Many targets completed early

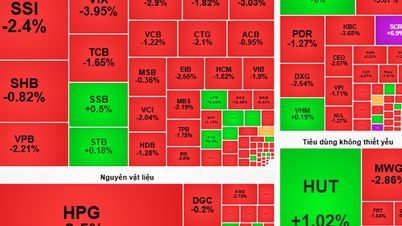

According to information from Hai Phong City Tax Department 1, in 2025, the state budget revenue estimate of Hai An Ward was assigned 43.43 billion VND. By the end of August, the total revenue of the ward reached nearly 50 billion VND, equivalent to exceeding the annual plan by more than 10%.

This is one of the few localities in the city to complete the budget early after only nearly 2 months of implementation, showing the strong resilience of Hai An when operating the new management model.

In the revenue structure, the non-state sector of the ward plays a key role, reaching 13.04 billion VND after 7 months (exceeding the estimate by 18%), and is expected to reach 18.5 billion VND (exceeding 68%) for the whole year of 2025. Non- agricultural land use tax also achieved high results of 12.14 billion VND, exceeding the estimate by 109%. Other revenues such as personal income tax, registration fee (both exceeding 7%) and fees and charges (reaching 91%) were basically completed and exceeded the plan, ensuring the balance of the local budget.

Hai An Ward currently manages nearly 2,838 business households with diverse structures. Of which, private house rental and construction households contribute more than 44% of total revenue. Although e-commerce business households are new, they also generate revenue of more than VND 2.17 billion (accounting for 11.3% of total revenue from business households), showing a clear trend of shifting business structure.

Mr. Tran Van Hoang, representative of Thinh Long Petro Petroleum Company Limited, said that the company currently has a branch in Hai An Ward. In the past 2 months, tax declaration procedures have changed, causing initial difficulties for the company. However, thanks to timely guidance from the tax authorities, the company quickly adapted and maintained stable tax declaration and payment."

With the advantage of converging diverse types of transportation, especially Cat Bi International Airport, near industrial parks and seaports, the processing and manufacturing industry continues to play a leading role in the entire industry of Hai An ward.

Many projects for manufacturing electronic components, measuring, testing, navigation and control equipment, communication equipment, etc. are attracting investment, creating a stable supply chain for trade and services. Particularly from July 15 to August 15, 2025, the ward received and processed 190 applications for business registration certificates, creating conditions for businesses to quickly operate...

Implementing sustainable solutions

Despite impressive results, tax management in Hai An ward still faces many challenges. According to the reflection of professional agencies, when the Department of Economy - Infrastructure - Urban Area issues a business registration, after 10 days, the business household must declare and pay taxes, but most households do not comply with the regulations.

Currently, on average, each tax official has to manage more than 400 business households, causing great pressure on reviewing and updating data into the system. The awareness of tax compliance of a number of business households is still limited, causing the rate of tax arrears to remain high.

In addition, non-agricultural land records are still overlapping after the arrangement; the implementation of electronic invoices, EtaxMobile initially reached 20.2% of households using them, but did not meet expectations, affecting the sustainability of revenue sources...

Faced with the above reality, Chairman of Hai An Ward People's Committee Cao Huy Hieu affirmed that the ward will continue to focus on directing and synchronously implementing measures to increase revenue, ensure correct, sufficient and timely collection, expand collection bases and prevent revenue loss. The focus is on exploiting revenue sources from land, e-commerce, and digital-based business; drastically transforming digitally, requiring electronic invoices in all fields. Strengthening inspection and examination to compensate for revenue losses due to policy changes.

According to the City's Base Tax 1, the unit is currently proposing that the ward establish a Steering Committee to prevent revenue loss, review all business households, and strictly handle cases of tax evasion. Strengthen coordination between tax authorities, police and local authorities in managing households renting houses and doing business online. Propaganda is also promoted through the grassroots information system, Zalo groups of residential groups, instructions on using EtaxMobile, and electronic invoices, helping people clearly see the benefits and proactively implement them.

In the long term, Hai An Ward focuses on nurturing sustainable revenue sources: planning and arranging markets and service areas; encouraging business households to transform into enterprises; strictly managing non-agricultural land taxes; synchronizing business household data with population management. In addition, supporting the development of e-commerce in the direction of complying with the law and effectively exploiting market potential, contributing to Hai An maintaining its top position in the city and increasing stable revenue for the local budget.

VAN NGA - MINH TRISource: https://baohaiphong.vn/phuong-hai-an-but-pha-thu-ngan-sach-521019.html

![[Photo] Science and Technology Trade Union honors exemplary workers and excellent union officials](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/17/842ff35bce69449290ec23b75727934e)

![[Photo] General Secretary To Lam chairs a working session with the Standing Committee of the Government Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/17/cf3d855fdc974fa9a45e80d380b0eb7c)

Comment (0)