VN-Index heading towards 1,400 point zone

Last week, the stock market received initial information about the Vietnam - US tariff negotiations with relatively positive sentiment.

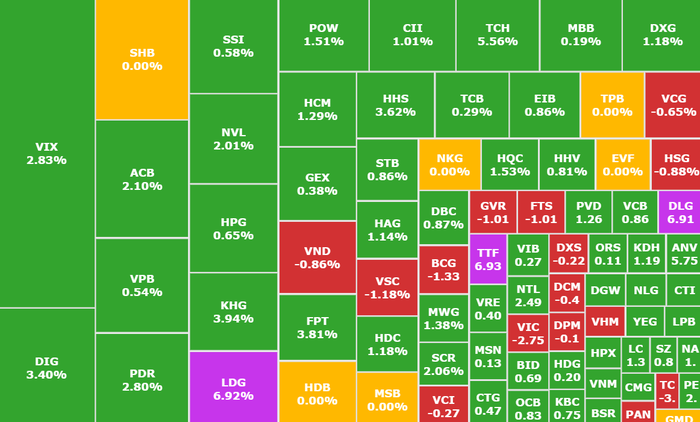

Closing the trading week of June 30 - July 4, the VN-Index reached 1,386.97 points, up 15.53 points (equivalent to 1.13%) compared to the previous weekend.

Last week's highlight was the group of securities stocks, which rebounded after a long period of accumulation, followed by the real estate group.

Meanwhile, industrial park real estate and textile stocks... were the "unhappy" focus when they reversed and decreased before the initial information about tariffs.

Market breadth is quite positive, maintaining recovery rotation. Outstanding in stocks of seaport, securities, agriculture , information technology, insurance, banking... groups. While under adjustment pressure in textile and garment, industrial park groups...

The highest matched liquidity in the past month and 6.4% higher than the 20-week average. Accumulated to the end of the trading session, the average weekly liquidity on the HSX floor reached 948 million shares (+13.84%), equivalent to a value of VND 23,320 billion (+8.96%).

Foreign investors also became a "bright spot" when they had a record net buying week in the past 2 years with a value of VND5,167 billion last week. The focus of net buying belonged to SSI (SSI Securities, HOSE) with VND667 billion, MWG (Mobile World, HOSE) with VND529 billion andFPT (FPT, HOSE) with VND515 billion.

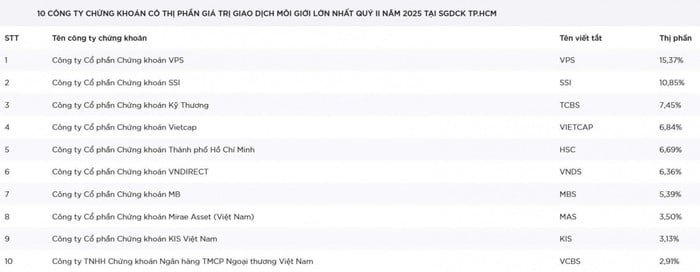

Top 10 HoSE brokerage market share in Q2/2025

Ho Chi Minh City Stock Exchange (HOSE) has just announced information on the brokerage transaction value of the 10 securities companies with the largest market share in the second quarter of 2025.

Leading the way is VPS with 15.37% market share, maintaining its position since Q1/2021. However, this figure has decreased by 1.57 percentage points compared to Q1/2025. After peaking at 20.29% in Q1/2024, VPS has continuously lost market share to competitors.

Top 10 Securities Companies with the Largest Brokerage Market Share in the Second Quarter of 2025

Source: HOSE

Compared to the first quarter of 2025, the rankings of the next 8 positions remained unchanged. SSI continued to rank second with 10.85% (+0.92%). TCBS ranked third but has slowed down its growth, with a market share of 7.45% (-0.04%).

Vietcap and HSC maintained their fourth and fifth positions, with market share increasing by about 0.1% in the first quarter of 2025. Notably, VNDirect recorded a strong increase of 6.36% (+1.1%).

Ranked seventh is MBS with 5.39%, up 0.2%. Meanwhile, MAS and KIS, although maintaining their rankings, saw their market shares fall to 3.5% and 3.13%, respectively. In 10th place, VCBS pushed FPTS out of the rankings with a market share of 2.91%.

VN-Index is expected to increase up 1,660 points with key industries

Vietnam's stock market continues to record positive developments, expected to set a new record in 2025. This increase occurred in the context of cash flow strongly pulling the VN30 pillar group before rotating to the securities, oil and gas, retail, mineral and export groups.

According to Vietcombank Securities (VCBS), VN-Index could reach 1,555 points in the base scenario.

In the positive scenario, if macro and policy factors are favorable, including market upgrade, the index could break out to the 1,660 point zone.

At the same time, market liquidity is also expected to surge. If the VN-Index approaches the 1,555-point mark, the average trading value per session could reach VND26,000 billion.

In addition, foreign investors are also showing many positive signs for the market. Specifically, foreign investors have had 3 consecutive net buying sessions, totaling nearly 3,400 billion VND, focusing on banking and securities stocks. This is considered a positive signal when foreign investors return after a long period of net selling.

