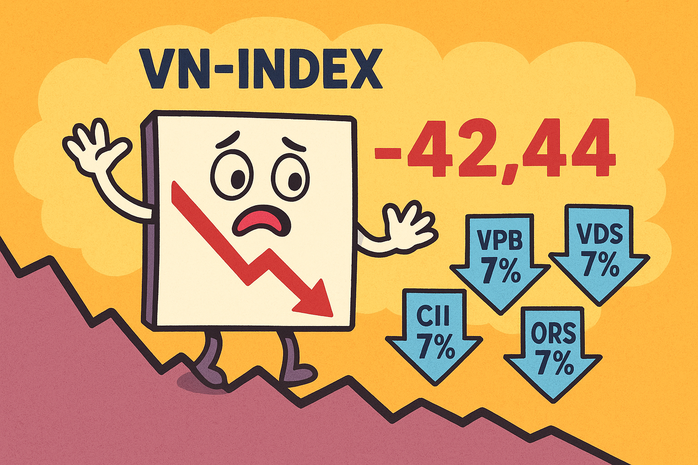

VN-Index drops sharply

The Vietnamese stock market on September 8 continued to record a sharp decline as selling pressure spread across the market.

The VN-Index closed at 1,624.53 points, down 42.44 points, or 2.55%. This was the deepest drop in recent weeks, bringing the index to a new bottom after a short recovery period before.

Similarly, the HNX-Index fell 3.24% to 271.57 points while the UPCoM-Index also fell to 109.63 points, down nearly 2%. The VN30 basket also fell sharply by 2.07% to 1,807.22 points, reflecting a broad-based correction trend.

Red covered almost the entire market with 285 stocks decreasing in price, while only 56 stocks increased. Liquidity on HoSE reached about VND41,971 billion, showing that the selling cash flow was overwhelming and investors were cautious in making new disbursements.

The stock market has had continuous strong corrections in the past 2 months. Photo: AI

In the finance and banking group, a series of large stocks such as VPB, VIB, MSB, TCB andSHB all decreased by 4-7%, creating great pressure on the general index. The securities sector also could not escape the correction trend when SSI, VND and VCI all lost points.

Real estate continued to be the group under heavy pressure, with PDR, NVL, DIG, and KDH falling sharply by 5-7%. Steel stocks in particular saw a divergence, with HPG and NKG maintaining a slight green color, while HSG fell slightly below the reference.

Foreign net buyers

A rare bright spot came from foreign transactions when foreign investors net bought nearly VND1,000 billion on the HoSE. Of which, HPG, SSI, CTG, SHB and VPB were the stocks that were strongly collected, with HPG alone net buying more than VND300 billion. On the contrary, some stocks such as GEX, VIX, NVL were strongly net sold by foreign investors.

Foreign investors net bought nearly 1,000 billion VND on HoSE floor

According to analysts, this correction reflects short-term concerns as the market has just experienced a period of overheating, combined with strong profit-taking pressure at the 1,700-point resistance zone.

However, the return of foreign net buying can be seen as a positive signal, contributing to supporting investor sentiment in the coming sessions. The market is expected to continue to fluctuate strongly around the support level, while the differentiation between industry groups is likely to continue.

However, Mirae Asset Securities Company in its latest report still believes that the Vietnamese stock market has entered a new growth cycle characterized by volatile sessions with amplitudes of up to nearly 100 points.

According to Mirae Asset, large-scale fluctuations are expected to continue in September as investors await the realization of positive news, which has been almost fully reflected in the recent increase of the VN-Index. Typical examples include FTSE Russell's September assessment of the opportunity to upgrade the stock market to emerging market status and the US Federal Reserve's decision to cut interest rates at its upcoming September meeting.

Source: https://nld.com.vn/vn-index-lao-doc-hon-42-diem-khoi-ngoai-bat-day-gan-1000-ti-dong-196250908150944911.htm

![[Photo] President Luong Cuong hosts state reception for Governor-General of Australia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/10/a00546a3d7364bbc81ee51aae9ef8383)

![[Photo] Prime Minister Pham Minh Chinh chairs the 20th meeting of the Steering Committee for important national projects and works](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/10/e82d71fd36eb4bcd8529c8828d64f17c)

![[Photo] Giant pipeline leading water to West Lake, contributing to reviving To Lich River](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/10/887e1aab2cc643a0b2ef2ffac7cb00b4)

Comment (0)