Gold price today in the world decreased sharply

Gold price today plummeted

Early on July 26 (Vietnam time), the spot gold price on the international market closed the week at 3,337 USD/ounce, down 27 USD compared to the peak of 3,360 USD/ounce in last night's trading session.

Gold futures for August delivery also fell, down $32 to $3,340 an ounce.

The decline in gold prices was due to profit-taking pressure from short-term traders, while market sentiment fluctuated between fear and risk-on. US stock indexes rose sharply, reflecting investors' optimism, reducing the attractiveness of gold prices today.

Hot spot is US monetary policy

In a notable development, President Donald Trump visited the US Federal Reserve (FED) on July 25. He and Fed Chairman Jerome Powell had a heated argument over the cost of renovating the agency's headquarters.

Previously, in a speech on monetary policy, Mr. Donald Trump emphasized that he only wanted to see one thing happen, very simply, interest rates must be reduced. This information raised market expectations about the possibility of loosening monetary policy in the future, but currently, the stronger USD has put great pressure on gold prices.

Meanwhile, in Asia, China's budget deficit in the first half of 2025 has increased, exports to the US have decreased due to tariff policies. The unstable economic situation in China is considered a factor contributing to the volatility of global gold prices.

External markets and prospects

Overseas markets also had a significant impact on gold prices. The US dollar index rose, putting pressure on dollar-denominated assets such as gold. Crude oil prices rose slightly, trading around $66.25 a barrel, while the yield on the 10-year US Treasury bond reached 4.4%, reflecting expectations of inflation and tighter monetary policy.

With a strong US dollar and continued profit-taking, gold prices may remain under pressure in the short term. However, global economic uncertainties, including China’s budget deficit, may support gold as a safe-haven asset in the long term. Investors should closely monitor the Fed’s moves and global economic data to make appropriate decisions.

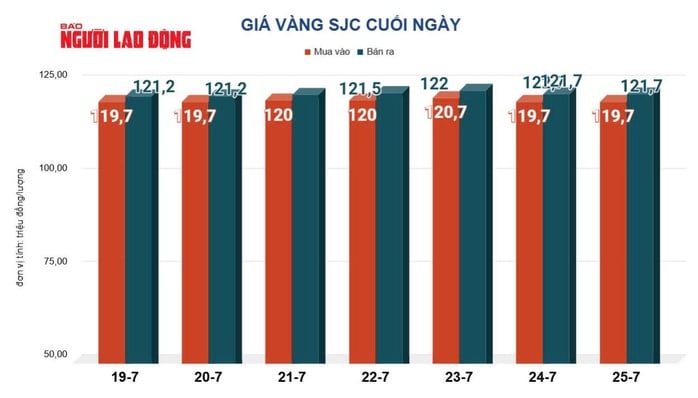

In Vietnam, at the end of July 25, SJC gold was sold at 121.7 million VND/tael, while ring gold was at 117.5 million VND/tael.

Source: https://nld.com.vn/gia-vang-hom-nay-26-7-chua-dung-da-lao-doc-196250726040111869.htm

Comment (0)