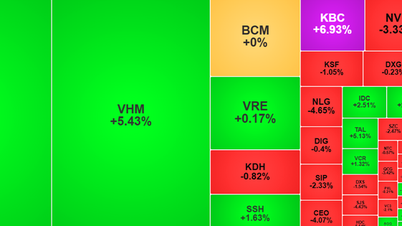

Unexpected developments continued to happen in the Vietnamese stock market last week, when the week ended, the VN-Index increased by 6%, reaching 1,584.9 points. The stock market surpassed its highest peak of 2022 - to the surprise of many investors.

The highlight was the historic trading session with a matched volume of 3.2 billion shares and a trading value of nearly VND83,000 billion across the entire market on August 5. Similarly, the VN30 index last week also increased by 7.15% to 1,729 points.

VN-Index is at historical peak

A series of stock sectors have made breakthroughs, with strong cash flows from steel, construction, fertilizer, agriculture , seafood, oil and gas, real estate, finance... Market liquidity set a new record, despite foreign investors increasing their net selling with a value of more than VND 12,800 billion on HOSE this week.

Talking to reporters of Nguoi Lao Dong Newspaper, many investors expressed disappointment when VN-Index did not decrease sharply as predicted at the peak, but continuously set new peaks.

Many investors have sold out their portfolios in the 1,550 - 1,580 point range, waiting for the market to correct downwards. However, at the end of the week, after strong fluctuations, the VN-Index continued to rise.

Vietnam's stock market has grown significantly compared to many countries.

"I sold all my securities and banking stocks; I sold most of my real estate stocks when the market shook strongly in the last two sessions of the week. As a result, I am now "standing outside" the market when the VN-Index reached a new peak" - Mr. Nam Phong, an investor in Ho Chi Minh City complained.

Mr. Dinh Viet Bach, Analyst, Pinetree Securities Company, also expressed surprise when the signal of VN-Index closing the week showed the possibility of the market adjusting down last week - but the actual development was completely opposite.

The index continued to break out and set a new historical peak at 1,584.9 points. Demand remained very good, as shown by the continuous flow of money between industry groups. Even in sessions where it seemed like the sellers were dominating, the money waiting to buy stocks still prevailed and pulled the market back.

"There is a high probability that the uptrend will continue next week. Foreign investors' buying and selling movements in the coming sessions can significantly impact the general market developments.

In the context of cash flow tending to rotate from large-cap stocks to mid- and small-cap stocks, investors can consider disbursing into these stocks to seek short-term profits. On the contrary, with stocks that have increased rapidly or continuously increased to the ceiling, investors should be cautious and prioritize taking profits gradually and avoid FOMO buying if VN-Index has continued strong increases" - Mr. Bach stated.

VN-Index hits historic peak

Shocking forecast appears, VN-Index up to 1,800 points?

SHS Securities Company also believes that the short-term trend of VN-Index is still maintaining growth, and is expected to move towards the next psychological zone around 1,600 points.

However, the market is trading actively with cash flow circulating in the context of "rising tide, rising boat", but starting to differentiate strongly. Short-term swing traders need to pay attention in the current context, maintaining a reasonable proportion.

Although VN-Index is at its peak, experts from Vietnam Construction Securities Company (CSI) said that the growth rate is showing signs of slowing down in the last two sessions of the past week.

It is not impossible that VN-Inex will have a correction in the sessions next week. CSI maintains a cautious stance, limiting the opening of new stock buying positions and continuing to prioritize a high cash ratio.

In its August 2025 strategy report, SSI Securities Corporation (SSI Research) said that short-term fluctuations due to profit-taking supply could create good opportunities for investors with the prospect of sustainable growth in the long term. VN-Index could reach its target of 1,750-1,800 points in 2026.

The fundamental factors strongly supporting the outlook on the stock market are economic growth and profits of listed enterprises; low interest rate environment, reduced tariff risks and the possibility of market upgrade...

Source: https://nld.com.vn/lien-tuc-nguoc-dua-bao-nha-dau-tu-chung-khoan-lam-gi-de-khong-bi-bo-roi-196250810121015765.htm

Comment (0)