The move comes as nearly 87% of adults have bank accounts and 59% of daily transactions are cashless.

Officially effective from July 1, 2025, Circular 40 of the State Bank of Vietnam (SBV) is considered an important legal framework, creating a boost for the digital payment market. E-wallets have been officially recognized as a means of payment equivalent to cash, cards and bank accounts. This allows e-wallets to make flexible payments such as transferring money between wallets, from wallets to bank accounts and vice versa.

Essentially, this circular focuses on simplifying the payment process, enhancing transaction security, and especially promoting interoperability between different e-wallet platforms. The goal is to create a level playing field, encourage more units to participate, while protecting the rights and bringing maximum convenience to consumers.

According to SBV, the interbank electronic payment system is processing an average of VND820,000 billion per day. Nationwide, there are more than 204.5 million payment accounts and 154.1 million active bank cards. Notably, the rate of cashless transactions among the 25-44 age group has reached 72%.

The initial results of Circular 40 show that the e-wallet and digital banking market not only satisfies the goal of increasing cashless transactions but also opens up opportunities for extensive cooperation between parties, building a synchronous, safe and convenient payment ecosystem.

In addition to the domestic market, Vietnam is also expanding cross-border payment cooperation via QR codes with Thailand, Laos, Cambodia and plans to move to other Asian markets, demonstrating its increasingly deep integration into the regional payment ecosystem.

In the context of Vietnam promoting digital transformation and regional integration, Circular 40 is not only a boost to the legal framework but also a driving force for the entire industry to continuously innovate and improve products and services. As consumers increasingly trust in electronic payment methods, financial and technology organizations will continue to accompany and work together to create a sustainable digital economy .

Seizing the opportunity, financial institutions have quickly taken many actions to improve their competitiveness. Vietcombank and Techcombank have chosen to launch promotional programs targeting customers who make cashless transactions via digital banking applications, enhancing engagement with existing customers through discounts and point accumulation since July 2025. In addition, Vietcombank and VPBank have also joined hands with e-wallets to expand their customer base and enhance the cashless payment experience.

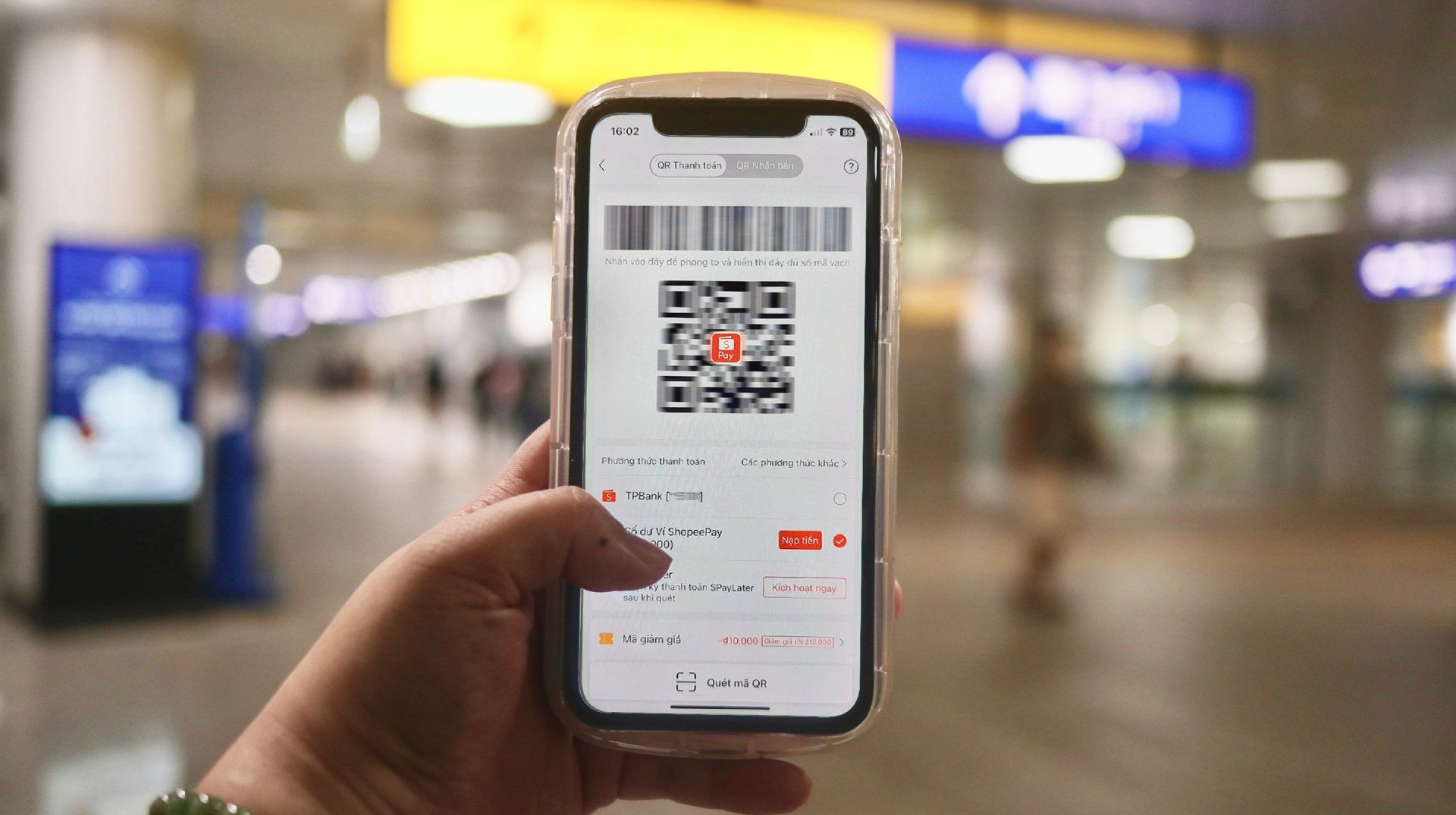

As a popular e-wallet, ShopeePay has just launched the "8.8 ShopeePay Tap to Discount" program with a discount of up to 50% (up to 80,000 VND) for all payment transactions at partners and phone top-ups on the ShopeePay application.

Also from the beginning of August, Metro Line 1 (Ben Thanh - Suoi Tien) passengers can pay for tickets by scanning the QR code on the ShopeePay application at the payment gateway to enjoy a convenient, smooth experience and receive an additional 50% discount. This activity is also ShopeePay's commitment to enhancing the online payment experience, while aiming to become an e-wallet trusted by Vietnamese users.

With an increasingly complete policy foundation and the synchronous participation of the entire industry, digital payments in Vietnam are opening a new stage of development - more flexible and approaching regional standards in the cashless era.

Phuong Dung

Source: https://vietnamnet.vn/mach-chuyen-dong-cua-thanh-toan-so-sau-1-thang-trien-khai-thong-tu-40-2429619.html

![[Photo] Discover the "wonder" under the sea of Gia Lai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/6/befd4a58bb1245419e86ebe353525f97)

![[Photo] Nghe An: Provincial Road 543D seriously eroded due to floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/5/5759d3837c26428799f6d929fa274493)

Comment (0)