Safe debt-to-equity ratio compared to practice

Recently, social media has been spreading rumors that Vingroup Corporation is in debt of VND800,000 billion (about USD30 billion) and is facing bankruptcy. However, Vingroup said it is initiating a civil lawsuit, reporting to authorities and sending documents to embassies about 68 domestic and foreign organizations and individuals providing false information about the corporation.

According to Vingroup, the rumors are false and "intentionally misleading public opinion". The content focuses on four topics: The group's financial situation; product quality and origin; product legal issues and personal information of leaders. These actions show signs of violating the Law on Cyber Security and the Penal Code.

Vingroup confirmed that the group's total debt is 280,000 billion VND, corresponding to a debt-to-equity ratio of only about 1.8 times.

So what is the actual number of 800,000 billion VND?

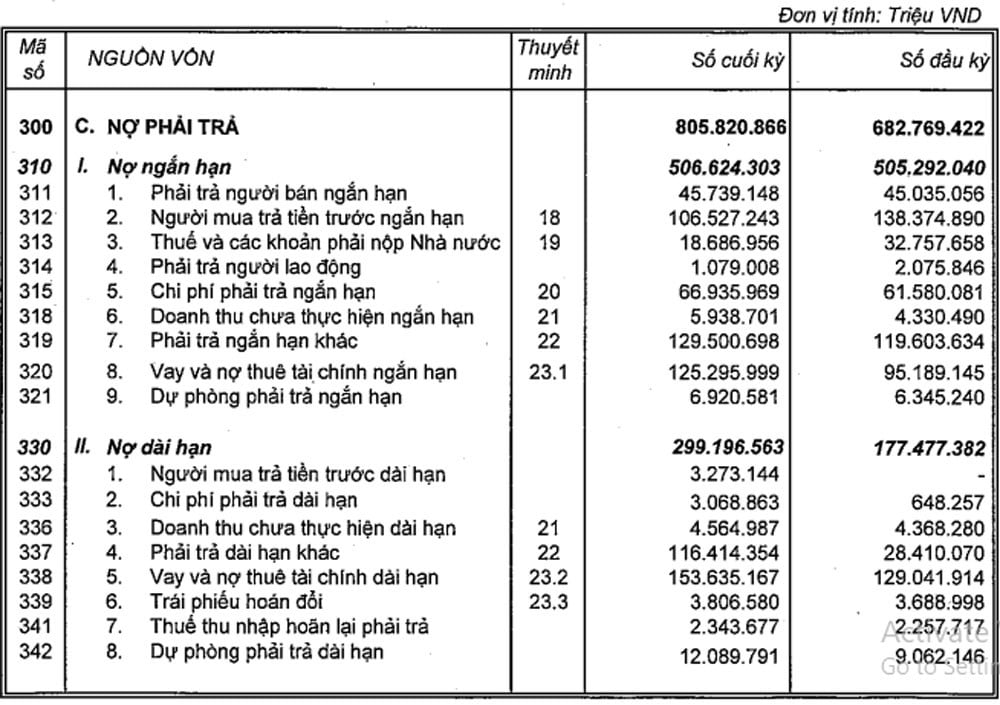

According to the consolidated financial report for the first half of 2025 of Vingroup Corporation (VIC), total liabilities as of the end of June were over VND805,800 billion, an increase of about 18% compared to nearly VND682,800 billion at the beginning of the year. Of which, short-term debt was VND506,600 billion (a slight increase compared to nearly VND505,300 billion at the beginning of the year) and long-term debt was nearly VND299,200 billion (an increase compared to nearly VND177,500 billion).

However, in the structure of liabilities, loans and financial leasing debt are VND 279,000 billion, including nearly VND 125,300 billion in short-term and more than VND 153,600 billion in long-term, respectively increasing by 31.6% and 19% compared to the corresponding figures of nearly VND 95,200 billion and more than VND 129,000 billion at the beginning of the year.

As of the end of June 2025, Vingroup had equity of more than VND 158,600 billion, a slight increase compared to more than VND 153,800 billion at the beginning of the year.

Thus, if calculated according to this figure, the debt-to-equity ratio is only about 1.76 times. This is a fairly safe figure compared to international and Vietnamese practices.

What does more than 800,000 billion VND in debt include?

Of Vingroup's more than VND800,000 billion in liabilities, about VND110,000 billion is prepaid by buyers (VND106,500 billion short-term, VND3,300 billion long-term). This is the amount of money buyers pay in advance as in contracts to buy houses/apartments or deposits to buy cars...

