormally, ensuring stable lending interest rates to support businesses and traders.

According to a representative of the State Bank of Vietnam, Region 2 branch, at the Bank-Enterprise Connection Program in Ho Chi Minh City in early 2025, credit institutions registered a credit package worth VND517 trillion. It is expected that the number of credit packages implemented will increase by about 30-35% - equivalent to about VND600-700 trillion of bank capital supplied to the market, of which more than 50% is medium and long-term capital to serve the double-digit economic growth target of Ho Chi Minh City this year.

In 2025, Ho Chi Minh City's total social investment capital needs more than VND620,000 billion for its double-digit growth target, of which bank capital can meet two-thirds of this, the remaining capital belongs to public investment, private investment, and remittances.

At the signing ceremony, 4 banks, Vietcombank Thu Duc branch, Agirbank, ACB , BIDV Thu Duc branch signed a commitment to lend to 10 customers with a capital value of more than 1,000 billion VND.

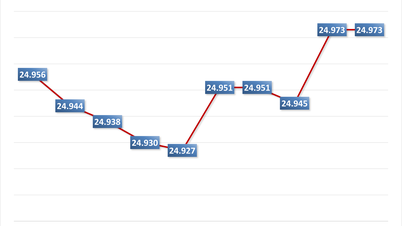

According to the State Bank of Vietnam, Region 2 branch, in early 2025, credit institutions in Ho Chi Minh City registered for a preferential credit package. By the end of April, credit institutions had disbursed more than VND 25,800 billion to customers in Thu Duc.

Source: https://thoibaonganhang.vn/them-1000-ty-dong-cam-ket-cho-vay-moi-vao-tp-thu-duc-164152.html

![[OCOP REVIEW] Tu Duyen Syrup - The essence of herbs from the mountains and forests of Nhu Thanh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/5/58ca32fce4ec44039e444fbfae7e75ec)

Comment (0)