VN-Index decreased for 2 consecutive weeks

Pressure Strong selling pressure appeared at the beginning of the week, causing the VN-Index to drop nearly 20 points, the market maintained a state of moving around the 1,315 point area with low liquidity.

By the end of the week, the heat from the conflict in the Middle East affected the Vietnamese stock market, causing most stocks to sink into the red, down 19 points. However, strong demand suddenly entered the market, pulling the representative index of the HOSE floor up sharply by 11 points.

VN-Index closed the trading week at 1,315.49 points, down 14.4 points (-1.08%) compared to the previous week.

Liquidity decreased with the weekly average at HOSE being VND 19,581 billion (-13.6%).

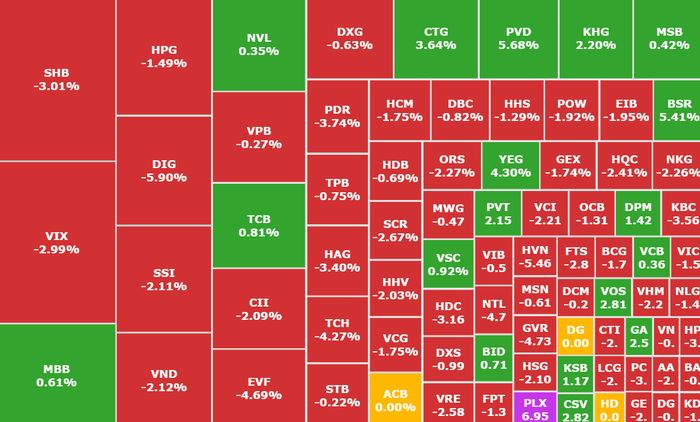

Vietnam's stock market has fallen for two consecutive weeks with strong differentiation between industry groups (Screenshot: SSI iBoard)

The market opened in red with 12/21 industry groups closing down during the week, of which: Real estate decreased the most with 8.83%, followed by industrial park real estate down 3.8% and electricity down 2.8%. On the other hand, retail increased by 4.59%, oil and gas increased by 3.29% and fertilizer increased by 3.04%, these were the three industry groups with the strongest increase in points during the week.

In the foreign block, last week, this group net bought 442.6 million units, equivalent to a value of VND 11,016.8 billion (down 3.93% in volume but up 7.33% in value compared to the previous week). In contrast, the selling force was 411.4 million units, worth about VND 10,658 billion (equivalent to the previous week in volume, down 13.76% in value compared to the same period last week).

Novaland convenes extraordinary general meeting of shareholders

No Va Real Estate Investment Group Corporation – Novaland (NVL, HOSE) has just announced that it will hold an extraordinary General Meeting of Shareholders (GMS) on August 7. The last registration date to finalize the list of shareholders attending is July 4. The meeting will present a plan to issue shares to convert debt and some other issues (if any).

Previously, Novaland proposed to consult shareholders on the plan to issue additional shares to convert debt, in order to fulfill the obligation to compensate major shareholders. The company affirmed that it will be transparent in developing the plan and ensure fairness for all investors.

NVL stock price movement from the beginning of the year until now (Screenshot: SSI iBoard)

According to the plan, NVL will issue shares to swap debts with some shareholders who have sold collateral to pay off debts on behalf of the company, including loans and bonds. Among these are two major shareholders, NovaGroup and Diamond Properties - both related to Chairman of the Board of Directors Bui Thanh Nhon.

According to Novaland, during the most difficult period, major shareholders have committed to accompanying and supporting the payment of due debts, to ensure the company's continuous operation.

Regarding the shareholder story, recently, 5 shareholders related to Mr. Nhon have registered to sell nearly 19 million NVL shares to restructure their investment portfolio, support debt settlement and serve personal goals. The transaction is expected to take place from May 16 to June 13, by order matching and negotiation. If completed, this group's ownership ratio at Novaland will decrease to 37.4%.

The development and submission of the current share issuance plan stems from the request for debt repayment from major shareholders. Novaland's Board of Directors is committed to being open and transparent during the implementation process, while ensuring fair benefits for all shareholders.

List of stocks providing "safe haven" from Middle East war

In the early morning of June 13, 2025 (Vietnam time), the Middle East continued to shake when Israel suddenly launched a military campaign called "Lion Rising", carrying out a series of airstrikes targeting Iran's key nuclear and military facilities.

The unstable psychology quickly spread to financial markets from the US stock market plummeting to Asian markets also sinking in red. Vietnam was not out of this wave, widespread selling pressure caused the VN-Index to drop nearly 18 points at one point last weekend, falling close to the 1,304 point mark.

According to KB Securities Vietnam (KBSV) , in the short term, the escalation of war in the Middle East will cause a negative psychological shock to the global financial market, leading to adjustments in many types of financial assets. The Vietnamese stock market will also be hard to avoid negative impacts in the initial stage.

In the medium term, KBSV believes that more time is needed to assess the impact on inflation and exchange rates, especially in the context of many other risk factors such as tariffs still present. In particular, oil price movements will play an important role. If Brent oil surpasses the $90/barrel mark, inflationary pressures will become more evident.

However, the lesson from the Russia-Ukraine war that took place in 2022, the initial shock caused the market to drop more than 1% as soon as the event happened, but the market quickly recovered and returned to the peak area before the war broke out.

