US imposes import tax on gold bars, gold futures hit new historical peak

Gold futures in the US hit a new record today, following news that the US government will impose high tariffs on imported 1kg gold bars. Meanwhile, spot gold prices, although slightly adjusted, are still on track for a second consecutive weekly gain amid trade uncertainty and expectations of interest rate cuts.

Gold price soars, difference with spot price exceeds $100

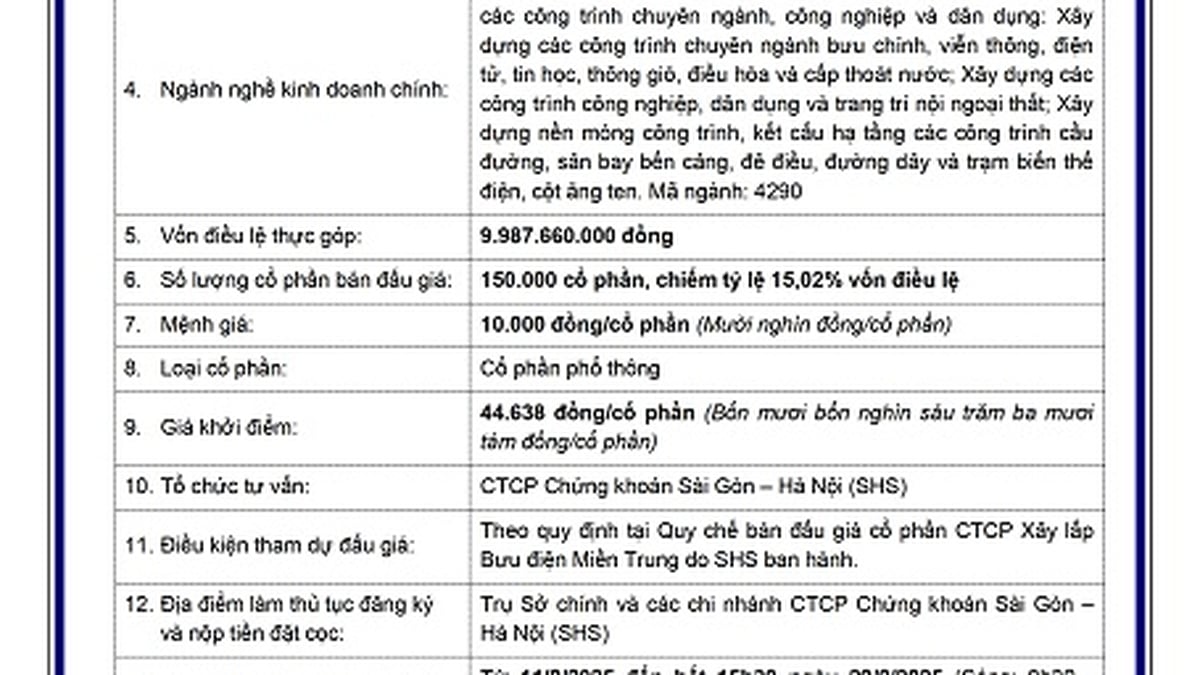

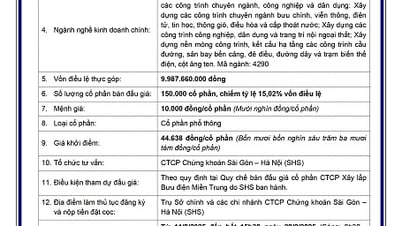

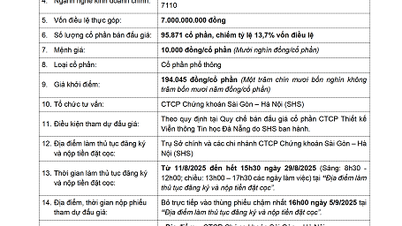

Specifically, spot gold prices fell slightly by 0.3% to $3,386.30/ounce, after hitting their highest level since July 23. Overall for the week, prices increased by about 0.7%.

Meanwhile, US gold futures for December delivery rose sharply by 0.9% to $3,484.10 an ounce, having previously hit a record high of $3,534.10 an ounce.

The gap between New York gold futures and spot gold prices widened to more than $100 an ounce after the Financial Times reported on new tariffs from the US.

1kg and 100oz gold bars subject to new tariffs from the US

According to a letter dated July 31 from the US Customs and Border Protection (CBP), 1kg and 100-ounce gold bars will be classified under a new customs code, subject to higher tariffs.

This is seen as a move that could have a major impact on Switzerland, the world's largest gold refining center, which produces the majority of global gold bullion.

“Imposing a tax on gold bars will disrupt the payment operations of major banks, and that is reflected in today's market prices,” said Brian Lan, CEO of GoldSilver Central in Singapore.

Starting August 8, US President Donald Trump's policy of increasing import tariffs took effect, affecting goods from dozens of countries, including Switzerland, Brazil and India, forcing major trading partners to seek to renegotiate trade conditions.

In this context, gold continues to play its role as a safe haven asset, preferred by investors in the face of political and financial instability.

Weaker U.S. jobs data last week also boosted expectations that the Federal Reserve will cut interest rates. According to CME Group's FedWatch tool, the probability of the Fed cutting interest rates by 25 basis points next month is now at 91%.

With the latest developments in trade policy and unexpected tariff moves from the US, gold prices are entering a period of strong volatility. If US interest rates do indeed drop next month, combined with global trade pressures, gold futures are likely to continue to set new highs in the coming time.

Source: https://baonghean.vn/gia-vang-tang-pha-ky-luc-sau-tin-my-ap-thue-nhap-khau-thoi-vang-1kg-10304048.html

Comment (0)