Comrade Tran Thanh Man, Politburo member, Chairman of the National Assembly, Secretary of the National Assembly Party Committee attended the 8th Congress of the State Audit Party Committee, term 2025 - 2030_Photo: VNA

Preventing and combating waste is the core task of the State Audit.

Preventing and combating waste is the function and task of the State Audit (SA) and is clearly stated in the 2013 Constitution, the State Audit Law, State Audit standards, the State Audit Development Strategy to 2030 and relevant legal documents. Article 118 of the Constitution stipulates that “The State Audit is an agency established by the National Assembly , operates independently and only complies with the law, and conducts audits of the management and use of public finance and assets”; at the same time, the State Audit Development Strategy to 2030 clearly states that the independence of SA activities must be commensurate with its position and role as an agency established by the National Assembly, operates independently and only complies with the law, and conducts audits of the management and use of public finance and assets; Upholding the core values of Independence - Integrity - Professionalism - Prestige - Quality, contributing significantly to the stable, sustainable and transparent development of national finance, improving the efficiency of using national resources and preventing and combating corruption and waste; enhancing accountability, publicity, transparency, protecting the law, integrity, maintaining people's trust in the Party and State.

Along with that, the State Audit Law and other laws also specifically stipulate the audit subjects, audit types as well as the powers and responsibilities of the State Audit in organizing audit activities... The Law on Practicing Thrift and Combating Wastefulness also stipulates that, within the scope of its tasks and powers, the State Audit is responsible for conducting audits to prevent, detect and handle violations of the law on practicing thrift and combating waste. The above laws and related legal documents are the legal basis for the State Audit to effectively perform the task of preventing and combating waste in the management and use of public finance and assets.

To effectively implement the work of preventing and combating waste, the State Audit Office has specified the Party's regulations and the State's laws on preventing and combating waste into legal documents under the authority of the State Auditor General, such as the State Audit Standards System, the State Audit Office's audit process, the audit process for cases with signs of corruption and waste; at the same time, it has issued audit guidelines on preventing and combating waste, regulations on organizing audit activities to organize effective and quality implementation. In particular, as a member of the Central Steering Committee on preventing and combating corruption, waste, and negativity, the State Audit Office has closely followed the direction of the Steering Committee, continuously innovated audit activities, focused on auditing major topics related to the management and operation of the state budget, areas prone to negativity, corruption, waste, and issues of public concern..., contributing to the work of preventing and combating waste.

Detect and recommend handling of many organizations and individuals in the wasteful and inefficient use of public resources.

Through audits, the State Audit Office has discovered phenomena and signs of waste and inefficient use of public resources. For example, in the field of regular expenditures, the State Audit Office pointed out the situation of slow budget allocation, multiple allocations, unrealistic allocations, no specific spending tasks, allocations when conditions are not met... leading to failure to disburse and having to cancel the budget; allocations exceeding the norm... Regarding investment expenditures, the allocation of capital for a number of projects that are not met the conditions, not included in the medium-term public investment plan, allocations exceeding the implementation capacity, exceeding the demand... leading to failure to disburse, having to adjust down or the disbursement rate is low, the capital plan must be cancelled in large numbers; the design is not economical; many investment projects are behind schedule, reducing the efficiency of investment capital; Investment exceeding the necessary scale, not suitable for the needs of use, causing waste... In the management and use of assets, the State Audit discovered that some units have not fully used the allocated land area or used it ineffectively, not for the right purpose, allowing encroachment and disputes; implementing joint ventures, associations, leasing, and lending land not in accordance with regulations...

Through audit findings, the State Audit has recommended increasing revenue and reducing state budget expenditures by tens of thousands of billions of VND each year; recommended reviewing the responsibilities of relevant collectives and individuals; transferred many audit records to competent authorities for investigation and handling according to regulations, thereby promptly correcting, creating deterrence, warning, and preventing more serious violations. In particular, the State Audit also pointed out many loopholes in mechanisms, policies, laws, "bottlenecks", barriers, affecting the driving force for rapid and sustainable economic development to recommend competent authorities to improve and "plug" loopholes, contributing to preventing acts of corruption and waste from mechanisms and policies, creating a legal basis and more favorable conditions for the management and use of public resources effectively and economically.

At the same time, in the reports sent to the National Assembly on the state budget estimate and the central budget allocation plan, and the investment policy for important national projects, the State Audit also proposed a number of recommendations to maximize cost savings.

Building a team of state auditors who have a firm grasp of the law, are proficient in their profession, and comply with professional ethics requirements_Photo: Document

Further promoting the role of State Audit in the fight against waste

From the audit results and through practical summaries, it can be seen that there are many causes leading to the situation of loss and waste, such as mechanisms and policies that are still inadequate, overlapping, incomplete, inconsistent or not keeping up with development requirements; the implementation of discipline and discipline in financial management and public assets in some places and some units is not strict; the qualifications, professional capacity and operational efficiency of a number of cadres and civil servants are still limited; inspection and control work has not met the needs... In the trend of innovation of the country with the goal of sustainable development and macroeconomic stability associated with the effective use of national resources, the responsibility of the State Audit before the Party, the State and the people is increasingly greater. To better perform its role in preventing and combating waste, the State Audit will focus on implementing a number of key solutions:

Firstly, closely follow the directions of the Party Central Committee, the Politburo, the Secretariat, and the resolutions of the National Assembly to organize effective audit activities, especially improving the quality of the State Audit Office's opinions on the state budget estimates, the central budget allocation plan, and opinions on investment policies for important national projects to prevent waste from the beginning.

