ANTD.VN - The General Department of Taxation requires tax departments nationwide to urgently review and standardize personal tax code data, synchronize tax data with the national population database to move towards using citizen identification codes as tax codes.

According to the General Department of Taxation, recently, tax departments of provinces and cities across the country have stepped up the review and standardization of personal tax code (MST) data, synchronized tax data with the national database on population and cleaned up and unified the use of citizen identification codes as MST according to the direction of the Government and the Ministry of Finance .

However, as of November 15, 2023, the results of the implementation of reviewing and standardizing personal tax codes with the rate of personal tax codes matching the National Database of the Ministry of Public Security are still low.

Therefore, the General Department of Taxation requires tax departments of provinces and centrally run cities to identify the implementation of reviewing and standardizing personal tax code data as an important political task directed by the Government, the Ministry of Finance, and the General Department of Taxation to complete the synchronization of tax data with the national database on population and clean up and unify the use of citizen identification codes as tax codes as prescribed in the Law on Tax Administration No. 38/2019/QH14.

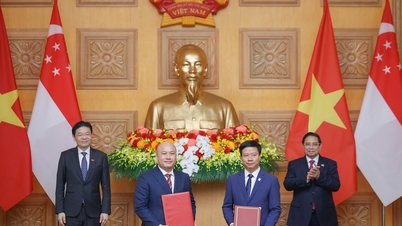

|

The results of implementing the review and standardization of personal tax codes with the National Database are still low. |

Tax departments must advise and propose to the People's Committees of provinces and cities, the Steering Committee for implementing Project 06 in localities to direct departments, branches, police agencies, and local authorities to closely coordinate with tax authorities in reviewing, cleaning, and standardizing personal tax code data.

The Director of the Tax Department of each province or city must direct and assign each department leader and each civil servant to be responsible for implementation. At the same time, clearly define the roadmap, develop plans and implementation methods for each group of subjects that must review and standardize personal tax code data.

The General Department of Taxation requires Tax Departments to strive to achieve the highest results from now until December 31, 2023.

Source link

Comment (0)