Representatives of RAR center andOCB signed a contract to deploy electronic authentication service via VNeID on OCB OMNI application

As the lifeblood, leading the country's economy, in recent years, the banking industry has always been a pioneer and leader in digital transformation, promoting cashless payments to bring optimal convenience and safety to people. On April 24, 2023, the State Bank of Vietnam coordinated with the Ministry of Public Security to sign Plan No. 01/KHPH-BCA-NHNNVN on implementing the tasks in Project 06. Accordingly, credit institutions have quickly started implementing and concretizing the Government's instructions on banking products and services, aiming for the goal of comprehensive digitalization.

OCB is one of the pioneer banks in digital transformation very early. In 2018, the bank launched the first version of OCB OMNI digital banking. Immediately after being launched on the market, the application received high appreciation from users for its convenience, speed, personalization and above all, security.

After 3 versions with many strong changes in interface and features, in May 2024, the bank officially introduced the latest version of OCB OMNI based on cooperation with Backbase - the world's leading financial technology company. Currently, the application has established a digital ecosystem with more than 200 utilities on a single platform, meeting all customer needs. Thereby, as of June 30, 2025, the transaction rate via digital channels has grown significantly compared to the industry. The number of transactions on OCB OMNI increased by 97%; CASA increased by 28% and online savings deposit turnover increased by 30% compared to the same period in 2024.

In the process of implementing the digital transformation strategy, OCB recognizes the importance of applying accurate and secure identification data. This is the foundation for developing effective digital financial services. Therefore, the bank has proactively established a cooperative relationship with the RAR Center - a specialized unit on population data and citizen identification under the Ministry of Public Security to strongly apply electronic authentication services via VNeID right on the OCB OMNI application. Thereby, helping to optimize customer experience, enhance competitiveness and, in particular, aim to accompany the Agencies to successfully implement Project 06.

According to the signed contract, OCB and RAR Center will jointly implement: Integrating electronic citizen identification data into account opening and customer identification processes; Accurately comparing customer information, contributing to minimizing risks and enhancing security; Optimizing business processes, bringing convenience and superior speed to customers.

The signing between OCB and RAR Center is expected to help optimize customer experience in terms of speed and superior security.

At the ceremony, Mr. Pham Hong Hai, General Director of OCB emphasized that this signing will be an important milestone, demonstrating a strong step forward in promoting the application of electronic identification and authentication technology in the finance - banking sector, contributing to the realization of the national digital transformation strategy and the development of digital government, digital economy, and digital society. In particular, the integration of electronic authentication services via VNeID into OCB's transaction process is expected to create practical values, helping to enhance information security and safety, and minimize fraud risks. Both banks and customers can simplify administrative procedures, saving time and costs. Customers will access online banking services anytime, anywhere without having to carry many identification documents.

Also at the event, Colonel Tran Hong Phu, Deputy Director of the Department of Administrative Police for Social Order, praised the efforts of the RAR Center and OCB in deploying electronic authentication services, and hoped that OCB would focus on implementing key tasks such as: ensuring smooth, stable operations, information security and safety, in accordance with legal regulations, preventing cyber attacks. Closely coordinate in implementing measures to monitor and control unusual transactions to prevent financial fraud, money laundering and other violations of the law. At the same time, promote products, services and applications using population data, citizen identification, identification and electronic authentication to meet the needs of socio-economic development, with special attention to the payment sector, to promote the connection between technology applications and business activities.

The cooperation between OCB and RAR Center once again affirms OCB's strong commitment to applying technology and improving service quality. At the same time, it is an important step, joining hands to create a modern, transparent, safe and efficient data ecosystem - the foundation for digital economic development, ensuring national data sovereignty.

Source: https://ocb.com.vn/vi/tin-tuc-su-kien/tin-tuc/ocb-hop-tac-cung-trung-tam-du-lieu-quoc-gia-thuc-hien-xac-thuc-dien-tu-qua-vneid

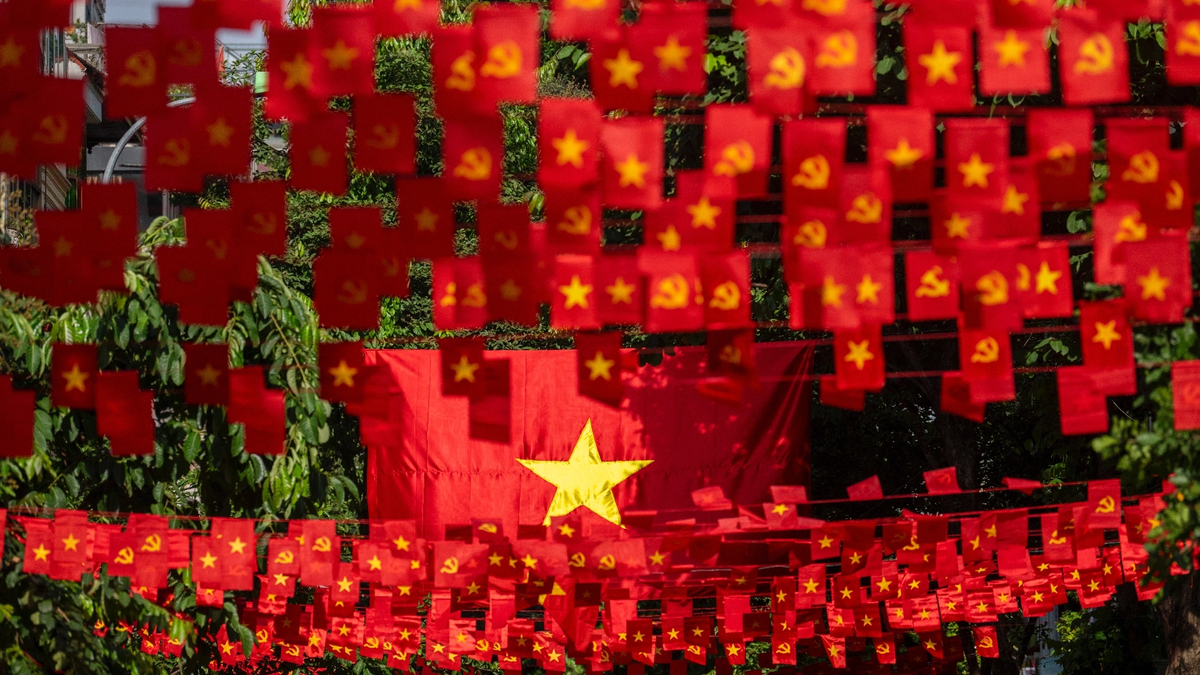

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)