These changes promise to create a transparent legal corridor, promote production and business and more effective state management.

Highlights of the new economic policies

From July 1, the two-tier government model officially came into operation, streamlining the administrative apparatus and increasing decentralization from the province to the commune. Along with that are new economic policies, including laws, decrees and circulars in key areas, creating a legal foundation for production - business activities and state management.

The 2024 Value Added Tax (VAT) Law, which took effect on July 1, brought about many important changes. Some items such as fertilizers, agricultural equipment, offshore fishing vessels, and securities services are no longer tax-exempt but are subject to a tax rate of 5% or 10%. Imported goods for charity and relief purposes are added to the list of goods not subject to tax.

The VAT taxable price for imported goods is the sum of the import price plus other taxes such as import tax, special consumption tax and environmental protection tax. In particular, promotional goods and services are taxed at 0%, creating convenience for businesses. The law also requires non-cash payment documents for all transactions to deduct and refund taxes.

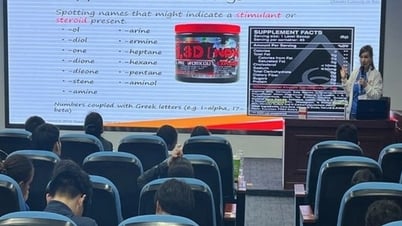

Decree 117/2025/ND-CP on e-commerce tax management requires e-commerce platforms such as Shopee, Lazada, Tiki... to deduct and pay VAT and personal income tax (PIT) on behalf of sellers. VAT is applied at a rate of 1% for goods, 5% for services, 3% for transportation and services associated with goods; PIT ranges from 0.5% to 2% depending on the type of business.

This regulation increases transparency and fairness between e-commerce and traditional commerce.

The Law on Geology and Minerals tightens technical safety in mineral exploitation. High-risk mines must ensure that personnel are well-trained, equipment is suitable for geological conditions, and emergency response forces are deployed.

The Law on Urban and Rural Planning requires that planning be made public within 15 days of approval, prohibiting illegal interference, falsification of documents or misuse of funds. Urban zoning and detailed planning are clearly defined in terms of economic and technical indicators, housing arrangement, infrastructure and environmental protection.

Decree 151/2025/ND-CP decentralizes the authority to issue land use right certificates (red books) to commune-level People's Committee Chairmen, including cases of initial issuance and land adjustment. This Decree expands agricultural credit, allows unsecured loans, simplifies appraisals, and uses future assets as collateral.

Circular 86/2024/TT-BTC replaces tax codes with personal identification numbers, simplifying administrative procedures.

Resolution 204 of the National Assembly on reducing 2% VAT for goods and services subject to 10% tax from July 1, 2025 to December 31, 2026, except for some fields such as telecommunications, finance, and real estate.

Increasing digitalization and transparency

New economic policies taking effect from July 1, combined with the two-tier government model, will create a turning point in state management and business activities, with profound impacts on the economy, businesses and people.

The Law on Urban and Rural Planning requires public disclosure of planning within 15 days, helping to reduce speculation and manipulation of land prices, especially in large cities such as Ho Chi Minh City and Hanoi. Real estate businesses must comply with clear planning standards, ensuring transparent and sustainable project development. This not only protects buyers but also promotes healthy development of the real estate market, reducing the risk of price bubbles.

Decree 117/2025 helps promote e-commerce and prevent tax losses. Accordingly, e-commerce platforms will deduct taxes on behalf of sellers, creating a fair competitive environment between e-commerce and traditional commerce.

Platforms like Shopee, Lazada, and Tiki must invest in upgrading their systems to comply, but this also helps increase consumer confidence. The logistics and digital marketing industries will benefit from standardization, while sellers will be forced to make their revenues transparent and reduce tax evasion. However, small individual businesses on the platform may face initial difficulties due to increased tax costs.

Regarding agricultural and rural support, Decree 156/2025/ND-CP expands agricultural credit, helping agricultural enterprises and cooperatives access capital more easily.

Simplifying procedures and accepting future assets as collateral will promote high-tech agriculture and digital transformation in rural areas. Mountainous provinces and remote areas will benefit from preferential capital flows, contributing to the sustainable development of the “three rural” sector.

The Law on Geology and Minerals helps control sustainable mineral exploitation. The law requires strict technical safety, forcing businesses to invest in technology and human resources; although it increases initial costs, it ensures sustainable exploitation, minimizing environmental impacts and work accidents. Provinces rich in mineral resources such as Quang Ninh and Thai Nguyen will benefit from tighter management.

Using personal identification numbers instead of tax codes and decentralizing the issuance of red books to the commune level helps reduce the burden on the provincial and district levels, while shortening the processing time for people. Small businesses and business households will benefit from a more transparent and faster tax process.

Along with that, tax authorities and local governments must also increase investment in digital infrastructure to ensure data synchronization.

Circular 39/2025/TT-BCT limits the maximum promotional value to 50%, preventing price increases before reductions. Retail and e-commerce businesses must adjust their strategies and increase transparency in advertising. This not only protects consumers but also creates a fair competitive environment, especially in the retail industry and large supermarkets.

It can be seen that the new policies reflect the trend of modernizing state management, increasing digitalization and transparency. The two-tier government model helps to implement policies quickly and synchronously, creating favorable conditions for businesses and people. Large provinces, cities and key industries such as real estate, agriculture, and e-commerce will witness strong transformation.

Source: https://vietnamnet.vn/mo-hinh-chinh-quyen-dia-phuong-2-cap-di-vao-hoat-dong-loat-chinh-sach-kinh-te-2416986.html

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)