Create room to reduce lending rates

Accordingly, the State Bank of Vietnam (SBV) requires banks to strictly implement the direction of the SBV Governor in Directive No. 01 on organizing the implementation of key tasks of the banking sector in 2025 to contribute to stabilizing the macro economy , controlling inflation, and achieving the growth target of 8% or more in 2025.

At the same time, implement solutions to stabilize and strive to reduce interest rate Deposits contribute to stabilizing the monetary market, creating room to reduce lending interest rates in accordance with the direction of the Government, Prime Minister and State Bank.

In addition, banks need to continue to drastically and more effectively reduce operating costs, increase the application of information technology, digital transformation, simplify procedures and other measures to reduce lending interest rates, support people and businesses to access bank credit capital, and promote production and business development.

The State Bank also requires banks to continue to publish average lending interest rates, the difference between average deposit and lending interest rates, lending interest rates for credit programs, credit packages and other types of lending interest rates (if any) on the bank's website so that customers, people and businesses can conveniently access and look up information.

In addition to reducing interest rates, banks must increase credit growth to ensure safety and efficiency, focusing on prioritizing the allocation of credit capital to production and business sectors, priority sectors and economic growth drivers; and strictly control credit to potentially risky sectors.

"The State Bank will closely monitor developments in deposit and lending interest rates, the announcement of lending interest rates on its website, and at the same time strengthen inspection, examination and supervision of banks' implementation of policies and directions of the Government , Prime Minister and the State Bank on deposit and lending interest rates," the State Bank emphasized.

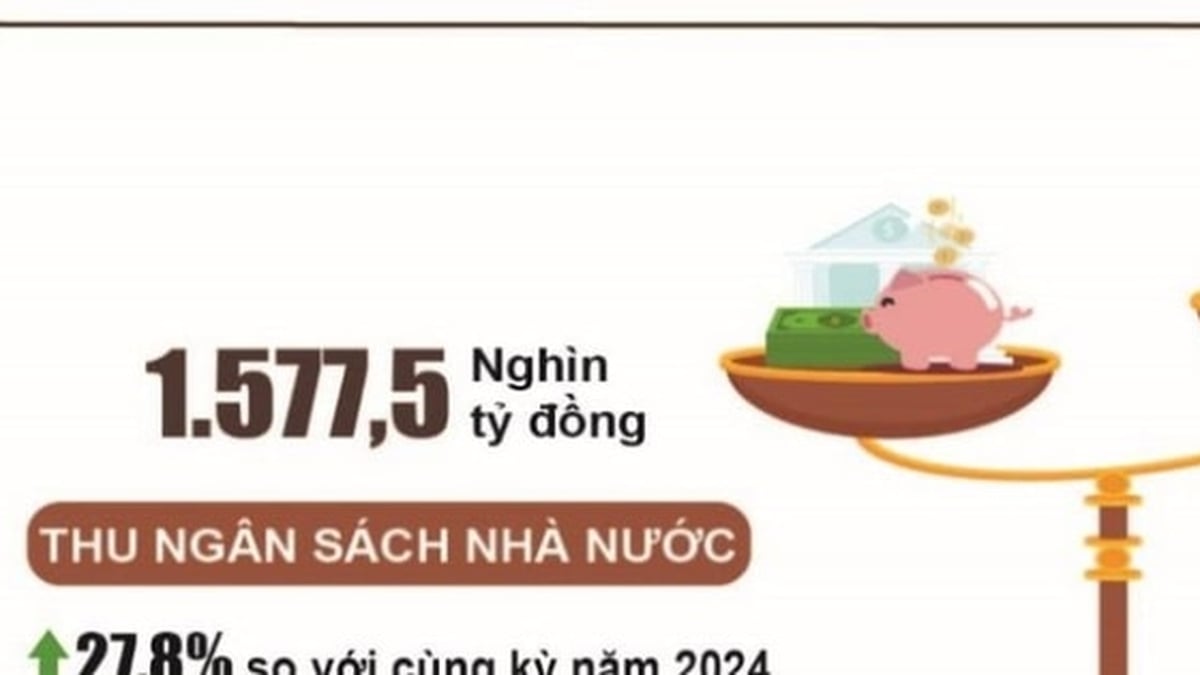

Credit growth highest in many years

According to statistics from the State Bank of Vietnam, by the end of June, credit in the entire economy reached more than 17.2 million billion VND, up 9.9% compared to the end of 2024 and nearly 2.5 times higher than the same period last year.

According to the leader of the State Bank of Vietnam, in the first months of 2025, the global economy witnessed many unpredictable fluctuations. Economic growth slowed down due to the combined impact of rapidly changing tariff policies. The world's financial and monetary environment still contained many uncertainties, affecting the management of interest rates, exchange rates and monetary policies of countries, including Vietnam.

The State Bank has proactively and closely monitored the macroeconomic situation, domestic and international financial and monetary markets, and at the same time developed flexible scenarios, implemented monetary policies proactively and effectively, and closely coordinated with fiscal policies, ensuring the goal of macroeconomic stability and inflation control, while supporting growth to reach the target of 8% in 2025.

Source: https://baoquangninh.vn/ngan-hang-nha-nuoc-yeu-cau-cac-ngan-hang-giam-lai-suat-cho-vay-3370189.html

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

Comment (0)