In recent years, the European electric car market, once a "promised land" for Tesla, has witnessed fierce competition. Declining car sales, especially in the UK and Germany, are a worrying sign for Elon Musk's empire. In July, figures from the Society of Motor Manufacturers and Traders (SMMT) showed that Tesla car sales there had fallen by nearly 60% compared to the same period last year. In Germany, the figure was also down by more than 55%.

When the core market is in turmoil, a leader of Elon Musk's caliber must find ways to expand and diversify revenue sources. And the surprising answer lies in the energy market. A seemingly unrelated field is a potential new playground for Tesla.

From electric vehicle "boss" to new "player" in the electricity market

The information was published on the website of Ofgem, the UK energy regulator, and has caused a stir in this market. Tesla Energy Ventures, a subsidiary of Tesla, has officially applied for a license to become an electricity supplier to households and businesses in the UK.

If approved, the move would open a new chapter for Tesla’s ambitions in the country, beyond simply selling cars or batteries. Analysts say that with the application filed and a team already recruited, Tesla’s entry into the UK energy market is only a matter of time, possibly in the coming months.

This isn’t Tesla’s first foray into this space. In the US, the company has been operating an electricity service called Tesla Electric in Texas since 2022. This model allows customers to optimize their energy consumption, charge their electric vehicles at low prices during off-peak hours, and even earn money by selling excess electricity from their home batteries back to the grid.

Tesla's replication of this model in the UK shows a clear strategy: not just selling products, but building a complete energy ecosystem, tightly integrated from electric vehicles, storage batteries, solar power to electricity supply services.

Elon Musk's Tesla Electric promises to help households save on electricity bills (Photo: Shutterstock).

Why is Tesla confident in "surprising" the market?

The UK energy market is a fiercely competitive one, dominated by big names like Octopus and British Gas. So what makes Tesla believe it can swoop in and make a difference?

Tesla is not a newbie to the industry. They already have a huge energy ecosystem in the UK:

Powerwall batteries: Tens of thousands of Powerwall storage batteries have been installed in UK homes, which can be charged using solar power or during off-peak hours.

Electric cars and chargers: Hundreds of thousands of Teslas are on the road, along with home charging systems.

Autobidder Software: This technology has been used by Tesla to manage large-scale battery systems, buying cheap electricity during off-peak hours and reselling it when prices are high.

The Virtual Power Plant (VPP) model is Tesla’s secret weapon. Instead of building a traditional, expensive power plant, Tesla can connect thousands of Powerwalls and electric vehicle batteries together through software. This network acts as a distributed power plant, capable of storing electricity when it is abundant (from solar or wind) and releasing it back to the grid when demand is high.

This VPP model not only helps Tesla maximize profits, but also directly benefits customers. Users can significantly reduce their electricity bills, while also receiving money when Tesla uses electricity from their batteries.

Additionally, Tesla has a large and extremely loyal customer base. Integrating its electricity service into its existing ecosystem would be a huge competitive advantage. Tesla customers can charge their cars, power their homes, and manage it all through a single app, an experience that traditional providers have a hard time providing.

Tesla's game isn't just about selling electricity.

Tesla’s move demonstrates a completely different business mindset. They’re not just selling electricity, they’re selling a complete energy solution. While traditional providers focus on distributing electricity, Tesla is going deep into optimizing how customers use, store, and even generate energy.

This “double growth” strategy is ambitious. As the electric vehicle market slows, the energy business could become a new growth driver, creating a virtuous cycle: customers buy Teslas, then Powerwalls, and finally Tesla electric services. Each product complements the other, creating a closed and extremely robust ecosystem.

Musk’s path to acquisition, however, is not without its obstacles. Ironically, the biggest risk comes from himself. His image as a tech genius is being overshadowed by a public figure with unpredictable statements and complicated political connections. His public support for controversial figures has turned off a significant portion of consumers, and that hatred could extend beyond his cars to his electricity bills.

