As reported by Nguoi Lao Dong Newspaper , the Ministry of Finance is seeking opinions on the draft of the new Personal Income Tax Law, which proposes to shorten the progressive tax rate from 7 to 5 levels. However, what experts and the public are concerned about is that the taxable income threshold, despite the adjustment, is still outdated and not suitable for family deductions and the current economic context.

How does the complete removal of the 35% tax rate affect the personal income tax threshold?

Professor Hoang Van Cuong, Deputy of the 15th National Assembly , Vice Chairman of the State Council of Professors, emphasized that reducing the number of tax rates in the tax schedule is very necessary, contributing to simplifying the tax system. However, in order to have a tax policy that is suitable for reality and in line with the goals of personal income tax, the drafting agency needs to carefully consider and calculate the income gap between the rates, as well as the tax rate applied to each rate.

Experts all recommend increasing the family deduction level as well as the tax threshold to suit current economic life. Photo: HOANG TRIEU

According to Professor and Doctor Hoang Van Cuong, in this new version of the Law on Personal Income Tax, a comprehensive approach is needed, not just to reduce the number of levels but to consider many other factors synchronously. The goal is for the tax schedule to truly reflect the tax paying ability of the people, encourage labor, and especially attract high-quality human resources. Mr. Cuong said that when building tax levels and tax rates for each level, it is necessary to consider the level comprehensively, fully calculate the costs of ensuring people's living standards, and then propose an appropriate tax rate.

Lawyer Nguyen Duc Nghia, a member of the Ho Chi Minh City Tax Consultants and Agents Association, commented that after more than a decade of being "frozen", the current personal income tax policy is no longer suitable for people's real lives.

He cited the last significant adjustment to the family deduction in 2013, when the personal deduction increased from VND4 million to VND9 million per month, then to VND11 million in 2020. Since then, while workers' living standards have increased rapidly, the tax schedule has not changed accordingly.

According to him, the actual cost of basic needs such as food, housing, healthcare, and education has increased by at least 50% compared to 2020, while the consumer price index (CPI) has only increased by about 21%. Therefore, if the draft only adjusts the highest tax bracket from VND80 million to VND100 million, it is too low and does not accurately reflect the current actual spending pressure.

From this analysis, Mr. Nghia proposed to raise the highest tax threshold (applying a tax rate of 35%) to about 120 million VND/month to match the inflation rate that has occurred over the past 10 years. At the same time, he recommended to synchronously adjust the taxable income thresholds from level 2 to level 5, with an increase equivalent to 40% compared to the present, to ensure fairness in tax calculation according to the progressive principle.

Lawyer Tran Xoa, Director of Minh Dang Quang Law Firm, emphasized that the current tax schedule is too dense, with 7 levels and the distance between the levels is too close together, making it easy for taxpayers to "jump up a level" even though their income does not increase significantly. Reducing it to 5 levels as in the draft is a positive step but according to him, it is still not enough.

He proposed to reduce the tax rate to 4 and completely eliminate the 35% tax rate, because this is too high and puts a lot of pressure on salaried workers. Specifically, level 1 applies to income from the starting level up to 20 million VND/month with a tax rate of 5%; level 2 from 20 - 40 million VND is 10%; level 3 from 40 - 80 million VND is 20%; and level 4 over 80 million VND is 30%. According to him, this tax schedule is simple, easy to calculate, helping taxpayers understand and have a more positive mentality.

If combined with shortening the tax bracket and raising the tax threshold, the policy will both support workers and ensure a stable source of budget revenue. "Reducing personal income tax is also one of the indirect solutions to promote the birth promotion policy. If people have more surplus income, they will be more proactive in their spending plans, stabilize their families and have children," said lawyer Tran Xoa.

Unreasonable deduction level

Meanwhile, Dr. Do Thien Anh Tuan, lecturer at the Fulbright School of Public Policy and Management, also said that the increase in family deductions is not enough to create a clear impact. He illustrated that if a person has an income of 15 million VND/month, he currently only has to pay 200,000 VND in taxes; when the deduction is increased to 15.5 million VND, this person will no longer have to pay taxes but will only be able to reduce exactly 200,000 VND.

Meanwhile, to ensure fairness and keep up with inflation, the highest taxable income must now increase to more than 170 million VND/month instead of 80 million as it is now. According to him, this level is still low compared to many countries in the region such as China, Thailand, Indonesia, Malaysia, which are also applying a tax rate of 35% but their income threshold is very high, calculated from 300 million VND to more than 1 billion VND per month.