Therefore, KBSV believes that this could also be an opportunity for investors to observe, grasp, and pay attention to stock groups such as upstream oil and gas and shipping thanks to the ability to directly benefit if tensions between Israel and Iran continue to escalate, because both hotspots are linked to the global oil supply chain and logistics activities.

Comments and recommendations

Mr. Bui Ngoc Trung, Consultant, Mirae Asset Securities (Vietnam) assessed that after a volatile trading session last weekend, the market entering the trading week next week will continue to face unpredictable variables from the escalating geopolitical tensions between Iran and Israel. However, from a long-term perspective, the main trend of the Vietnamese market is still considered to be more positive.

The internal strength of the Vietnamese economy continues to be a solid support with a series of policies to support the economy and reform the country, including: The approval of the merger of provinces and cities, which will create many breakthrough and more effective development drivers in the future; GDP growth is maintained stably around 8% according to the government's target from the beginning of the year, accompanied by a flexible monetary policy to support growth; public investment activities are promoted, promoting the real estate market strongly in recent times;....

VN-Index is forecast to continue to "shake" in the short term.

In addition, in the Vietnamese stock market, the application of Circular 03 and the good operation of the KRX system are gradually helping the market get closer to the opportunity to be upgraded in 2025, which will contribute to attracting more international capital flows estimated at more than 6 billion USD.

In terms of industry groups and stocks, the market is clearly differentiated, creating favorable conditions for business selection strategies in the new period.

The banking group will maintain its leading role, with a target of sustainable and high credit growth in 2025 at 16%. Real estate and construction, despite short-term adjustments, are still potential groups in the medium and long term thanks to the spread of public investment cash flow with a big boost from infrastructure. In particular, the oil and gas and fertilizer groups are likely to benefit in the short term due to rising oil prices and concerns about global supply disruptions due to the impact of Middle East conflicts.

In the short term, investors should optimize portfolio weights, prioritize risk management, and monitor global geopolitical developments. Disbursements should be made in stages at appropriate price levels, focusing on stocks with good fundamentals, stable liquidity, and maintaining a medium-term uptrend with their own prospects. Cash flow will continue to rotate rapidly between industry groups, so the strategy should be flexible, prioritizing stocks with internal support factors, to optimize investment efficiency in June and in the vision to the end of 2025.

BSC Securities commented that the market is showing a tug-of-war sentiment as the index recovers from the short-term bottom of 1,305 points. Investors should trade cautiously during this period, when the market needs more directional candles and liquidity support to confirm the recovery trend.

ASEAN Securities predicts that the VN-Index will continue to fluctuate and struggle in the short term. Investors should consider buying points during corrections and fluctuations. Prioritize stocks that are maintaining a short-term uptrend and belong to supported sectors such as banking, securities, real estate, retail, and public investment.

Dividend schedule this week

According to statistics, there are 27 businesses that have decided to pay dividends in the week of June 16-20, of which 21 businesses pay in cash and 6 businesses pay in shares.

The highest rate is 32%, the lowest is 0.2%.

6 companies pay by stock:

Tien Giang Investment and Construction Joint Stock Company (THG, HOSE) , ex-right trading date is June 17, rate 20%.

Petro Times JSC (PPT, HNX) , ex-right trading date is June 17, rate 8%.

CNT Group Corporation (CNT, UPCoM) , ex-dividend date is June 18, rate 30%.

VIX Securities Corporation (VIX, HOSE) , ex-right trading date is June 18, rate 5%.

PetroVietnam Transportation Corporation (PVT, HOSE) , ex-right trading date is June 19, rate 32%.

Kien Hung JSC (KHS, HNX) , ex-right trading date is June 19, rate 15%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| HMC | HOSE | June 16 | June 27 | 8% |

| CPC | HNX | June 16 | 11/7 | 18% |

| GDT | HOSE | June 16 | June 27 | 10% |

| THG | HOSE | June 17 | 7/23 | 10% |

| VNP | UPCOM | June 17 | 18/7 | 20% |

| SAC | UPCOM | June 17 | 4/7 | 8.8% |

| VOC | UPCOM | June 17 | June 26 | 10% |

| TTN | UPCOM | June 18 | 14/7 | 9% |

| TCW | UPCOM | June 18 | June 30 | 23% |

| CNT | UPCOM | June 18 | 30/7 | 2% |

| HLC | HNX | June 19 | 7/21 | 8% |

| VCS | HNX | 19/7 | June 27 | 20% |

| SDV | UPCOM | June 19 | 10/7 | 30% |

| BWS | UPCOM | June 19 | June 30 | 10% |

| CTT | HNX | June 19 | June 30 | 10% |

| VSI | HOSE | June 19 | June 30 | 7% |

| TVM | UPCOM | June 19 | 15/7 | 5% |

| SFG | HOSE | June 19 | 18/7 | 5% |

| CDH | UPCOM | June 19 | June 27 | 5% |

| CSV | HOSE | June 19 | 10/17 | 10% |

| DDV | UPCOM | June 20 | 18/7 | 9% |

| CDP | UPCOM | June 20 | 11/7 | 9% |

| VTE | UPCOM | June 20 | June 30 | 0.2% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-16-20-6-co-phieu-tiem-nang-truoc-xung-dot-trung-dong-20250616074852629.htm

Comment (0)