In addition, the UK regulatory apparatus, shaken by the 2021 energy crisis that saw a string of suppliers go bust, has become more cautious than ever. Tesla’s licensing process can be lengthy and fraught with requirements. Another practical drawback is that Tesla currently only applies for electricity, while most British households also use gas, forcing them to maintain two separate contracts – a significant inconvenience.

Tesla isn't just selling electricity, it's selling a complete energy solution (Photo: Shutterstock).

Tesla's move to the UK is more than just a business move. It's a strategic move that represents Elon Musk's long-term vision for a sustainable future where energy is managed intelligently and efficiently.

When a tech giant suddenly invades a traditional industry, big changes are inevitable. Soon, the UK energy market will no longer be a game for the traditional giants. The question now is not whether Tesla will succeed, but how will its long-time rivals react to the shock? And is this the beginning of a similar wave globally?

Source: https://dantri.com.vn/kinh-doanh/elon-musk-danh-up-thi-truong-nang-luong-anh-tesla-tu-ban-xe-sang-ban-dien-20250813002759255.htm

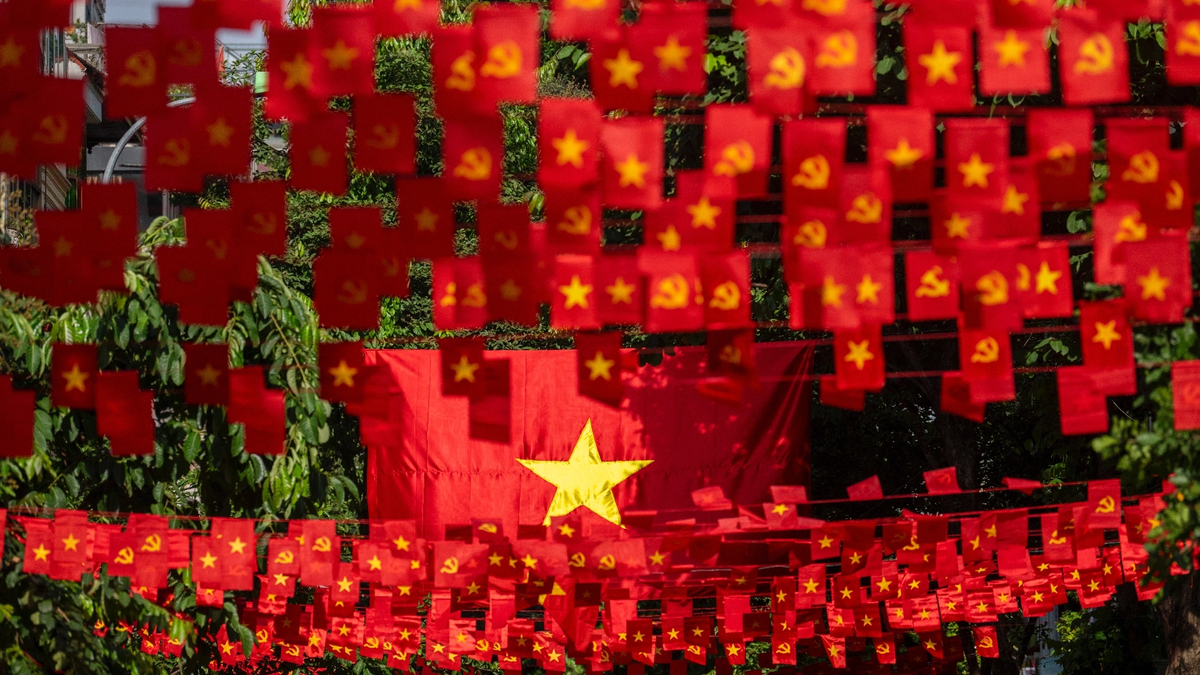

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

![[Photo] Prime Minister Pham Minh Chinh chairs the meeting of the Government Party Committee Standing Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/8e94aa3d26424d1ab1528c3e4bbacc45)

Comment (0)