Therefore, VCBS believes that FTSE's ability to upgrade Vietnam to an emerging market in the third quarter will be a big boost for international capital flows. It is estimated that the market can attract 1.3-1.5 billion USD in net capital, of which the ETF simulating the FTSE Emerging Markets index alone can allocate about 950 million USD to Vietnam, due to its portfolio weight of nearly 1%.

During this time, VCBS recommends that investors continue to prioritize large-cap stocks, especially leading private enterprises that are likely to benefit from policy reforms. Small and mid-cap stocks will become attractive again if profits improve and cash flows spread more strongly.

Industry groups to consider:

Banking, real estate: Benefit from low interest rates, stable housing demand and legal obstacles.

Securities: Expectations of a comprehensive recovery in brokerage, margin, and investment banking, especially in the context of IPO activities showing signs of recovery.

Consumption – food: Recovering with purchasing power, livestock groups benefit from high pork prices.

Electricity – energy: Output is forecast to increase by 6% over the same period; additional momentum from Power Plan VIII and a 40% probability of La Nina returning.

Comments and recommendations

Grandfather Tran Nam Quang Trung, Head of Investment Consulting, Mirae Asset Securities (Vietnam) assessed that the market had an impressive trading week with the index continuously conquering new milestones this year.

In terms of trading data, although there were slight fluctuations in the session on Thursday when the US announced the preliminary reciprocal tax rate for Vietnam, afterwards, with strong cash flow and strong foreign net buying, the market continued to increase.

Next week, the market will begin to receive preliminary information on the business results (KQKD) of enterprises in the second quarter of 2025. This is expected to be the next driving force for the market in the coming time when many industry groups will have positive business results in the first half of the year, especially in large industries such as Banking, Real Estate or Consumer Retail.

VN-Index is expected to continue to conquer new highs this year.

On the other hand, open market operations last weekend saw a slight net withdrawal after the State Bank pumped in quite a lot last week to compensate for liquidity at the end of the quarter. If net withdrawals become stronger next week, pressure from macro factors such as exchange rates, along with sensitive information such as the market's margin balance or business results that do not meet expectations, the market may have a short-term correction.

Overall, the market has increased quite strongly by nearly 300 points since the beginning of April. Although there are a few events to note, the VN-Index is expected to continue to conquer new highs this year with signals from positive cash flow, foreign capital returning to strong net buying and positive information about business results in the second quarter of 2025.

Asean Securities The market index will test the resistance zone of 1,390 - 1,400 points. However, volatility will also increase gradually in the context of momentum indicators moving in the overbought zone or approaching the overbought zone.

Short-term investors should prioritize holding current positions, especially stocks that are moving in an uptrend and have a supporting story (for example, Q2/2025 business results are forecasted to be positive), and are in sectors that are less affected by tariffs; new purchases should only be considered during the next market corrections and potential stocks.

Phu Hung Securities assume that, The market situation may continue to fluctuate within a narrow range to accumulate more, with the goal of breaking through the 1,400 point mark. When surpassing this threshold, the index may open a range of fluctuations towards the 1,450 point area. The general strategy is to increase the proportion of stocks, possibly taking advantage of correction or fluctuations signals in the coming sessions. Priority industry groups include: Banking, Technology, Real Estate, Retail and Securities.

Dividend schedule this week

According to statistics, there are 19 enterprises that have decided to pay dividends for the week of July 7 - July 11, of which 14 enterprises pay in cash, 1 enterprise pays in shares, 3 enterprises give bonus shares and 1 enterprise issues additional shares.

The highest rate is 100%, the lowest is 2%.

1 company pays by stock:

Viet Duc Steel Pipe JSC VG PIPE (VGS, HNX), ex-right trading date is July 7, rate 10%.

3 companies award shares:

Vinacontrol Group Corporation (VNC, HNX), ex-right trading date is July 9, rate 100%.

Son Ha Energy Development JSC (SHE, HNX), ex-right trading date is July 9, rate 30%.

Nam A Commercial Joint Stock Bank (NAB, HOSE), ex-right trading date is July 10, rate 25%.

1 additional issuer:

North Asia Commercial Joint Stock Bank (BAB, HNX), ex-right trading date is July 9, rate 10%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| TAL | UPCOM | 7/7 | 30/7 | 15% |

| MCH | UPCOM | 7/7 | 16/7 | 25% |

| S55 | HNX | 7/7 | 31/7 | 10% |

| DXP | HNX | 7/7 | 7/22 | 5% |

| CQT | UPCOM | 7/7 | 1/8 | 3.3% |

| MA1 | UPCOM | 7/7 | 7/21 | 15% |

| SGH | HNX | 8/7 | 7/21 | 7% |

| GMD | HOSE | 9/7 | 17/7 | 20% |

| ADP | HOSE | 9/7 | 6/8 | 7% |

| VNC | HNX | 9/7 | 1/8 | 2% |

| HEP | UPCOM | 10/7 | 7/28 | 12% |

| TUG | UPCOM | 10/7 | 7/22 | 6% |

| EMG | UPCOM | 10/7 | 7/21 | 15% |

| VRG | UPCOM | 10/7 | 24/7 | 35% |

| PJT | HOSE | 10/7 | 7/25 | 6% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-7-7-11-7-vn-index-tang-tich-cuc-don-cho-kqKD-quy-2-2025-20250707084843843.htm

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)