On the morning of June 9, the National Assembly Standing Committee gave opinions on explaining, accepting and revising the draft Law on Digital Technology Industry.

Supplementing preferential regulations for some special investment projects

Regarding information on tax laws, finance and investment incentives for a number of large-scale projects, Chairman of the Committee for Science , Technology and Environment Le Quang Huy said that, taking into account the opinions of National Assembly deputies, the draft Law has been reviewed, transferring the provisions related to corporate income tax incentives and investment incentives in the draft Law on Digital Technology Industry to the provisions in the draft Law on Corporate Income Tax, the draft Law amending and supplementing 7 laws.

The Draft Law on Digital Technology Industry only provides references to ensure the consistency of the legal system.

Chairman of the Committee for Science, Technology and Environment Le Quang Huy. (Photo: DUY LINH)

Regarding the provisions related to the Law on Personal Income Tax, the draft Law currently stipulates a policy of exemption from personal income tax for high-quality digital technology industry human resources. These are policies aimed at attracting high-quality human resources and talents to institutionalize Resolution No. 57-NQ/TW.

As planned, the draft Law on Personal Income Tax (amended) will be submitted to the 15th National Assembly for consideration, comments and approval at the 10th Session. In order to ensure timely institutionalization of policies to attract talents in the fields of the digital technology industry according to the Party and State's policies; at the same time, the Government has no other opinions on the content of the provisions on personal income tax incentives in the draft Law on Digital Technology Industry, the Standing Committee of the Committee agrees with the drafting agency to keep this provision in Article 19 and Clause 6, Article 50 of the draft Law.

Regarding the supplementary regulations on incentives for some special investment projects, the Standing Committee of the Science, Technology and Environment Committee found that Resolution No. 29-NQ/TW and Resolution No. 57-NQ/TW identified the digital technology industry as a foundation industry, requiring specific and outstanding incentive mechanisms in terms of tax, land, etc. to promote development; especially mechanisms to attract large-scale strategic digital technology projects such as semiconductors and artificial intelligence.

Therefore, in order to institutionalize the Party's policy and absorb the Government's opinions, on the basis of agreement with the Standing Committee of the Economic and Financial Committee, the draft Law on Digital Technology Industry has added this provision and stated it as in Clause 3, Article 29.

Specifically, projects to produce key digital technology products, projects to research and develop, design, manufacture, package, and test semiconductor chip products, projects to build artificial intelligence data centers with large investment scales are eligible for preferential projects and special investment support according to the provisions of the Investment Law, and are entitled to incentives according to the provisions of the law on corporate income tax, land, and other relevant laws.

