Many large stocks put pressure on the session on February 29, securities stocks attract cash flow

Many stock prices increased sharply in the session of February 29 amid strong selling of some large-cap stocks.

VN-Index continued to easily surpass 1,242 points in the session of February 28. Liquidity remained high and market orders reached VND23,600 billion, of which transactions on HoSE alone accounted for VND21,000 billion. Entering the session of February 29, the excitement continued and VN-Index at times surpassed the threshold of 1,260 points.

However, the market's excitement did not last long as pressure quickly increased and caused a series of stock groups to reverse, and the indices therefore also fell below the reference level.

In the afternoon session, VN-Index mostly fluctuated below the reference level. However, the selling pressure was not too "intense", helping the market avoid a deep decline.

Today’s strong pressure came from some large-cap stocks. In the Vin group, VHM fell 2.3% and took away 1.07 points from the VN-Index. VRE and VIC fell 4.7% and 1.3%, respectively, taking away 0.73 points and 0.56 points, respectively.

In addition, the banking group recorded a number of stocks that had a relatively significant correction. Of which, BID decreased by 1.7% and was the biggest factor negatively affecting the VN-Index, BID took away 1.26 points from the index. CTG decreased by 1.1%, MBB decreased by 1%...

Today's session coincides with the time when the MSCI Frontier Market Index simulation fund restructures its investment portfolio. Of which, 3 new Vietnamese stocks were added: NKG, FTS and SJS. At the same time, MSCI Frontier Markets Index did not remove any Vietnamese stocks from the basket while removing 9 stocks from Nigeria and 2 from the Oman market. Thanks to this move, FTS received a sudden demand in the ATC session, thereby pushing the stock to the ceiling price.

Meanwhile, SJS increased slightly by 0.8% while NKG decreased by 0.8%. Besides NKG, another steel stock, HSG, also decreased by 0.7%. This development is quite surprising when the leading steel stock, HPG, increased by 1.3% and continued to match orders of 33.6 million units. Today is also the day that a huge amount of HPG shares (87 million shares) were transferred to investor accounts.

HPG was the second largest contributor to the VN-Index with 0.57 points. Meanwhile, MSN contributed the most with 0.74 points. At the end of the session, MSN increased by 3.1%.

Besides FTS, other securities stocks also had positive fluctuations. SSI increased by 2.5% and matched 43 million units. BVS increased by 4.2%, VDS increased by 3.1%, CTS increased by 1.9%. On the contrary, HCM caused a surprise when it decreased sharply by 1.9% and matched 16.3 million units, in which foreign investors net sold nearly 3.5 million units.

Cash flow also focused quite well on real estate stocks, in which, KDH was pulled up to the ceiling price and matched 13.9 million units. NLG increased by 3.7%, DXG increased by 1.1%, DIG increased by 1.5%...

The retail group still recorded a tremendous increase of FRT with an increase of 6.4% to 145,000 VND/share. In addition, MWG also increased by 2% after the news that CDH Investments, one of the largest alternative (non-traditional) asset investment funds in China, is said to be negotiating to buy a minority stake in Bach Hoa Xanh (BHX).

At the end of the trading session, VN-Index decreased by 1.82 points (-0.15%) to 1,252.73 points. The entire floor had 214 stocks increasing, 262 stocks decreasing and 80 stocks remaining unchanged. HNX-Index increased by 0.29 points (0.12%) to 235.46 points. The entire floor had 65 stocks increasing, 83 stocks decreasing and 94 stocks remaining unchanged. UPCoM-Index increased by 0.09 points (0.09%) to 90.63 points.

Total trading volume on the HoSE reached nearly 1.1 billion shares, worth VND26,137 billion, up 15% compared to yesterday's session. Of which, negotiated transactions contributed VND1,715 billion. On the HNX, trading volume reached 109.4 million shares, worth VND2,160 billion.

SSI ranked first in terms of matched volume in the entire market with 43.2 million shares. VIX and HPG matched 36.5 million shares and 33.6 million shares, respectively.

Foreign investors net sold a total of more than VND400 billion today, of which, this capital flow net sold the most VHM with VND211 billion. VRE was net sold VND172 billion. VNM and HCM were net sold VND116 billion and VND98 billion respectively. Meanwhile, this capital flow net bought the most SSI with VND179 billion. HPG and NLG were net bought VND91 billion and VND56 billion respectively.

Source

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

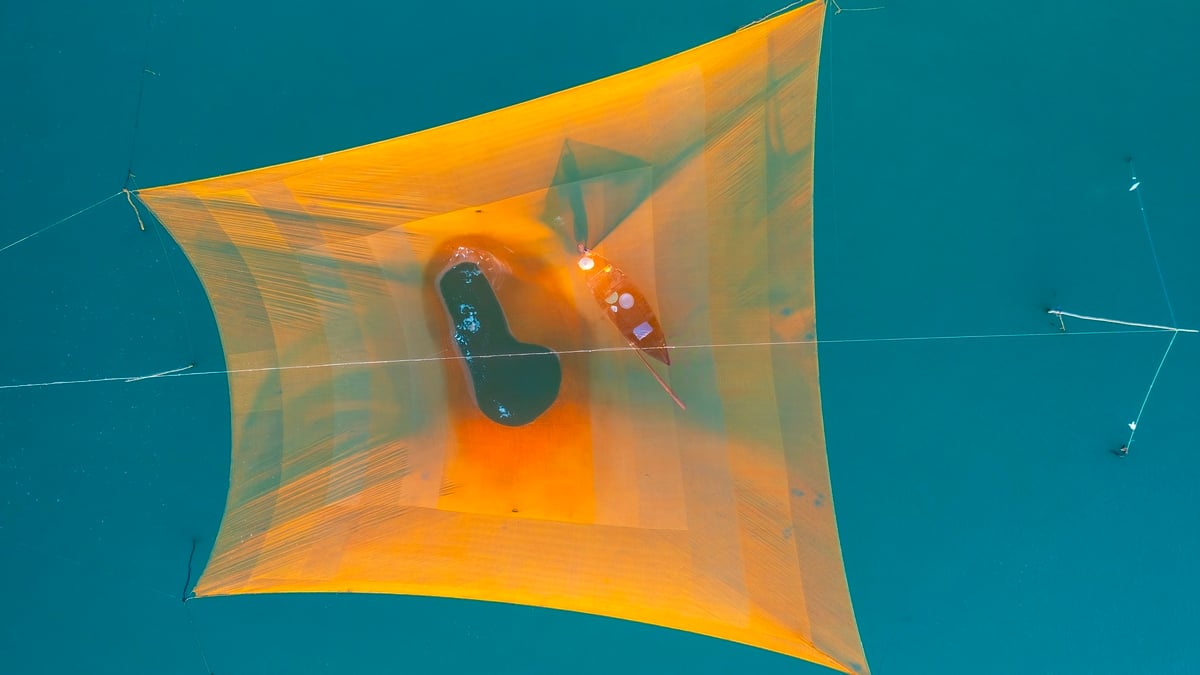

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

Comment (0)