In essence, this is not immediate revenue, because the business has not yet fulfilled its obligation to deliver goods/services, but is the amount of money that customers pay in advance to the business before the business delivers or provides services. When the business has delivered goods/services (such as handing over an apartment), this amount of money is transferred to revenue. Thus, this is considered a positive amount of money for the business.

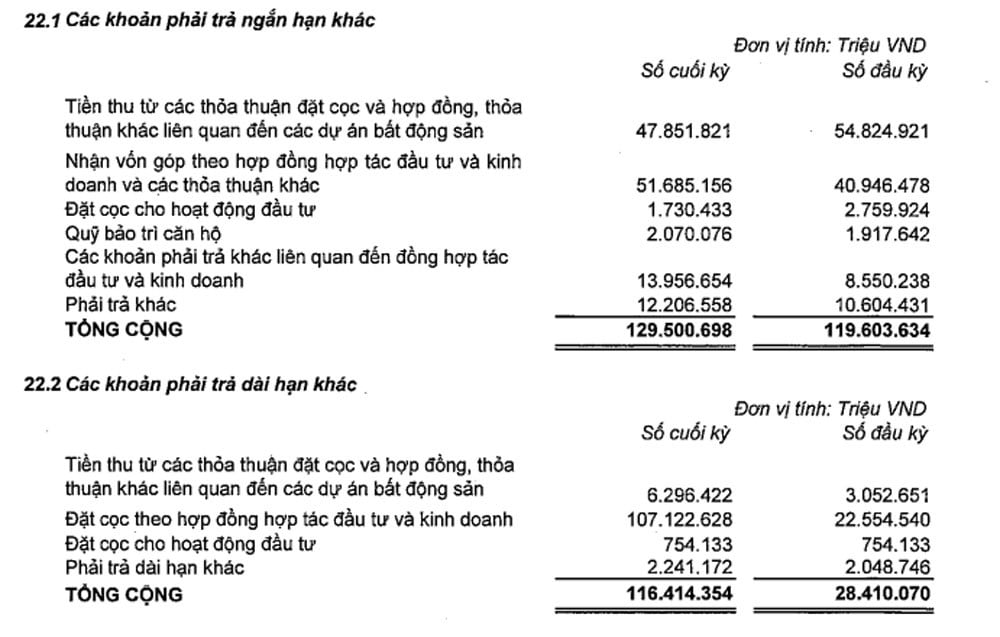

Vingroup also recorded two large amounts in the "liabilities" category of more than VND800,000 billion, which are more than VND129,500 billion in "other short-term payables" and more than VND116,400 billion in "other long-term payables". The total is VND245,900 billion.

"Other payables" is essentially a short-term (or long-term) debt item on the balance sheet, reflecting the financial obligations of the enterprise to pay to related parties other than suppliers, employees, banks. It can be capital contributions from members, deposits, customer deposits, third-party collections and payments, etc.

According to the report, of which, there are nearly 54,200 billion VND in revenue from deposit agreements and other contracts and agreements related to real estate projects (nearly 47,900 billion short-term); nearly 51,700 billion VND in short-term capital contributions under investment and business cooperation contracts and other agreements and more than 107,100 billion VND in long-term deposits under investment and business cooperation contracts.

In the asset table, Vingroup recorded other short-term receivables of more than VND 145,000 billion and other long-term receivables of more than VND 10,200 billion.

Regarding loans and financial leasing debts, as of June 30, 2025, Vingroup had short-term loans of nearly VND 125,300 billion and long-term loans of more than VND 153,600 billion. Of which, more than VND 94,000 billion came from bonds, the rest was mainly borrowed from a number of banks such as: VPBank, Techcombank, BIDV, Vietcombank, VietinBank, HDBank,SHB ... and a number of corporate partners (nearly VND 29,400 billion).

Therefore, Vingroup has a legitimate reason to sue individuals and organizations that spread the news that this enterprise has a debt of up to 800,000 billion VND.

Source: https://vietnamnet.vn/su-that-ve-cac-khoan-no-cua-vingroup-2441027.html

![[Photo] General Secretary To Lam chairs the Politburo's working session with the Standing Committee of the National Assembly Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/11/e2033912ce7a4251baba705afb4d413c)

![[Ảnh] Chủ tịch nước Lương Cường tiếp Bộ trưởng Quốc phòng Thổ Nhĩ Kỳ Yasar Guler](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/11/7f1882ca40ac40118f3c417c802a80da)

Comment (0)