The application of online loan registration via QR codes by commercial banks not only marks a strong step forward in the digital transformation journey of the banking industry but also brings a new, modern and professional experience to customers.

Now, with just a few operations on smartphones, people and businesses can proactively register for bank loans quickly and conveniently without having to queue at the transaction counter.

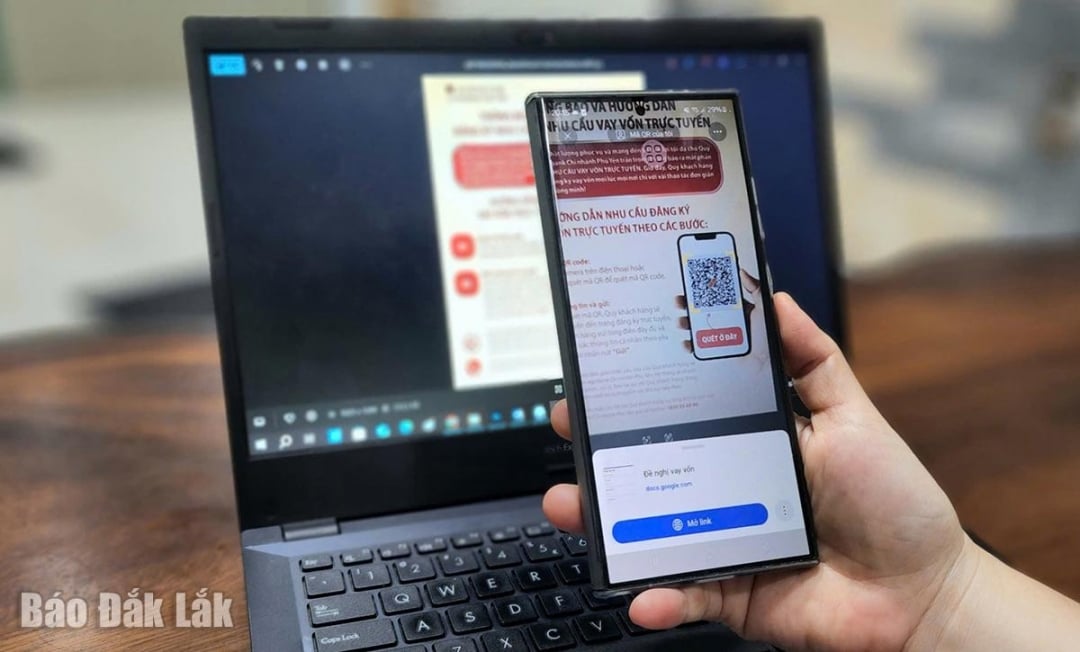

Apply for a loan by scanning the QR code

Grasping the digitalization trend and the increasing demand for convenience in financial transactions, from July 2025, Vietnam Joint Stock Commercial Bank for Investment and Development, Phu Yen Branch (BIDV Phu Yen Branch) started implementing the form of online loan registration via QR code. This is one of the specific steps to realize the goal of comprehensive digital transformation in banking operations.

|

| Bank staff guide customers to scan QR code and register for loan online. |

“Compared to the traditional way of receiving documents, the application of QR codes has brought about many clear changes in the working process. Customers can now proactively scan QR codes, fill in loan information online via phone, instead of having to write by hand or declare directly at the counter. The system also automatically classifies documents, forwards them to the appropriate processing department, thereby speeding up the approval process. It can be said that this form not only enhances the customer experience but also contributes to improving internal operational efficiency,” said Ms. Tran Thi Viet Hung, Acting Director of BIDV Phu Yen Branch.

Recently, in order to improve service quality and bring convenience to customers, Vietnam Bank for Agriculture and Rural Development Phu Yen Branch ( Agribank Phu Yen Branch) also launched software to register for online loan needs. Accordingly, customers can easily register for loans anytime, anywhere with just a few simple steps on their smartphones. Specifically, customers use their phones or applications to scan the QR code provided by the bank. After scanning the code, customers will be redirected to the online registration page to fill in the required information.

According to Mr. Truong Van Vu, Deputy Director of Agribank Phu Yen Branch, the implementation of software to register loan needs online via QR code helps the bank approach customer needs more quickly and scientifically. After receiving the application on the system, credit officers will quickly process and contact customers as soon as possible.

The inevitable trend in digital transformation of the banking industry

After a short period of implementation, both banks recorded a significant increase in the rate of customers proactively scanning QR codes to register for loans, especially among young customers and small business customers who are familiar with using technology.

|

| Customers scan the QR code to fill out loan application information. |

“In the past, every time I needed a loan, I had to go to a bank branch, get a number, then wait for instructions on filling out the application, preparing documents, etc. These things were quite time-consuming, especially if the bank was crowded. Now, all you need to do is use your phone to scan the QR code and you can apply for a loan at any time. Overall, compared to the traditional way, this form is more convenient, saves time and feels more professional. If the bank continues to expand such digital utilities, it will definitely create sympathy with customers,” said Mr. Nguyen Trong Tai in Tran Hung Dao neighborhood (Tuy Hoa ward).

Similarly, Ms. Nguyen Thi Huong, owner of a construction materials store in Dong Hoa ward, said: “I used to be afraid to borrow from the bank because of the complicated procedures. But recently, when I saw that the bank had a form of online loan registration through scanning QR codes, I found it more accessible. I can proactively scan the code, fill in the information at home, and after submitting, the bank will call to confirm, very quickly.”

Identifying digital transformation as not only a trend but also a core solution to improve access to capital for people and businesses, banks are planning to expand a number of key digital utilities such as: Developing a comprehensive online lending platform, allowing customers to register for loans, identify, sign contracts and monitor loans entirely via the application or website without having to go to a branch. Integrating eKYC (electronic identification) and automatic credit scoring, helping to shorten the loan approval and decision-making process, especially for small loans or fast consumer loans.

The bank also plans to enhance online support tools such as loan consulting chatbots, expected loan limit lookup, transparent interest rate calculation, etc. to help customers be more proactive in the process of preparing documents. At the same time, connecting inter-industry data such as tax, insurance, electronic invoices, etc. to help customers avoid submitting too many documents, while increasing accuracy and transparency in reviewing documents. In addition, the bank is also researching digital financial solutions specifically for individual businesses and micro-enterprises, based on actual cash flow instead of relying solely on collateral or financial statements.

“With digital utilities, we expect to shorten the approval and disbursement time, while expanding access to formal credit for customer groups who have never borrowed from banks before,” said Tran Thi Viet Hung, Acting Director of BIDV Phu Yen Branch.

“Digital transformation is not a destination, but a long-term journey. And on that journey, the bank will always accompany, helping customers access more modern, transparent and sustainable financial products and services,” emphasized the representative of Agribank Phu Yen Branch.

In the 4.0 era, banks' proactive digital transformation and simplification of loan procedures are a positive signal for the entire industry. Not only helping to improve operational efficiency and save costs, these digital utilities also bring a more professional and convenient service experience to people and businesses.

Viet An

Source: https://baodaklak.vn/kinh-te/202508/mo-canh-cua-tai-chinh-thoi-cong-nghe-2fa0474/

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

Comment (0)