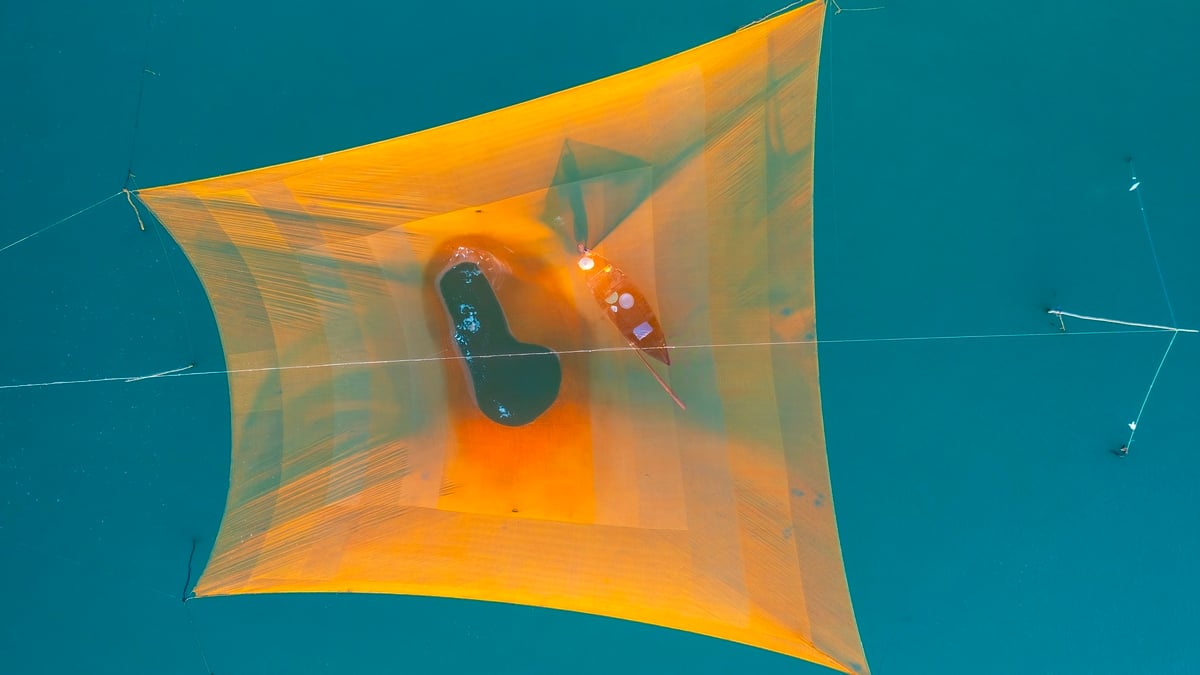

View of the meeting. (Photo: DUY LINH)

Strengthening risk management in the field of digital assets and artificial intelligence

Regarding the mechanism for monitoring and controlling artificial intelligence, the agency in charge of the review agreed to maintain the provisions on risk control throughout the life cycle of the artificial intelligence system (Article 42 of the draft); requirements on monitoring and inspection of high-risk, high-impact artificial intelligence systems (Clause 3, Article 46); at the same time, assign the Government to specify details for implementing this content.

Regarding training human resources to deploy and use artificial intelligence systems and labeling artificial intelligence systems, taking into account the opinions of National Assembly deputies, the draft Law has been reviewed and revised to promote human resource training in digital technology, as shown in Clause 2, Article 18, Article 43; and has added regulations on identification marks for artificial intelligence systems in Article 45.

Regarding digital assets, the draft Law defines digital assets as assets under current civil law. Property rights, ownership, transactions, security, liability, dispute resolution, risk management, etc. are regulated under the provisions of criminal law, anti-corruption and anti-money laundering laws, and relevant laws.

In order to ensure the feasibility, flexibility and stability of the legal system, the draft Law only stipulates principles on this issue and assigns the Government to make specific regulations in accordance with development practices.

Incorporating the opinions of National Assembly deputies, the draft Law has more specifically stipulated some core contents in state management of digital assets in Clause 1, Article 49 and assigned the Government to specify in detail the authority and management of digital assets in specialized fields to suit practical conditions.

Speaking at the meeting, National Assembly Chairman Tran Thanh Man emphasized that the Law on Digital Technology Industry will serve the implementation of Resolution 57 and Resolution 68 of the Politburo..., these are extremely urgent contents.

National Assembly Chairman Tran Thanh Man. (Photo: DUY LINH)

The National Assembly Chairman said that the provisions on artificial intelligence in the draft Law have been revised to encourage development, taking people as the center; at the same time, adding risk management criteria and clear identification marks for AI products.

The National Assembly Chairman suggested that the drafting agency and the verification agency need to continue reviewing and perfecting regulations to ensure consistency and non-overlap with current laws, creating a favorable legal corridor for digital technology enterprises to develop.

"It is necessary to clarify incentive mechanisms for strategic industries such as semiconductors and artificial intelligence. At the same time, it is necessary to ensure feasibility in implementing support policies, with shortcuts," the National Assembly Chairman emphasized.

The National Assembly Chairman also noted the need to strengthen risk management, especially in the fields of digital assets and artificial intelligence, to both encourage and protect the interests of people and businesses.

As expected, the draft Law on Digital Technology Industry will take effect from January 1, 2026. National Assembly Chairman Tran Thanh Man said that if there is careful preparation, when it is passed, there will be a decree and guiding circular, the Law should take effect soon to synchronize with the Law on Science, Technology and Innovation (considered and approved at the 9th Session).

Source: https://nhandan.vn/mien-thue-thu-nhap-voi-nhan-luc-cong-nghiep-cong-nghe-so-chat-luong-cao-post885530.html

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

Comment (0)