Second, promote the type of operational audit, conduct large-scale thematic audits, wide audit scope, use many State resources, have a great impact on the socio-economic situation of the country and localities; focus on auditing areas with high risks of corruption, waste, negativity, "hot" issues of public opinion and voters' concern, such as public investment, management, land use, environment, resources, minerals, investment, capital contribution of state-owned enterprises, management, use of assets, public finance. On that basis, promptly detect inadequacies of mechanisms, policies, laws as well as barriers affecting economic development motivation to make recommendations to the Party and State to improve the legal system in the direction of transparency, strictness, completeness and synchronization, contributing to improving the effectiveness of management, use of public resources and preventing loss and waste.

Third, promote and diversify the forms of publicizing audit results, publicizing the list of organizations and individuals who do not implement the conclusions and recommendations of the State Audit; promptly publicize cases of loss, waste and the responsibilities of related organizations and individuals, create pressure and strong impact with effects, create widespread public opinion to participate in the process of monitoring the management and use of public finance and assets, actively contributing to the fight against corruption and waste.

Fourthly , strengthen the application of information technology and digital transformation in all activities; streamline and streamline the organizational apparatus; focus on training and professional development, improve capacity, political will, and professional ethics of auditors, ensure the building of a team of state auditors who have a firm grasp of the law, are proficient in their profession, and comply with professional ethics requirements to continuously enhance the prestige of the industry, meet the requirements of the Party, the State, and the people; contribute significantly to improving the capacity for management and administration of finance and public assets, serving the socio-economic development of the country as set out in the State Audit Development Strategy to 2030./.

Source: https://tapchicongsan.org.vn/web/guest/chinh-tri-xay-dung-dang/-/2018/1099203/phat-huy-vai-tro-cua-kiem-toan-nha-nuoc-trong-cong-cuoc-phong%2C-chong-lang-phi.aspx

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

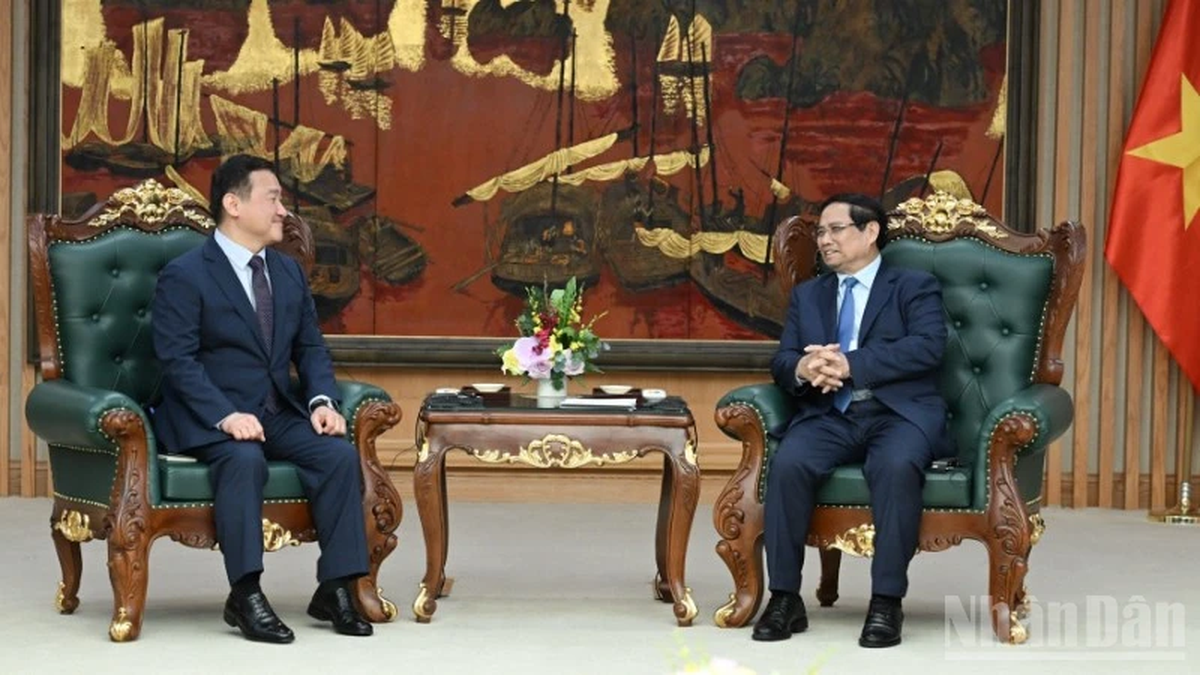

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)