Sharing the same view, lawyer Tran Xoa commented that the Ministry of Finance's use of CPI as a basis for adjusting the personal income tax threshold is in accordance with current legal regulations but is not really suitable for the current context of workers' lives. He analyzed that CPI is calculated based on the average price of 752 items, mainly for macroeconomic management, so it does not accurately reflect people's essential spending.

Meanwhile, workers often only use a small amount of basic goods such as food, necessities, healthcare, education, etc., which have a much higher price increase than the CPI. Therefore, although the National Assembly has stipulated that the CPI is the basis for adjusting the tax threshold, according to him, this approach is becoming outdated due to the pressure of increasing living costs.

Lawyer Xoa cited the context of the promulgation of the Personal Income Tax Law in 2007, when the CPI increased by more than 10% per year, reaching 20% in just 2 years. Today, although the CPI increases more slowly thanks to good inflation control, people's actual expenses have escalated sharply. Therefore, the Ministry of Finance's proposal to increase the deduction from 11 million VND to 13.3 million VND/month is too low, and the level of 15.5 million VND, although closer to reality (because it is based on GDP), is still not enough to meet the minimum living standard and lacks a clear legal basis.

From that reality, he proposed that the reasonable deduction level should be adjusted to 18 - 20 million VND/month, applied stably in the period of 2026 - 2031 to help taxpayers not only have enough to live on but also have the ability to be financially proactive in the long term. According to him, the Ministry of Finance's concerns about the risk of budget loss when raising the tax threshold are unfounded. Reality has proven the opposite, that in 2009, 2013 and 2020, when the family deduction levels were adjusted to increase, budget revenue not only did not decrease but also grew steadily every year.

Dr. Nguyen Quoc Viet, University of Economics (Vietnam National University, Hanoi), also said that although average income has increased, young families and middle-class households are still under a lot of pressure because taxed income does not reflect the true cost of living. According to him, the family deduction mechanism should not be based solely on the CPI, because this index does not fully reflect the increase in essential costs such as housing, healthcare, and education, which have increased sharply in recent years.

According to Dr. Viet, the proposal to adjust when the CPI fluctuates by 20% is too slow, this level should be reduced to about 10% to promptly reflect actual fluctuations. In addition, Vietnam can learn from countries in the region by adding large expenses, such as home loans, house rent, investment for basic living expenses... into the deduction mechanism to support the right subjects, especially young households with high spending.

Regarding the progressive tax schedule, he said that the current 7 levels with tax rates too close together are causing a mentality of making many people suffer. This reduces the motivation to save and reinvest, especially for young workers. Therefore, the amendment of the Personal Income Tax Law needs to be more comprehensive, aiming at real fairness, creating motivation and supporting the right subjects.

Focus on e-commerce tax

From the perspective of budget collection, lawyer Nguyen Duc Nghia further noted that in the context of the state needing to mobilize many resources for public investment, the focus on reforming and expanding the tax base should be prioritized on areas with great potential, such as e-commerce. This is a sector with an increasingly large transaction scale, is developing rapidly but still has a lot of room to strengthen management and exploit more effectively than continuing to increase the burden on workers with fixed incomes.

Reduce pressure on taxpayers

In the process of providing comments on the revision of the progressive tax schedule, the Thai Nguyen Provincial Tax Department (formerly) proposed to reduce the tax rates for the first three levels, in order to reduce the financial pressure on low-income taxpayers and help them improve their quality of life. Specifically, this agency proposed to reduce the tax rate for level 1 by half, from 5% to 2.5%; level 2 from 10% to 5%; level 3 from 15% to 10%.

Similarly, the People's Committee of Ninh Thuan province (old) also proposed adjusting the tax gap between levels to avoid sudden "tax jumps" when income increases slightly.

Source: https://nld.com.vn/can-xem-xet-toan-dien-nguong-chiu-thue-196250723205604327.htm

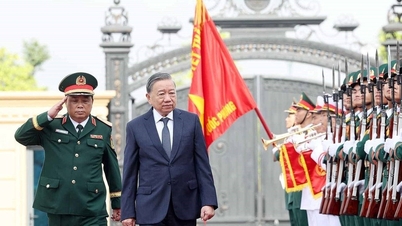

![[Photo] General Secretary To Lam attends the 80th Anniversary of the General Department of Defense Industry](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/fb8fd98417bb4ec5962de4f7fbfe0f6a)

![[Photo] President Luong Cuong attends the opening ceremony of the new school year at the National Defense Academy](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/15/c65f03c8c2984e60bd84e6e01affa8a0)

Comment (0)